The recent powerful rally in the S&P 500 has been fueled by improving economic reports and the promise of continued easy money and zero interest rates from the Federal Reserve.

The response by global financial markets has been nothing less than impressive with a strong rotation out of commodities and into equities, putting precious metals and some commodities into bear markets and propelling the S&P 500 to highs not seen since 2008.

So now the question is, “can this rally continue or is a correction overdue/in order?”

On My Wall Street Radar

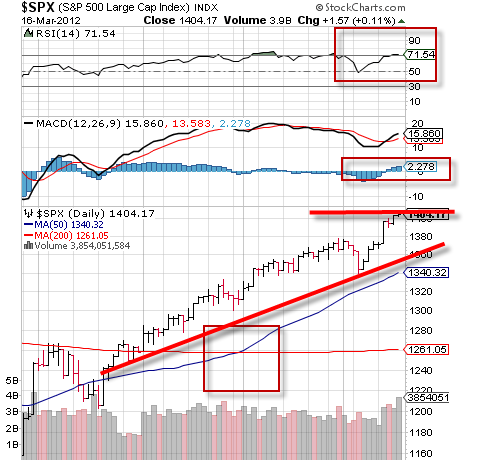

In the chart of the S&P 500 we see RSI in the overbought region at 71.54 in the top display, a region from which significant declines oftentimes occur. Also recent action, while breaching the 1400 level, puts the index into another significant resistance zone dating back to the beginning of the financial crisis.

Bulls will point to MACD just turning positive to a “buy” signal, the unbroken uptrend above the diagonal red line and the formation of the “golden cross,” another bullish signal when the blue 50 day moving average crossed the red 200 day moving average.

Fundamentals offer a mixed picture, as well, as positives include declining unemployment and a slate of positive economic reports in manufacturing and retail sales, while Friday’s consumer confidence and price reports were negative.

The biggest potential headwind of all, of course, is the ongoing high price of oil, now at $107.05, and gasoline which jumped 6% last month and now averages $3.82, the highest level in nearly a year. Gas prices in three states, California, Hawaii and Alaska, average north of $4.00/gal.

So for ETF investors, it appears that the best, easy part of this rally is behind us and that general markets may have come too far, too fast, on a technical basis. Indicators a very overextended, complacency is high, while oil prices and geopolitical concerns add further uncertainty to this coming week’s situation.

The Economic View From 35,000 Feet

Last week’s economic reports were a mixed bag with retail sales growing, the Philly Fed and Empire Manufacturing reports showing continued growth but with some weakness in the sub indexes, unemployment claims continuing to decline, the Fed committing to zero interest rates for years, and major stock indexes reclaiming levels not seen since way back in early 2008.

On the negative side of the ledger, oil and gasoline prices continued their climb, interest rates took a jump in the U.S. Treasury market, and inflation started to rear its ugly head with year over year Consumer Prices clocking in at 2.9%, above the Fed’s target rate of 2%.

On Friday, the University of Michigan Confidence Index shocked markets with its first drop in six months during last summer’s stock market correction and gas prices moved into the high $3/gal. range across the United States and north of $4.00 in California, Alaska and Hawaii.

Next week’s economic reports will center on the housing sector with Home builders on Monday, Housing Starts on Tuesday, Existing Home Sales on Wednesday, Unemployment and Leading Indicators on Friday and New Home Sales on Friday.

Also, on Monday comes the conclusion of the Greek default saga with the auction on Greek bonds involved in the credit default operation. Approximately $2.5 Billion is due to be paid out and most observers believe that the impact on global markets will be muted. So this act of the Greek Tragedy appears to be drawing to a close, however, already, the IMF is saying that Greece could need further bailouts and is subject to significant risk.

ETF Summary:

SPDR S&P 500 (NYSEARCA:SPY) +2.4% for the week, at overbought levels on a technical basis but still in uptrend. Breached 1400 level not seen since 2008.

Russell 2000 (NYSEARCA:IWM) +1.6% for the week, back to recent highs set in early February.

NASDAQ 100 (NYSEARCA:QQQ) +2.4% as tech continues to shine and be powered higher by Apple Computer (AAPL), up 7% from the previous week’s close.

Gold (NYSEARCA:GLD) -3.3% for the week to $1660/oz. as the sell off in gold continues and the yellow metal is now down over 7% since the beginning of March.

Bottom Line for stock market and ETF investors:

The major markets have made a swift move higher and now are vastly overextended on many technical levels and in zones from which significant declines can occur. However, overall uptrend remains intact. Fundamentals are turning mixed and so markets will be continuing their reliance on global central bankers to keep prices moving higher.

Disclaimer: Wall Street Sector Selector actively trades a wide range of exchange traded funds (ETFs) and positions can change at any time.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Stock Markets, ETFs Claw Higher

Published 03/19/2012, 02:07 AM

Updated 05/14/2017, 06:45 AM

Stock Markets, ETFs Claw Higher

Stock markets clawed higher this week, reaching milestones and overextended conditions

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.