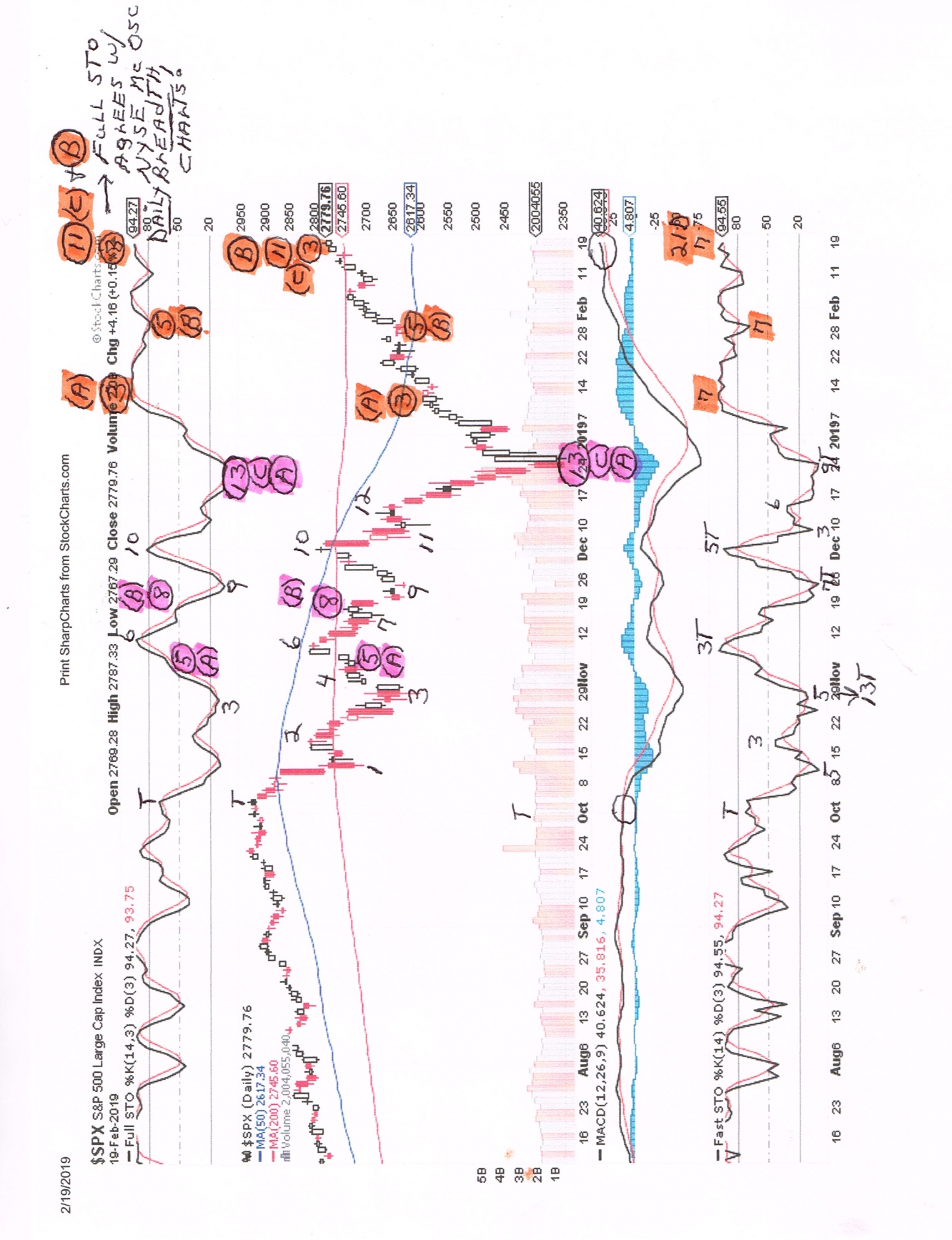

I use basic Elliott Wave (EW) analysis to identify patterns and wave/sub wave counts.I have been waiting for a sub wave count to equal my target total and I got it yesterday. Today (Wednesday) we are now starting the "new downtrend."

This is a "very important reversal" and based on my longer term analysis, we "could" repeat what happened from October/18 thru December/18. That was a wild downtrend ride, of down and up volatility.

Many of the popular indexes have already seen their "Death Cross" of the 50 ma crossing over their 200 ma on their daily charts. The next move down (my big "C" wave) could result in a total of 20% or more to the downside.

That's a common definition of a "bear market".

If my analysis is correct, it's also a great opportunity to take your uptrend profits and start working the downside -- until this next big downtrend ends. Realize there are going to be some very strong up days on the way down.

Happy Trading,

Robert WaveGuy/thetrendfriend.com