It’s Friday in the Wall Street Daily Nation!

That means the longwinded analysis is out. And instead, some carefully selected charts are in. After all, a picture is supposed to be worth a thousand words, right?

Without further ado, check out these snapshots on the annual disappearing act by S&P 500 companies, why Sunday’s big game really isn’t about the game and, lastly, how the White House could be to blame for the current stock market selloff.

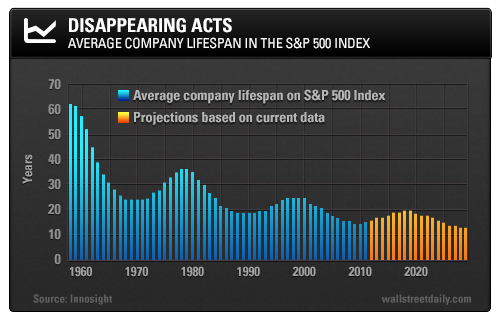

Is “Buy and Hold” Dead?

When we hear the term “creative destruction,” we most often think about a new innovation coming along that destroys an existing technology.

After today, though, I want you to think about it in terms of actual companies.

By analyzing 100 years’ worth of stock market data, Innosight’s Director, Richard N. Foster, found that the average company in the S&P 500 Index in 1958 remained there for 61 years. By 1980, the average tenure plummeted to 25 years. Today, a company’s lifespan rests below 20 years.

Bottom line: At the current churn rate, 75% of companies in the S&P 500 will be replaced by 2027. Here’s hoping we’re not caught holding onto any of these stocks when they’re “creatively” destroyed.

Or as Foster concluded, “You must embrace creative destruction rather than wait to become a victim of this unstoppable force.” Indeed!

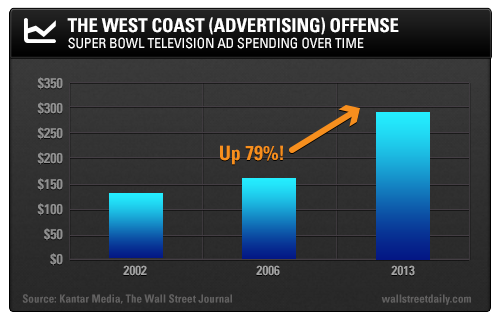

A Super Bowl for Advertising

Peyton Manning is in the Super Bowl this year. Ironically, he’ll be squaring off in his little brother Eli’s house.

As a New York Giants fan, you can probably guess that I couldn’t care less which team wins. But it’s not really about the game, anyway. It’s all about the advertising – increasingly so, too.

Here’s the graphic proof…

Bottom line: Forget trying to bet correctly on the winner to score some extra spending cash from your office mate. Prepare your mind to defend against the onslaught of advertisements so you don’t inadvertently spend your cash on something you definitely don’t need.

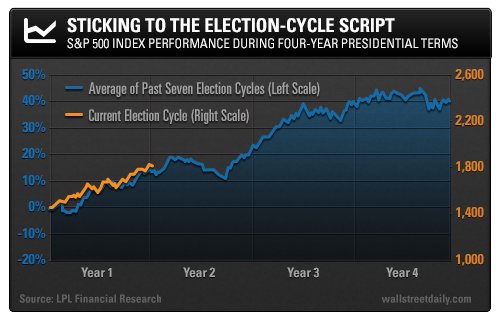

The Two-Year Curse

To say the stock market stumbled out of the gates in 2014 would be an understatement. As I write, the S&P 500 is down 4% for the year, with most of the losses coming in the last week.

Many people want to blame it on emerging markets, the Fed, even Leonardo DiCaprio.

Turns out, it’s all the presidents’ fault. (Notice I said, “presidents” – as in, not just Obama.)

As LPL Financial’s Chief Market Strategist, Jeffrey Kleintop, shared on Twitter (TWTR) recently, the S&P 500 typically struggles in year two of the election cycle.

Specifically, stocks drop to start the year, rally briefly, stumble again for most of the year, and then finish strong. And, so far, we’re following the pattern like clockwork.

Obviously, the past is no guarantee of the future. But it’s the best thing we have to evaluate.

Bottom line: Election cycle curse or not, it appears that we’re in store for a volatile year for stocks. So load up on Tums and get ready to do battle with us in the trenches.

Whether the market heads up, down, or sideways, we’re committed to uncovering the best ways to protect and increase your net worth.