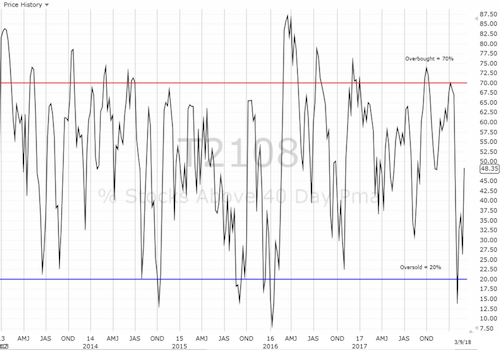

AT40 = 48.5% of stocks are trading above their respective 40-day moving averages (DMAs)

AT200 = 52.9% of stocks are trading above their respective 200DMAs

VIX = 14.6 (11.5% drop)

Short-term Trading Call: bullish

Commentary

The (expected) plunge in the volatility index, the CBOE Volatility Index, says it all…the stock market is ready to return to its originally scheduled programming.

The volatility index, the VIX, broke down below the 15.35 pivot line a day after bouncing perfectly off its magic number pivot.

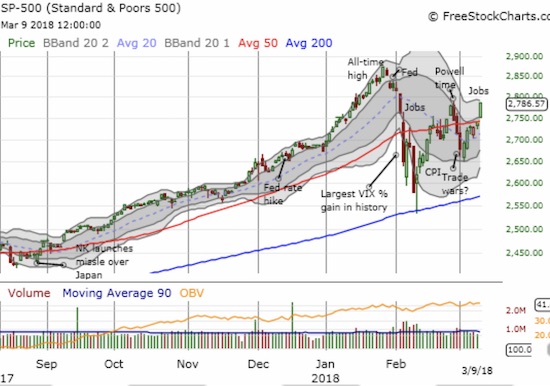

It was a news-filled week and almost everything worked toward relieving market anxieties: President Trump announced tariffs that represented concessions to political and economic pressures; the jobs report for February delivered a goldilocks report with a bushel full of jobs, minor wage inflation, and a monthly increase in the size of the labor force that was last this large 35 years ago; and a surprise bonus with North Korea claiming it is ready to negotiate denuclearization of the Korean peninsula. Essentially every significant and palpable negative headwind whisked right off the market’s radar.

I used this occasion to cover my short in the iPath S&P 500 VIX Short-Term Futures Exp 30 Jan 2019 (NYSE:VXX). While I was bolstered by a hedge with call options in the ProShares Ultra VIX Short-Term Futures (NYSE:UVXY) I was determined to fade VXX given what I saw as the high certainty of an imminent volatility implosion. I will continue this fading strategy if VXX shares remain available for shorting. However, I highly suspect the short volatility trade will get very popular all over again. Note that VXX has yet to reverse all its gains from the day the VIX soared at its highest percentage in history. I am still projecting an eventual complete reversal and more.

The iPath S&P 500 VIX ST Futures ETN (VXX) closed at its lowest point since the VIX’s historic surge.

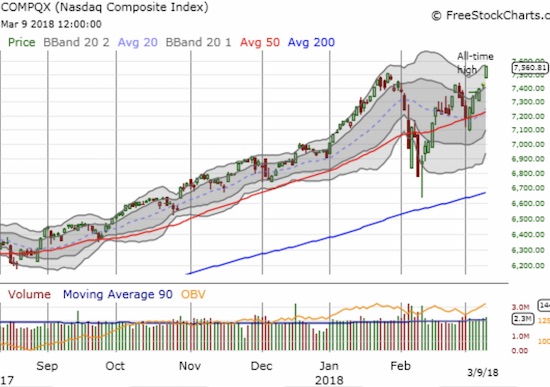

Part of the stock market’s original programming is to achieve all-time highs. The NASDAQ and the PowerShares QQQ Trust Series 1 (NASDAQ:QQQ) answered the casting call with 1.8% and 1.9% gains respectively. The S&P 500 (SPY (NYSE:SPY)) is scrambling to catch-up with a 1.7% gain that represents a convincing breakout above its 50-day moving average (DMA) and its highest close since February’s job report.

The NASDAQ powered its way to a new all-time high and delivered a resounding confirmation of its latest test of 50DMA support.

The PowerShares QQQ ETF (QQQ) delivered its own all-time high and convincingly invalidated the bearish engulfing pattern that preceded the test of 50DMA support.

The S&P 500 (SPY) broke out from 50DMA resistance and offers a lot more upside for a rendezvous with its all-time high.

The iShares Russell 2000 (NYSE:IWM) gained 1.6% and is just a point away from its all-time closing high.

I am frankly surprised that any of the major indices could pull off a new all-time high so soon after February’s breakdown. I just assumed the S&P 500 would be stuck between its all-time high and its picture-perfect test of 200DMA support for several months to come. Now I have to take a new all-time high seriously. Accordingly, I bumped the short-term trading call from neutral all the way to bullish. I reloaded on SPY shares and calls. The easy stop loss is a close below the 50DMA. Note that this trade is not about anticipating some new catalyst to boost the stock market yet higher. This trade is about the return of regularly scheduled programming; the resumption of the previous momentum that rode on narratives of high consumer confidence, a strengthening American economy, and robust global growth.

AT40 (T2108), the percentage of stocks trading above their respective 40DMAs, confirmed the bullish day by soaring from 39.5% to 48.4%. This level is its highest since the February jobs report. AT200 (T2107), the percentage of stocks trading above their respective 200DMAs, is back above 50% and a marginal new high for this bounce from oversold conditions.

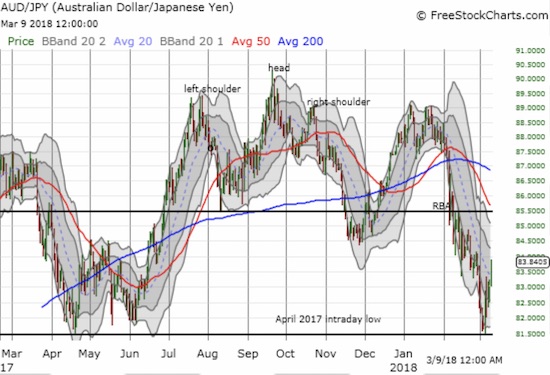

The currency markets are also on board with the refreshed bullish sentiment. The Australian dollar soared across the board. AUD/JPY almost gained 1% in what looks like a confirmation of a successful test of the April, 2017 intraday low (you just can’t make this stuff up!). I still grew my short AUD/JPY position as a hedge while I get busy with bullish trades elsewhere in forex.

AUD/JPY likely confirmed a bottom, but it has a long way to go to invalidate its head and shoulders top.

CHART REVIEWS

iPath Bloomberg Cocoa SubTR ETN (NIB)

I write extensively about cocoa and trading the representative ETN NIB. On Thursday I took profits on my core position. I have not turned bearish. Instead, the recent run-up looks very extended, and I want to meet the next dip with aggressive buying. I could not do that while still holding the extremely large position that I had.

The iPath Bloomberg Cocoa SubTR ETN (NIB) has gone nearly straight up for since the December low which almost tested the all-time low. The run-up is almost parabolic and the risk/reward favors taking profits.

Teucrium Corn ETF (CORN)

Looks like it is time to pay more attention to corn again. The Teucrium Corn ETF broke out from its downtrending 200DMA. I assume this breakout confirms the December/January double-bottom. However, I need to review the latest and upcoming crop reports to regain my confidence. When I last wrote about CORN, I lamented that CORN broke below a price barrier I thought would hold. Yet the drop below the cost of production and seasonal factors encouraged me to look forward to an eventual price rally. Almost two months later that rally launched.

The Teucrium Corn ETF (CORN) broke out above its 200DMA downward trend and the Fall consolidation period that preceded fresh all-time lows.

Cboe Global Markets, Inc. (CBOE)

With volatility finally imploding as expected, I took another look at CBOE. As I mentioned earlier, I expect the fade volatility trade to quickly regain momentum. CBOE remains the best way to play the trading volume. My abundance of caution with the stock kept me out even as CBOE bounced away from 200DMA support, but I am ready to go with Friday’s 50DMA breakout. I will be accumulating a substantial position as long as the 200DMA holds as support.

The Cboe Global Markets, Inc. (CBOE) survived its test with 200DMA support. The brief breakdown likely shook out a lot of motivated sellers.

El Pollo Loco Holdings, Inc. (LOCO)

The chicken trade is trying to make a comeback. Post-earnings LOCO gained 7.8% on 6x average volume. That kind of trading volume on buying pressure is good enough to confirm a bottom. I will be eating up shares with an easy stop on a complete reversal of all the post-earnings gains. LOCO is loco cheap at this point with a 14.2 forward P/E, 1.0 price/sales ratio, and a 1.5 price/book ratio.

El Pollo Loco Holdings, Inc. (LOCO) has struggled since late last summer. The bottom may finally be here.

Kroger (NYSE:KR)

KR was a great trade on the rebound from an Amazon (NASDAQ:AMZN) panic. Unfortunately, the latest earnings debacle confirms that the business is fundamentally flawed in the eyes of investors. Price competition is brutal in groceries, and the CEO likely underlined investor fears in the Q&A period with this response (from the Seeking Alpha transcript):

“As I’ve said before, we’re not going to lose on price, but we’re not out there trying to lead the market down. And as you know, as part of Restock Kroger, we committed to improving operating margin dollars by 400 million over the next three years.”

I am not clear on how you win on price without leading the market on the downward slope! KR lost 12.4% post-earnings. It was a gap down that confirmed 50DMA resistance and cracked 200DMA support. The post-earnings gains from November are now all gone. While KR rebounded 4.8% on Friday, I am not interested in trying to bottom-fish again here, at least not without a further discount like the one I snatched with the Amazon panic.

Kroger (KR) gave up the ghost with its 200DMA breakdown.

United Parcel Service, Inc. (NYSE:UPS)

Speaking of Amazon panics, UPS is finally pulling away from its own bout of Amazon panic a month ago. Given the stock first broke down from earnings and is below both 50 and 200DMAs, the stock carries substantial risk. I am willing to take the risk given package delivery is a growth business. The easy stop loss is a new post Amazon panic low.

United Parcel Service, Inc. (UPS) is struggling to pull away from its rendezvous with Amazon panic, but overhead resistance looms large.

Other trades related to previous posts past 2 trading days: added a second USCR call option (I need to write an earnings update!); second leg of AAPL calendar spread expired worthless – I should have taken the small profit I had when AAPL started falling from $180 last week; I returned to my normal AAPL weekly trade starting on Thursday with just one call – it sold on Friday after hitting a double. I am hoping to get a dip on Monday, but I am not optimistic; started a new call spread in TWTR; I am in accumulation mode as SSTI made new all-time highs

— – —

FOLLOW Dr. Duru’s commentary on financial markets via email, StockTwits, Twitter, and even Instagram!

“Above the 40” uses the percentage of stocks trading above their respective 40-day moving averages (DMAs) to assess the technical health of the stock market and to identify extremes in market sentiment that are likely to reverse. Abbreviated as AT40, Above the 40 is an alternative label for “T2108” which was created by Worden. Learn more about T2108 on my T2108 Resource Page. AT200, or T2107, measures the percentage of stocks trading above their respective 200DMAs.

Active AT40 (T2108) periods: Day #16 over 20%, Day #5 over 30%, Day #1 over 40% (overperiod ending 22 days under 40%), Day #23 under 50%, Day #24 under 60%, Day #30 under 70%

Black line: AT40 (T2108) (% measured on the right)

Red line: Overbought threshold (70%); Blue line: Oversold threshold (20%)

Be careful out there!

Full disclosure: long SPY calendar call spread, long SPY shares and calls, short AUD/JPY, long CORN, TWTR call spread, long USCR calls, long SSTI