Street Calls of the Week

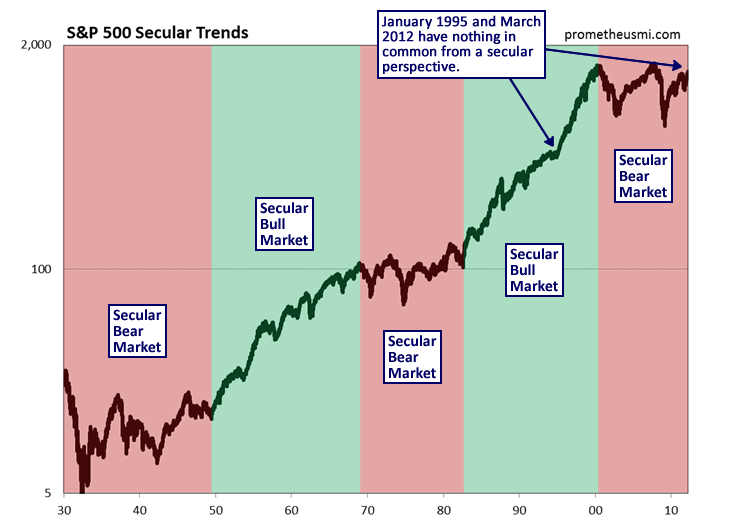

Today, a prominent mainstream market analyst drew a dubious parallel between current stock market conditions and those in early 1995, implying that stocks are poised for a strong rally during the remainder of 2012.

The S&P 500’s price-earnings ratio has dropped to 14.5 from 24.2 in December 2009, mirroring its retreat to 16 from 26.5 in the 32 months ended in January 1995. Stocks soared that year, with the index gaining 34 percent for an annual return unmatched in the last half century. The potential for surprise now is similar to 1995…

As we often note, secular context matters and the preceding comparison is only valid if these time periods occur during similar stages of the long-term cycle. As we move into the second quarter of 2012, the stock market is in the middle stage of a secular bear market that began in 2000. Given that stocks were about to enter the final, blow-off phase of a secular bull market in 1995, the two time periods in question have nothing in common from a long-term perspective, so the given comparison is invalid.

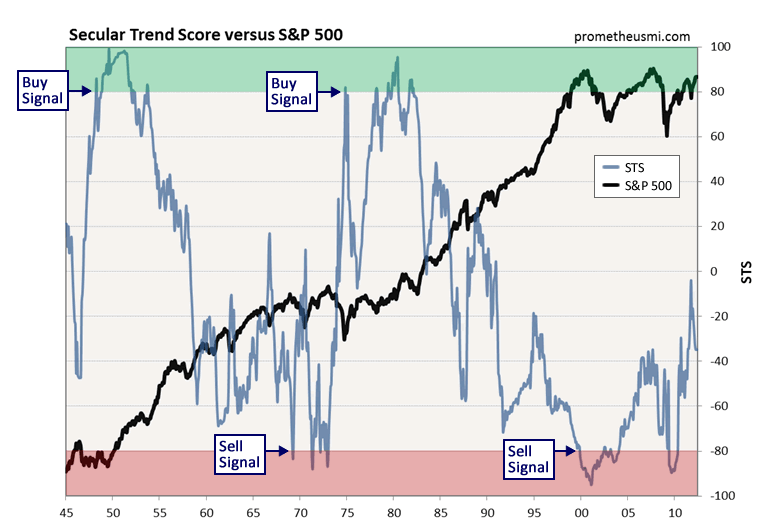

The computer models that calculate our Secular Trend Score (STS) and Cyclical Trend Score (CTS) analyze a large basket of market data that includes fundamentals, technicals, internals and sentiment. These models have correctly predicted every secular turning point since the market crash in 1929 and more than 90 percent of the cyclical turning points, while issuing only three false signals during the past 70 years.

These highly reliable computer models indicate that the current risk/return profile of the stock market is in the worst 1 percent of all historical observations. In other words, from both an investing and a trading perspective, our models indicate that now is one of the riskiest times to be long stocks during the last 80 years. It is highly likely that the cyclical bull market from early 2009 is in the final stage of its development and it is also highly likely that the rally from October of last year will be followed by a violent overbought correction that will retrace a majority, if not all, of the gains logged during the first quarter of 2012.

If it seems as though we have been dwelling on the heightened risk associated with the current stock market environment during the past several weeks, that has been intentional. It is crucial to remain focused on the big picture during times like these, because it is all too easy to become swept up in the mainstream mania that is accompanying the latest speculative advance in stocks. It is highly likely that anyone entering the market from the long side at these levels will suffer substantial losses sometime during the next few months, so we urge you to remain defensive.