- US equity indices enter bear market territory

- China retaliates, while Europe is still discussing its response

- Pressure on the Fed to save the day; Powell is not giving in yet

- Gold, oil and bitcoin suffer considerable losses

Markets Suffer, as Trump Preaches Calmness

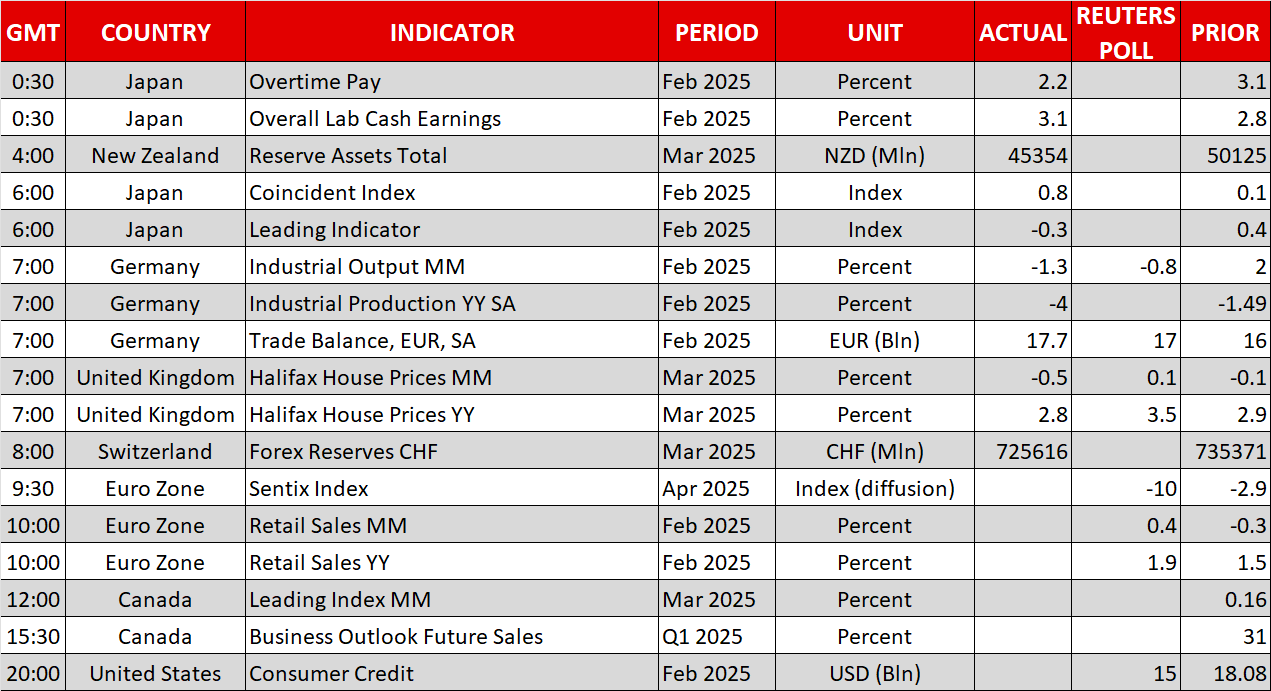

Risk appetite is in freefall for the third consecutive trading day, as investors are still trying to find their footing after last week’s tariff developments. Following the April 3 start date for the automobile tariffs and the April 5 commencement of the universal 10% US tariff on all goods imported from all countries, the countdown is on for Wednesday’s reciprocal tariffs’ start.

US President Trump has essentially made a significant move on the chessboard and is now waiting for the reactions. China has responded with similarly sized tariffs on US imports, while the European Union is still debating its response to the automobile tariffs. According to reports, around 50 countries have already contacted the White House for negotiations, aiming for a reduction in their tariffs.

However, Trump is also trying to pressure the Fed into cutting rates. As anticipated, Trump criticized Chair Powell again on Friday, ‘demanding’ lower rates. His rhetoric is not expected to ease until the Fed actually implements his wishes. Interestingly, certain major US investment banks are gradually adding rate cuts to their policy outlook for 2025, on the back of the increased chances for a US recession, and markets are now pricing in 120bps of easing until December.

Fed is Still on the Sidelines

Chair Powell did not reveal much at last Friday’s speech and the accompanying Q&A session, putting on a calm face. He preached patience, as the Fed is waiting for further clarity on the tariffs' front. However, the Fed is at a crossroads and might soon be forced to make a decision that most Fed members might not enjoy.

If the Fed decides to ease its monetary policy stance, essentially Trump wins. He will probably continue to ‘dictate’ the Fed’s actions, and he tends to be very persuasive. Additionally, after the initial positive short-term market reaction to rate cuts, investors would probably seek justification for these moves. If the Fed is just aiming to address the ailing risk appetite, then it might risk a COVID-like inflation surge going forward.

On the flip side, should Powell et al. maintain their current “wait-and-see” stance, despite acknowledging the fact that “larger tariffs risk higher inflation and slower growth”, they risk the wrath of Trump, which could eventually even lead to Powell’s replacement. Additionally, if inflation accelerates, and the US economy continues to weaken, stagflation could soon arrive, traumatizing markets even further. But more importantly, for how long can the Fed really watch markets record significant daily losses, further damaging the weak underlying economic momentum?

Realistically, the US economy could offer sufficient grounds for the Fed to start easing its policy, though that won’t happen if Friday’s jobs data sets a trend for data releases going forward. All eyes are now on Thursday’s March inflation report, where the Fed doves are craving a significant downside surprise.

Stock Indices Enter Bear Market Territory

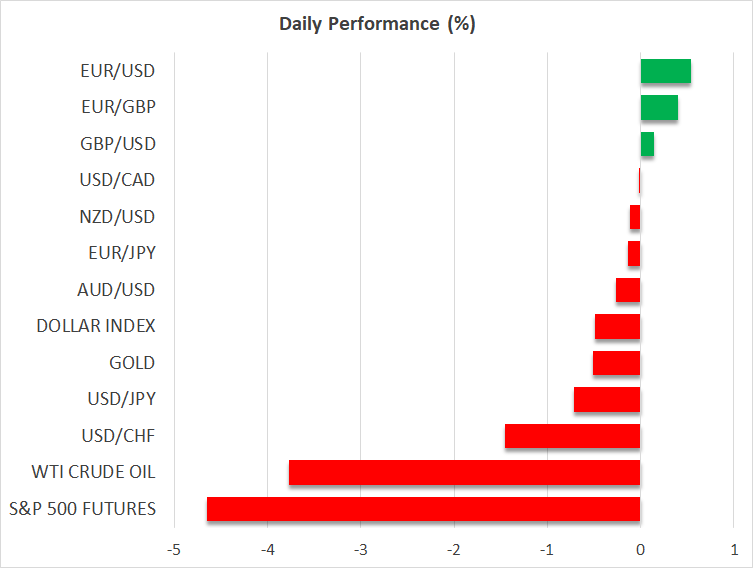

The result of these shenanigans was the worst weekly performance in US equities since the February-March 2020 period when the COVID pandemic was unfolding. Technology stocks led the sell-off, with European stock indices following suit. With Chair Powell closing the door to the “Fed put”, Asian stocks are feeling the brunt of the drop at the start of this week. Similarly, the dollar is surrendering most of its Friday gains, with euro/dollar trading just north of 1.1000.

Gold is hovering around $3,020, $150 below its recent peak. One could say that gold is just correcting after a phenomenal rally, but it is evident that stock weakness is affecting demand for gold.

More importantly, WTI oil has dropped to its lowest level since April 2021. Oil is a key barometer of the health of the global economy, and considering the latest move, the outlook looks extremely bleak.

Finally, despite its measured reaction after Trump’s announcements, the crypto market has been drawn into the mayhem as well.

Bitcoin is struggling to remain above $75k, and similarly to WTI oil, a significant change in the prevailing market rhetoric is necessary for a move higher.