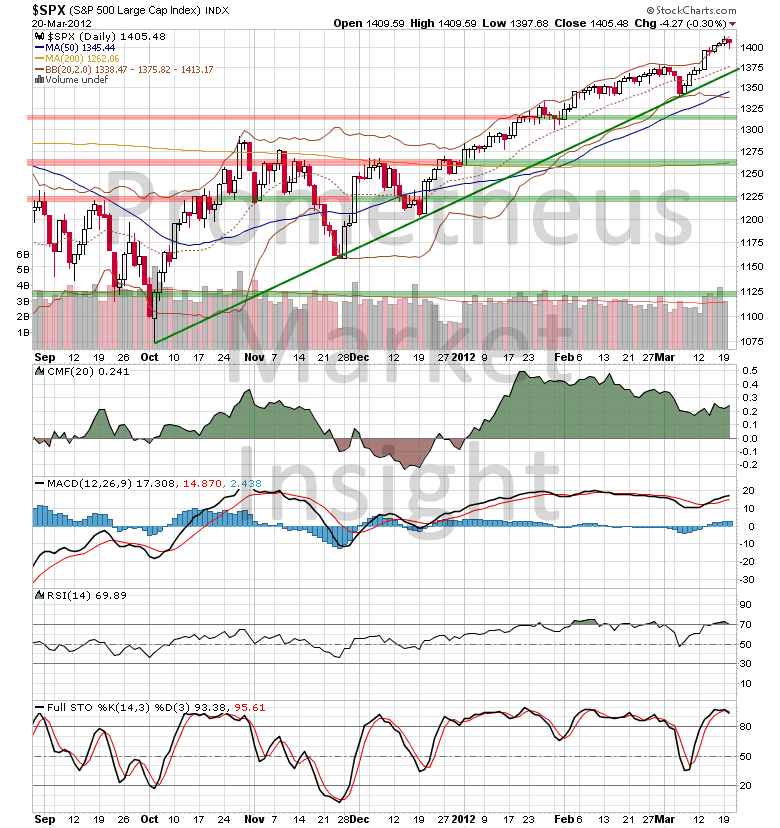

The S&P 500 index closed slightly lower today, holding near recent highs of the rally from October 2011. Although technical indicators favor a continuation of the advance, the uptrend is extremely overextended on a short-term basis and it will almost certainly be followed by a violent overbought correction. Speculative overextended rallies of this type tend to remain overextended for a long time, but when they finally correct, the move is nearly always fast and furious.

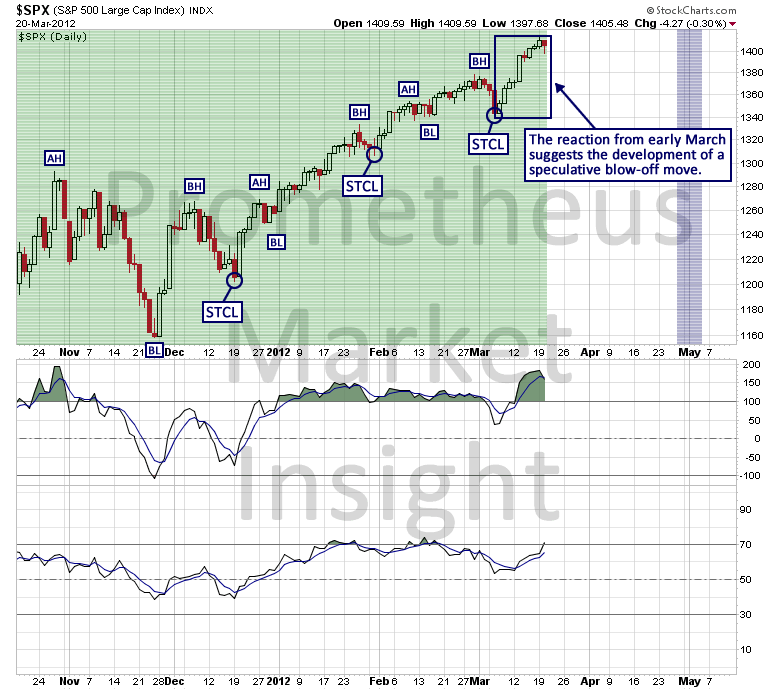

We are now 10 sessions into the alpha phase rally following the last Short-Term Cycle Low (STCL) on March 6. The S&P 500 has gained 12 percent since the beginning of the year and we are approaching the window dressing period at the end of the first quarter. Therefore, stocks should enjoy additional buying support during the remainder of March as fund managers increase their exposure to equities in an attempt to improve the quality of the quarterly statements being sent out to clients in early April. However, the character of the reaction off of the last STCL suggests that the development of a speculative blow-off move has become more likely, so it will be important to monitor price behavior closely during the next few weeks.

We are now 10 sessions into the alpha phase rally following the last Short-Term Cycle Low (STCL) on March 6. The S&P 500 has gained 12 percent since the beginning of the year and we are approaching the window dressing period at the end of the first quarter. Therefore, stocks should enjoy additional buying support during the remainder of March as fund managers increase their exposure to equities in an attempt to improve the quality of the quarterly statements being sent out to clients in early April. However, the character of the reaction off of the last STCL suggests that the development of a speculative blow-off move has become more likely, so it will be important to monitor price behavior closely during the next few weeks.