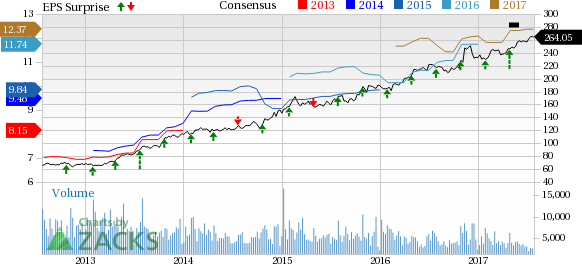

Northrop Grumman Corporation (NYSE:NOC) reported second-quarter 2017 earnings of $3.15 per share, beating the Zacks Consensus Estimate of $2.84 by 10.9%. Reported earnings were also up 10.5% from $2.85 recorded in the year-ago quarter.

Total Revenue

In second-quarter 2017, Northrop Grumman reported total revenue of $6.38 billion, beating the Zacks Consensus Estimate of $6.21 billion by 2.7%. Revenues also increased 6.3% from the year-ago figure of $6 billion. The revenue upside was primarily driven by a 14.2% increase in Aerospace systems sales.

Segmental Details

Aerospace Systems: Segment sales of $2.97 billion increased 14.2% year over year as a result of higher volumes of manned aircraft programs. Strong autonomous systems and space sales also benefitted this segment.

Operating income also rose 1% to $315 million, while operating margin contracted 140 basis points (bps) to 10.6%.

Mission Systems: Segment sales increased 3.4% to $2.78 billion due to higher sales volume of Sensors and Processing systems.

Operating income improved 6.6% to $374 million, while operating margin expanded 40 bps to 13.4%.

Technology Services: Sales at the segment dropped 3.1% to $2.78 billion, driven by lower sales for System Modernization and Services programs as well as Advanced Defense Services programs.

Operating income increased 2.3% to $134 million while operating margin expanded 60 bps to 11.4%.

Operational Update

Total operating cost and expenses at the end of the quarter was $5.52 billion, up 6.1%.

Operating income during the quarter also increased 7.3% to $0.9 billion.

Financial Condition

Northrop Grumman’s cash and cash equivalents as of Jun 30, 2017 were $1.38 billion, down from $2.54 billion as of Dec 31, 2016.

Long-term debt (net of current portion) as of Jun 30, 2017, was $6.21 billion, down from $7.06 billion as of 2016 end.

Net cash outflow from operating activities as of Jun 30, 2017 was $68 million compared with the year-ago figure of $544 million.

2017 Guidance

Northrop Grumman currently expects to generate revenues lower than $25 billion during 2017 compared with its earlier guidance of approximately $25 billion. On the bottom-line front, the company has raised its outlook. Northrop Grumman now expects to generate earnings in the range of $12.10–$12.40 compared with the earlier guidance range of $11.80–$12.10.

However, the company maintains its free cash flow guidance in the range of $1.8–$2 billion.

Zacks Rank

Northrop Grumman currently holds a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Peer Releases

Lockheed Martin Corp. (NYSE:LMT) reported second-quarter 2017 earnings from continuing operations of $3.23 per share, beating the Zacks Consensus Estimate of $3.10 by 4.2%. Earnings also surpassed the year-ago period’s bottom-line figure by 10.2%.

Textron Inc. (NYSE:TXT) reported second-quarter 2017 adjusted earnings from continuing operations of 60 cents per share, beating the Zacks Consensus Estimate of 55 cents by 9.1%.

The Boeing Company (NYSE:BA) reported adjusted earnings of $2.55 per share for second-quarter 2017, beating the Zacks Consensus Estimate of $2.32 by 9.9%. In the year-ago quarter, the company had reported a loss of 44 cents.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Northrop Grumman Corporation (NOC): Free Stock Analysis Report

Boeing Company (The) (BA): Free Stock Analysis Report

Lockheed Martin Corporation (LMT): Free Stock Analysis Report

Textron Inc. (TXT): Free Stock Analysis Report

Original post