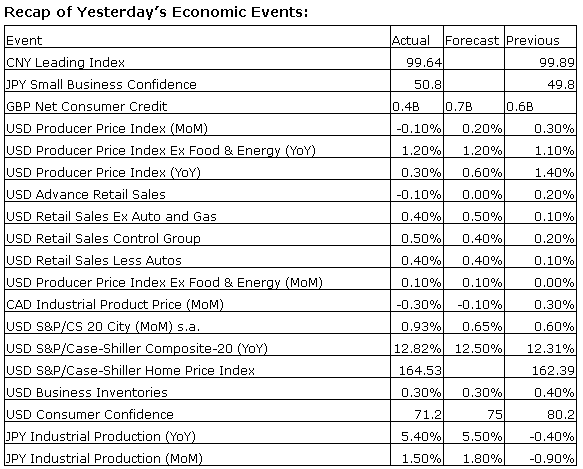

Upcoming US Events for Today:

- ADP Employment Report for October will be released at 8:15am. The market expects 138,000 versus 166,000 previous.

- Consumer Price Index for September will be released at 8:30am. The market expects a month-over-month increase of 0.2% versus an increase of 0.1% previous.Excluding Food and Energy, the increase is expected to show 0.2% versus an increase of 0.1% previous.

- Weekly Crude Inventories will be released at 10:30am.

- The FOMC Meeting Announcement will be held at 2:00pm.The market expects rates to remain unchanged at 0 – 0.25%.

Upcoming International Events for Today:

- German Unemployment Rate for October will be released at 4:55am EST. The market expects no change at 6.9%.

- Economic Sentiment for October will be released at 6:00am EST. The market expects 97.2 versus 96.9 previous.

- German Consumer Price Index for October will be released at 9:00am EST. The market expects a year-over-year increase of 1.4%, consistent with the previous report.

- Japan Manufacturing PMI for October will be released at 7:15pm EST.

The Markets

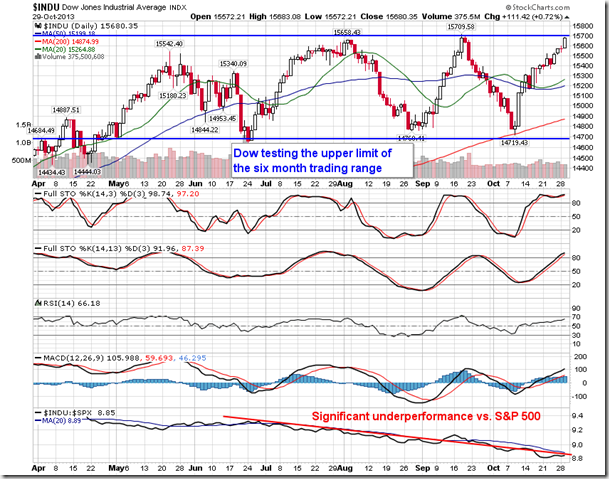

Stocks pushed higher on Tuesday as investors positioned portfolios ahead of the FOMC announcement on Wednesday. Investors overwhelmingly expect no change to present stimulus measures as a result of recent lacklustre employment reports that were less than expected. Despite the risk-on trading environment that would be implied by maintaining stimulus measures, consumer staples, a defensive sector, continues to dominate market performance. Sectors that have lagged the market activity as of recent, such as the consumer staples and energy, outperformed the market on Tuesday in what may be construed as month-end positioning; cyclical sectors that have led the markets higher over recent weeks, such as industrials and materials, underperformed broad market benchmarks during the session. The Russell 2000 Small Cap Index, the classic risk-on play, is also starting to show signs of lagging broad market performance. Stocks remain significantly overbought and some sort of consolidation appears to be in order to rejuvenate upside momentum.

The gains on the session pushed the Dow Jones Industrial Average to a new closing high as the blue chip index attempts to join the other benchmarks in previously uncharted territory. The Dow is presently testing the upper limit of an over 6 month trading range. The Dow has significantly underperformed the S&P 500 since mid-April due to lagging performance in Exxon Mobil, IBM, and Caterpillar, each of which typically trend positive into the end of the year.

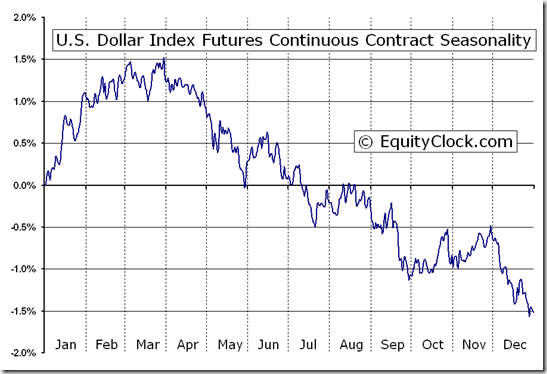

One of the factors contributing to equity market strength over recent months has been the declines in the US Dollar Index. Correlation of the US Dollar index and stocks is generally negative, indicating that as the US dollar declines, stocks gain, and vice versa. The dollar index is presently testing long-term support around 79.0 and a short-term positive momentum divergence with respect to MACD has become apparent. The US dollar index seasonally rises into the month of November, which typically weighs on equity market momentum into the middle of the month. The trend in the US Dollar Index will remain dependent on Fed policy, which we’ll find out about on Wednesday. Further gains in the dollar index from this significant level of support could have the potential to weigh on equity markets once again.

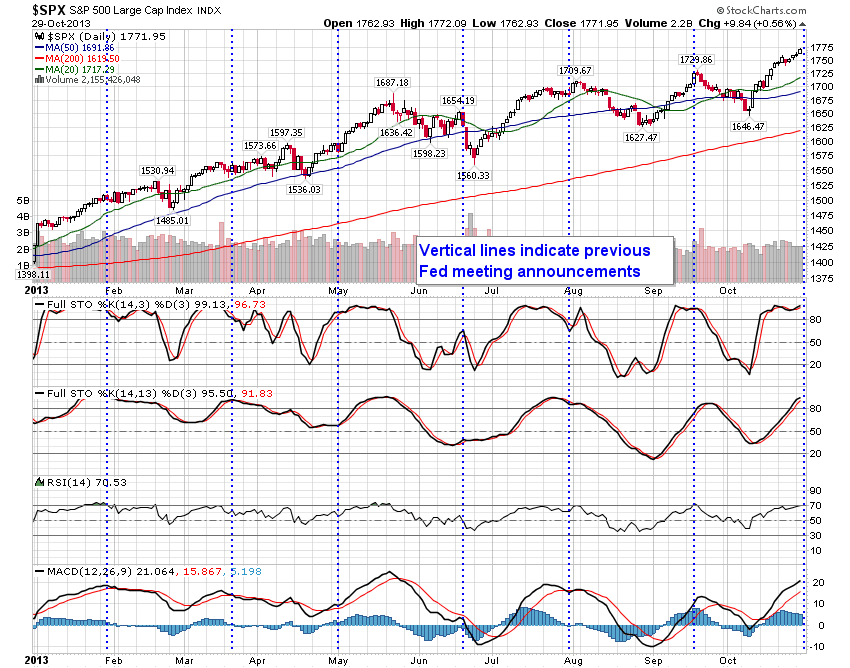

And finally, with the Fed meeting announcement this afternoon I thought it be prudent to present a chart of the S&P 500 with previous FOMC event days noted. The last two FOMC announcements saw a market peak shortly thereafter; the S&P 500 was lower during the few weeks that followed. Will today’s Fed announcement bring an end to the present short-term trend?

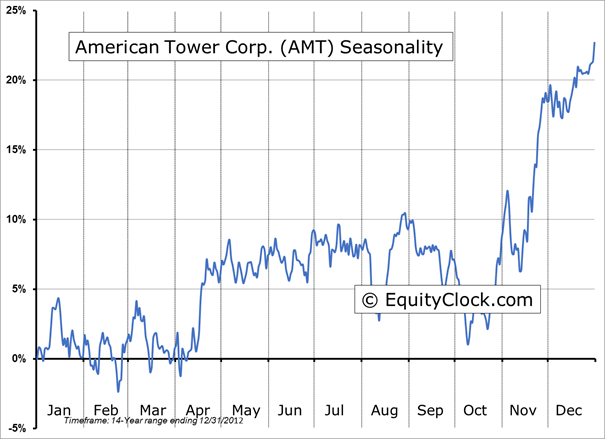

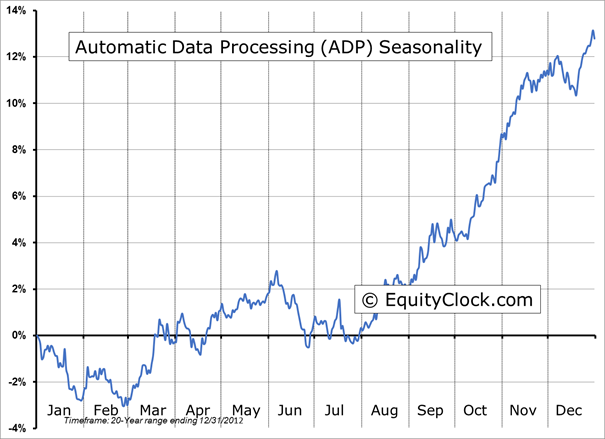

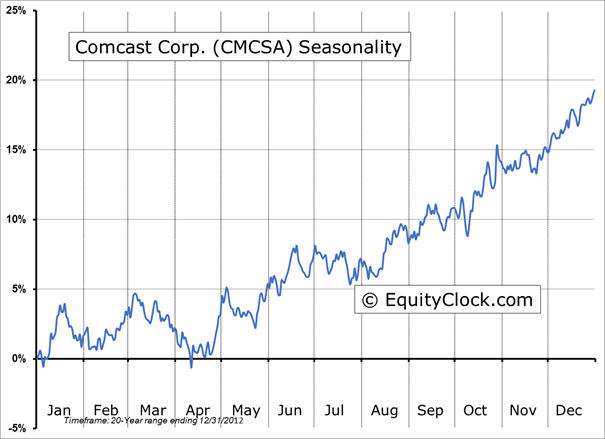

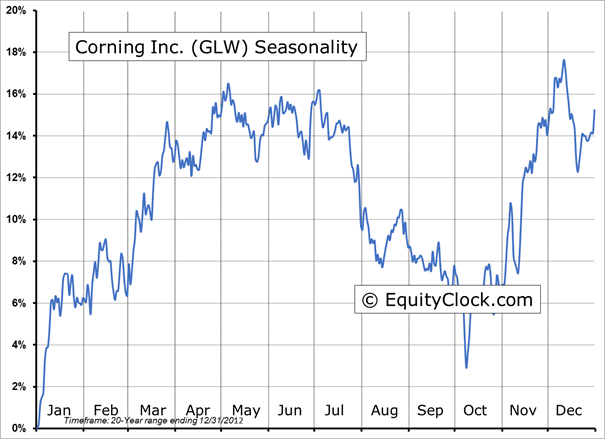

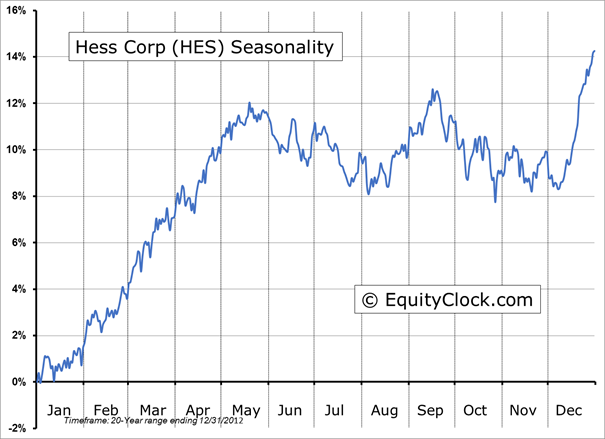

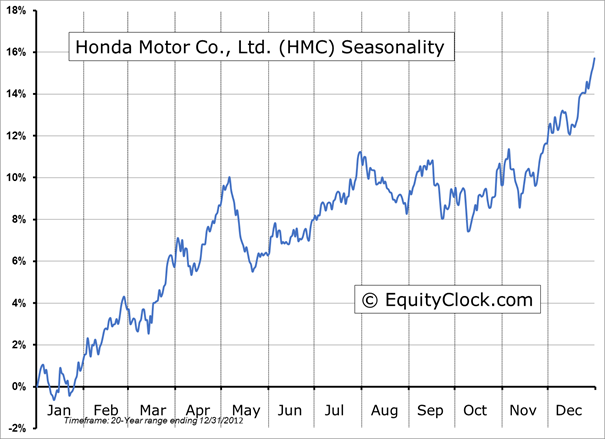

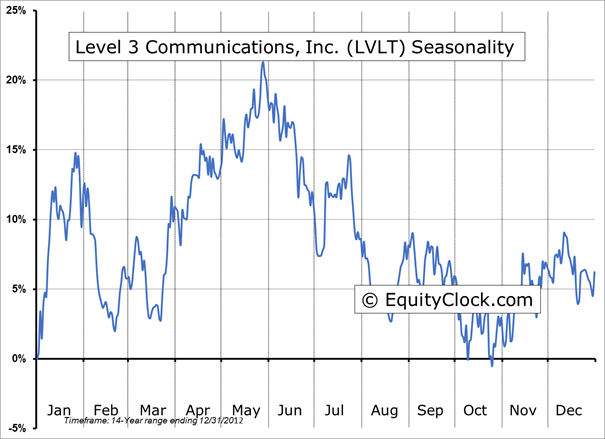

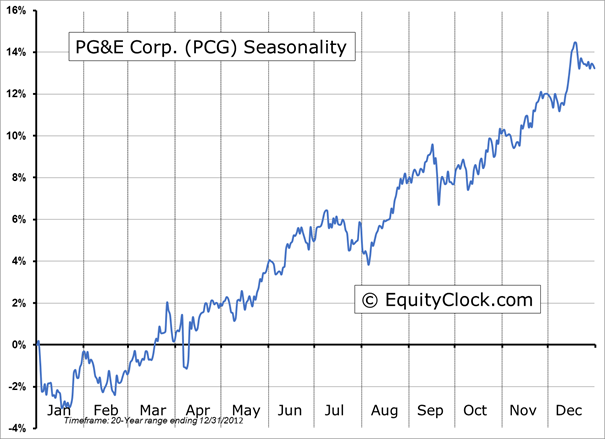

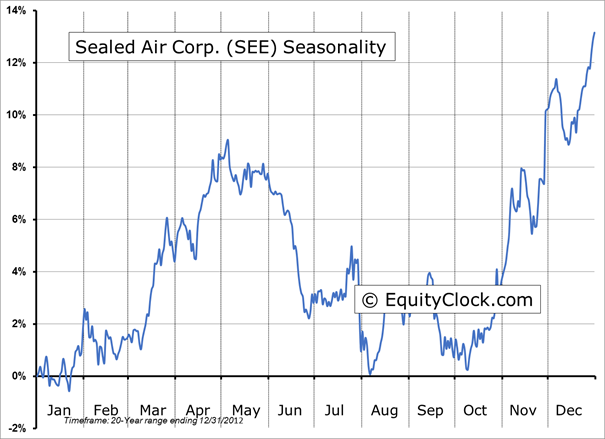

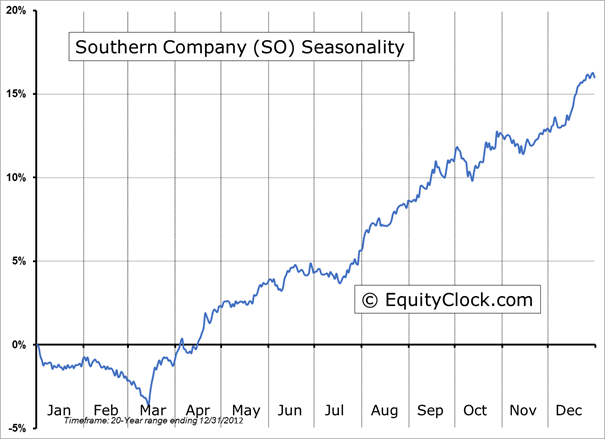

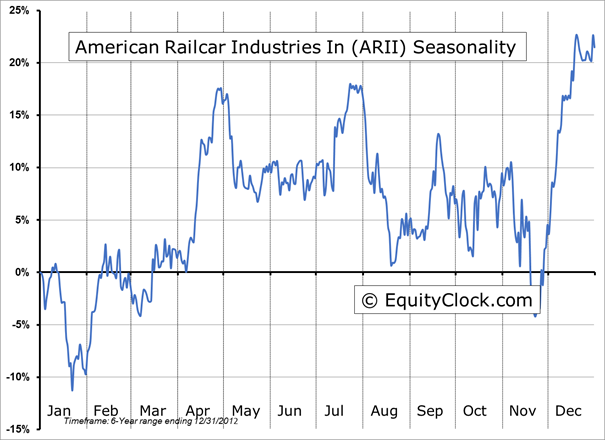

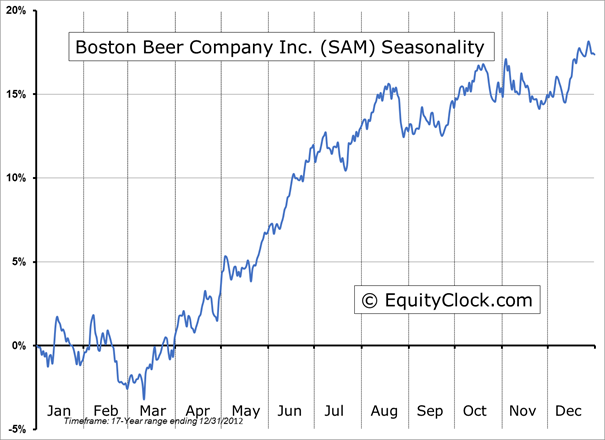

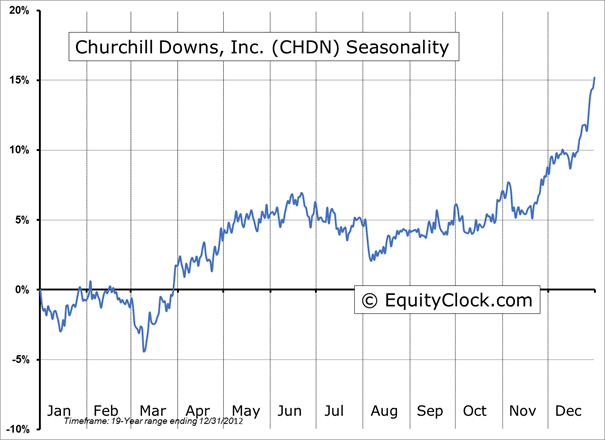

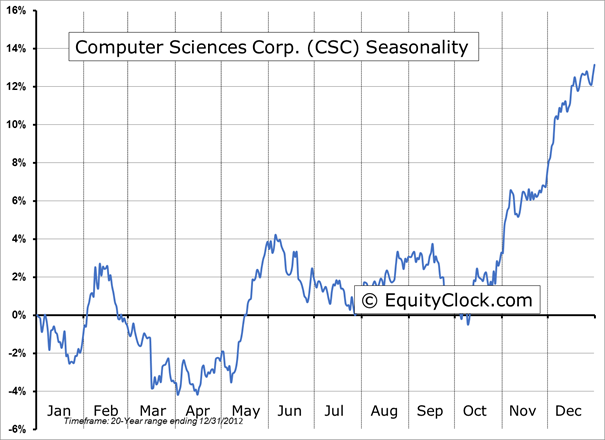

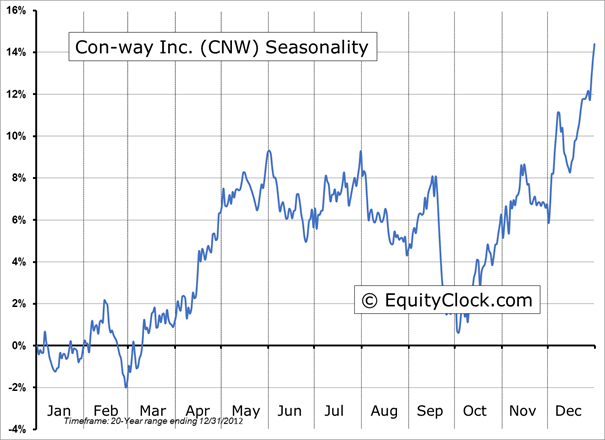

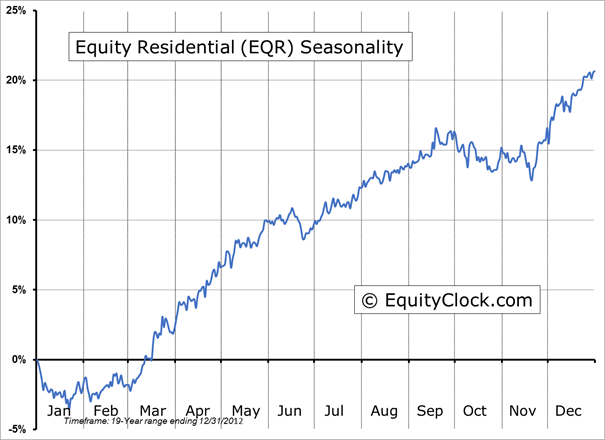

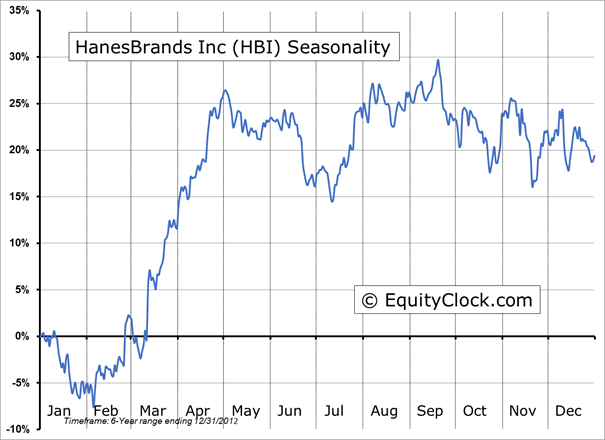

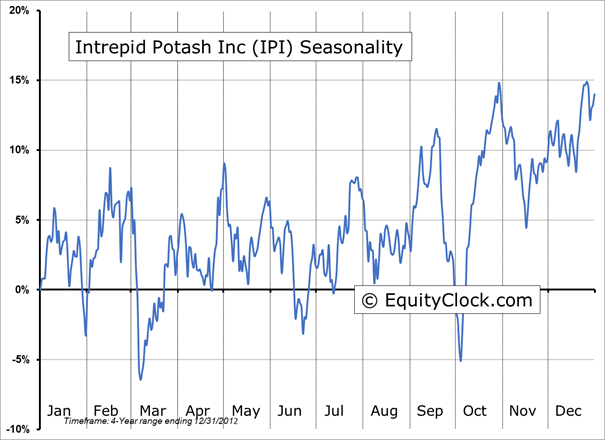

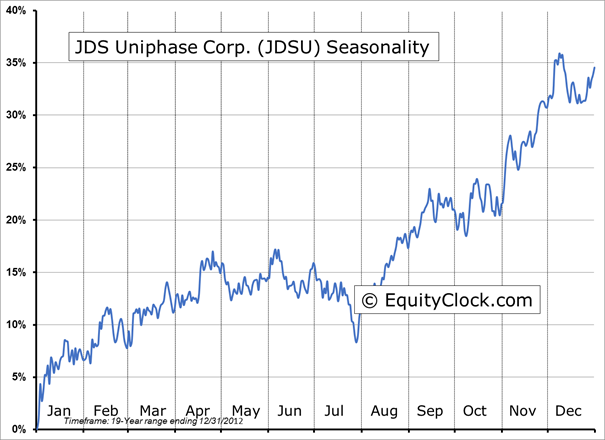

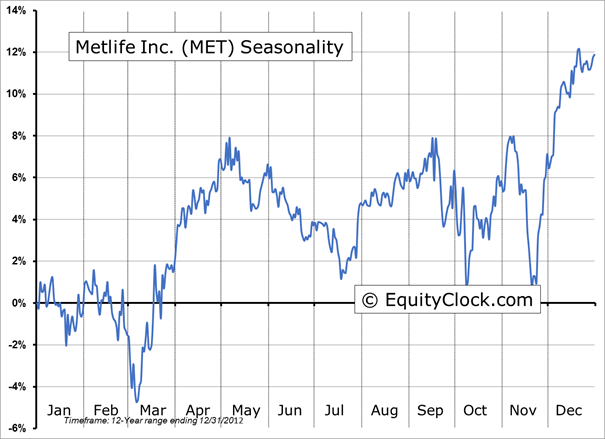

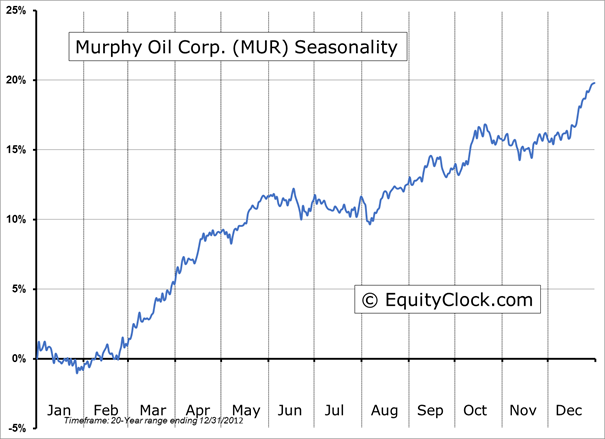

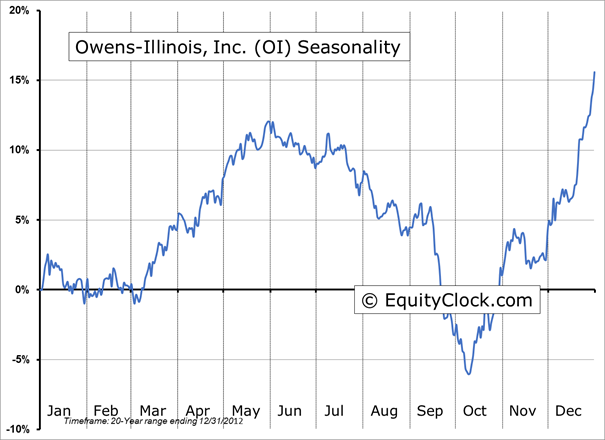

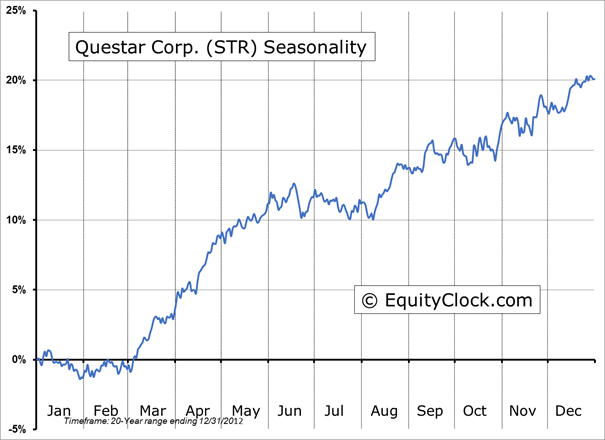

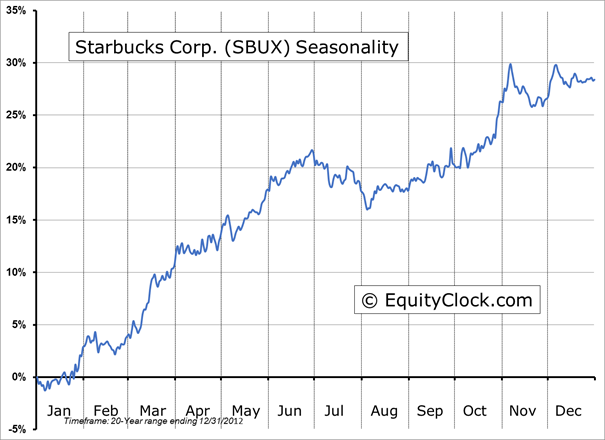

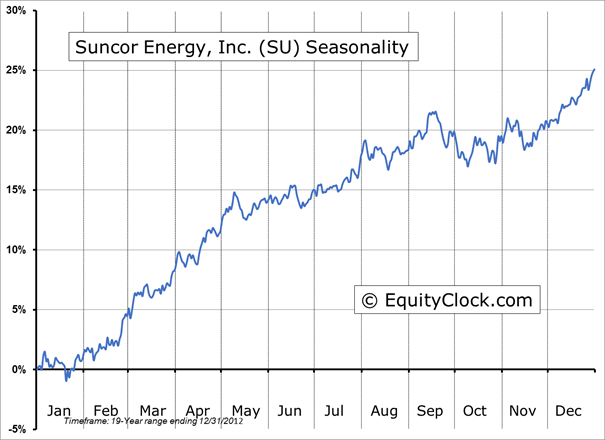

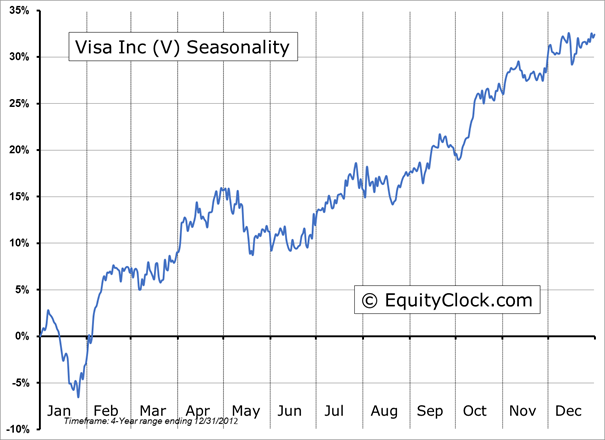

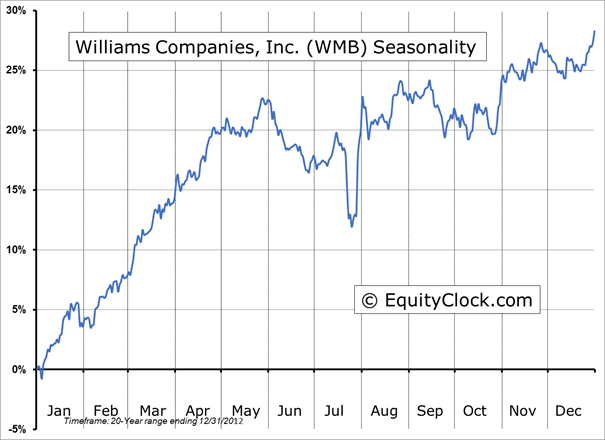

Seasonal charts of companies reporting earnings today:

Sentiment on Tuesday, as gauged by the put-call ratio, ended bullish at 0.74. Complacency is showing signs of spiking ahead of Wednesday’s potentially market moving FOMC event.

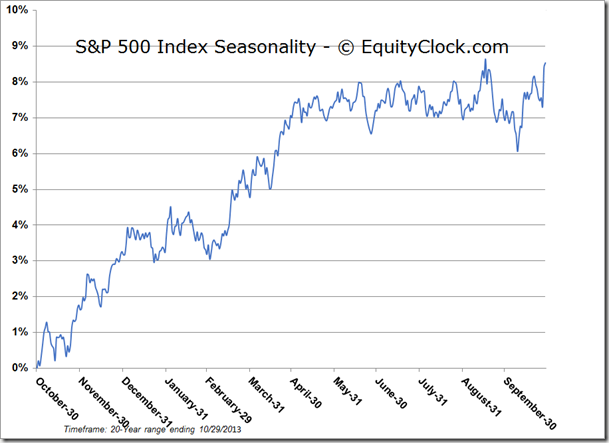

S&P 500 Index

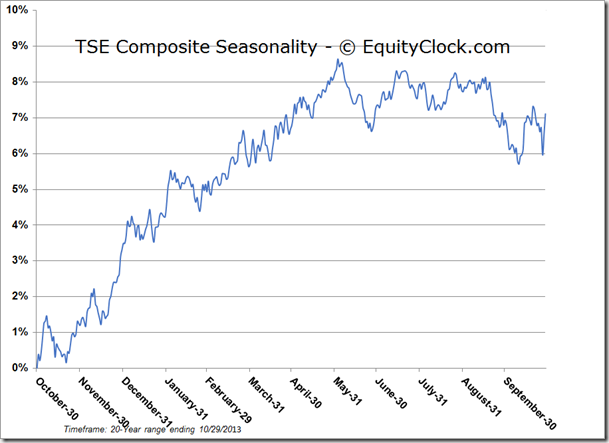

TSE Composite

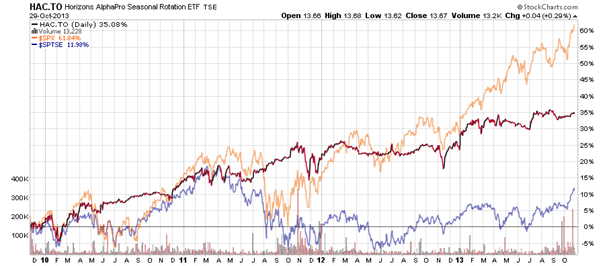

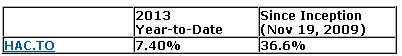

Horizons Seasonal Rotation ETF (TSX:HAC)

- Closing Market Value: $13.67 (up 0.29%)

- Closing NAV/Unit: $13.66 (up 0.22%)

Performance*

* performance calculated on Closing NAV/Unit as provided by custodian

Click Here to learn more about the proprietary, seasonal rotation investment strategy developed by research analysts Don Vialoux, Brooke Thackray, and Jon Vialoux.