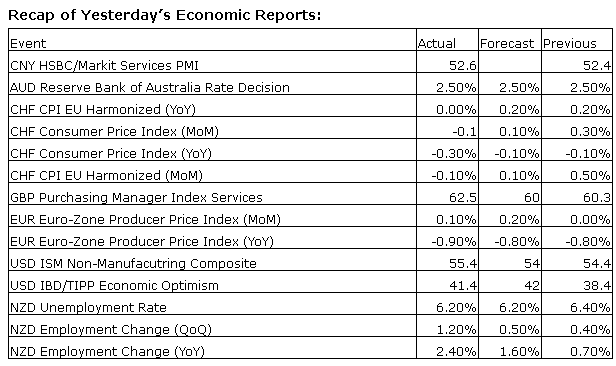

Upcoming US Events for Today:

- Leading Indicators for September will be released at 10:00am. The market expects a month-over-month increase of 0.7%, consistent with the previous report.

- Weekly Crude Inventories will be released at 10:30am.

Upcoming International Events for Today:

- German PMI Services for October will be released at 3:55am EST. The market expects 52.3 versus 53.7 previous.

- Euro-Zone PMI Services for October will be released at 4:00am EST. The market expects 50.9 versus 52.2 previous.

- Great Britain Industrial Production for September will be released at 4:30am EST. The market expects a year-over-year increase of 1.8% versus a decline of 1.5% previous.

- Euro-Zone Retail Sales for September will be released at 5:00am EST. The market expects a year-over-year increase of 0.5% versus a decline of 0.3% previous.

- German Manufacturers’ Orders for September will be released at 6:00am EST. The market expects a year-over-year increase of 5.7% versus an increase of 3.1% previous.

- Canadian Ivey PMI for October will be released at 10:00am EST.

- Great Britain NISER GDP estimate for October will be released at 10:00am EST. The market expects an increase of 0.5% versus an increase of 0.8% previous.

The Markets

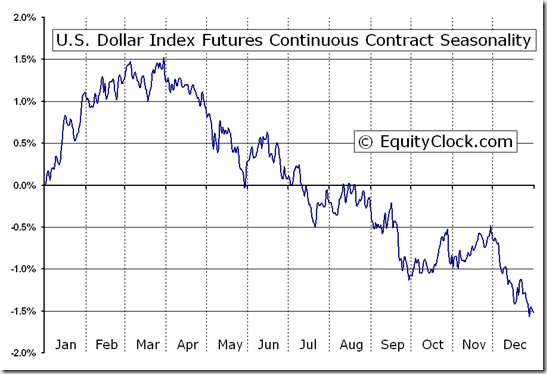

Stocks posted marginal declines on Tuesday as the European Commission indicated that economic growth in the European Union will be sluggish and unemployment high into next year. The announcement put pressure on the Euro currency while lifting the US Dollar index, which in turn pressured stocks lower. The US Dollar Index recently bounced from a significant level of support around 79 and has now surpassed a minor level of resistance around 80.75, hinting of a change in the intermediate trend from negative to positive. Continued strength in the US Dollar could negatively pressure stocks, which are typically inversely correlated to the currency. Meanwhile, the Euro is testing a key intermediate rising trendline, a breakdown through which would imply a change of trend, likely to coincide with equity market weakness. The US Dollar index seasonally gains between October and November before resuming a downtrend into the month of December.

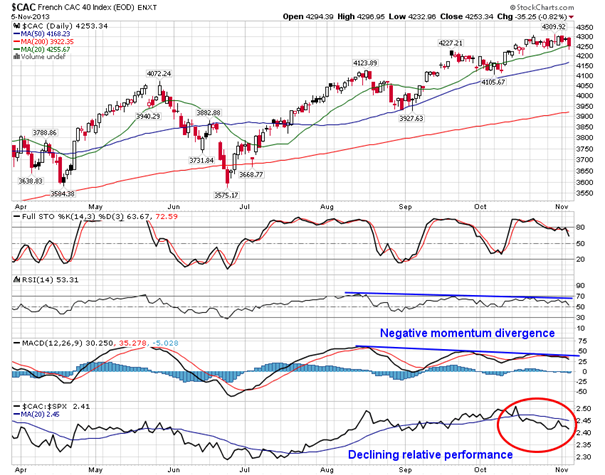

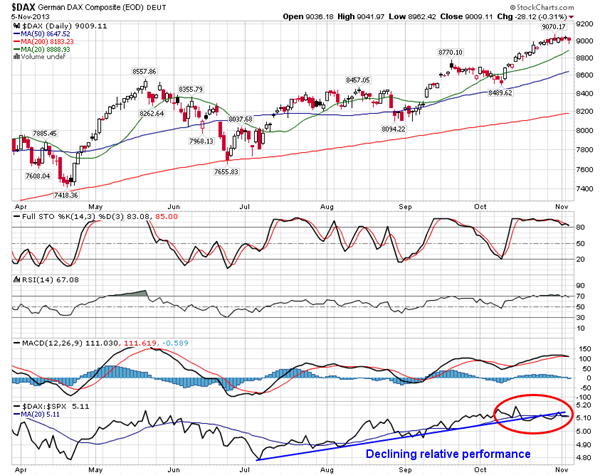

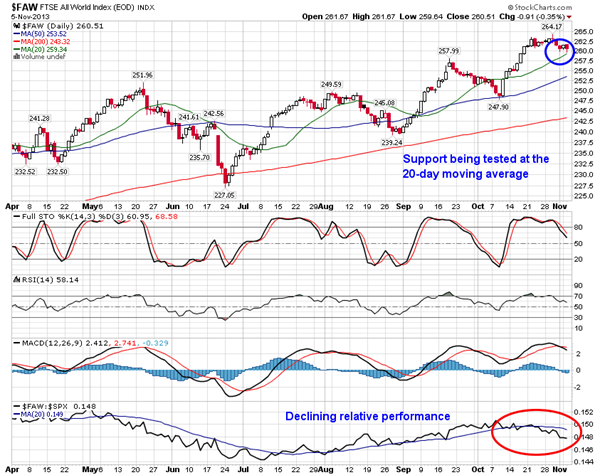

And while the Euro currency faltered, so too did European equity indices, which are showing signs of underperformance versus American equivalents. Levels of support around the 20-day moving average are coming into play. European indices remain in a period of seasonal strength through to next Spring, implying that short-term weakness may present ideal buying opportunities.

And finally for today, Mark Leibovit of VRTrader.com sent over a video last night explaining why he is negative on the US market at the present time. Mark uses a proprietary strategy of identifying volume reversals in order to trigger buy and sell signals for the market and individual equity positions.

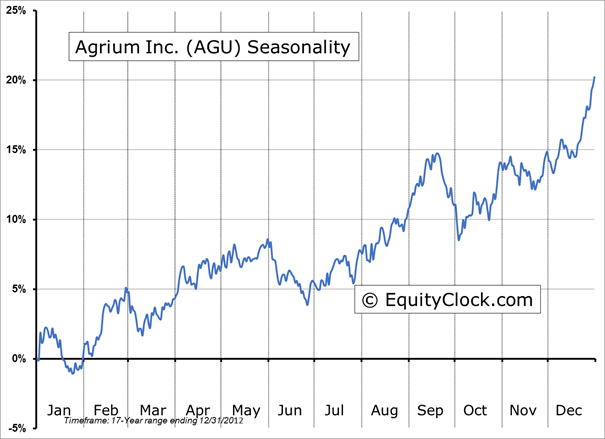

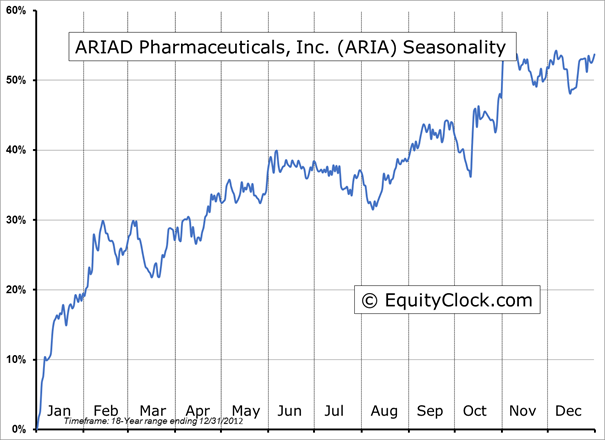

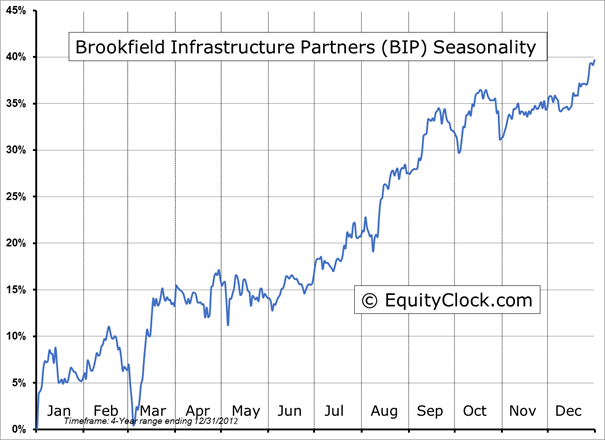

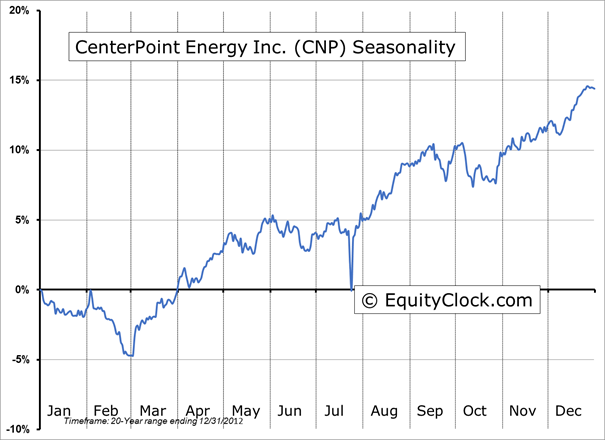

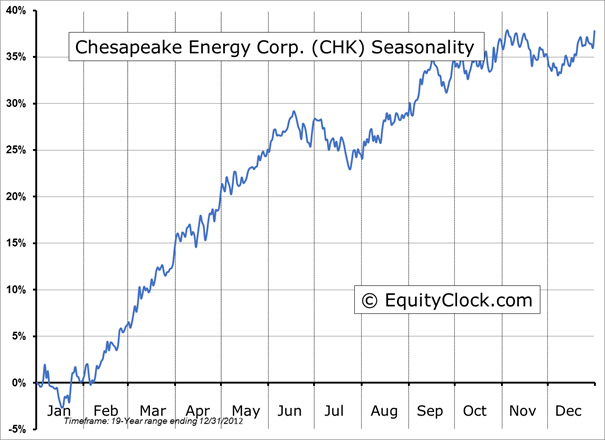

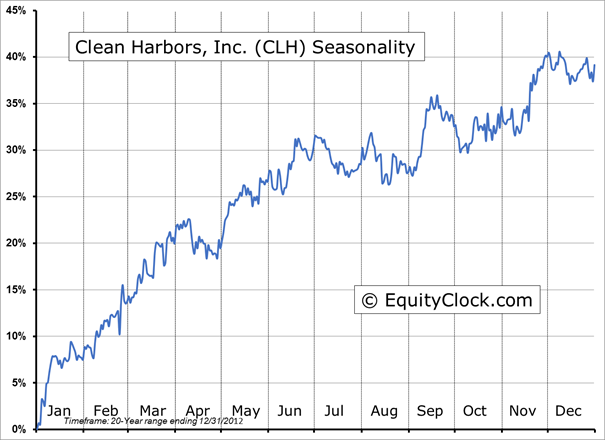

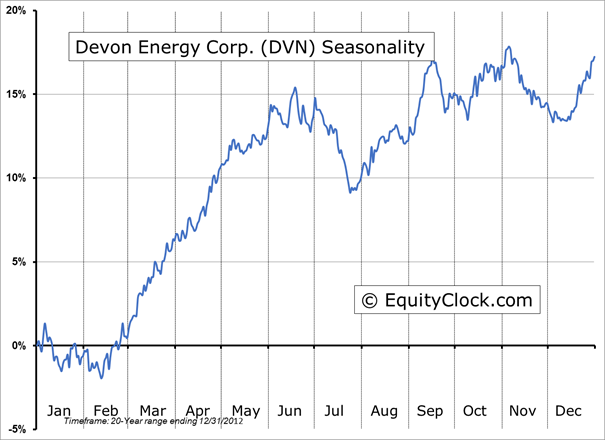

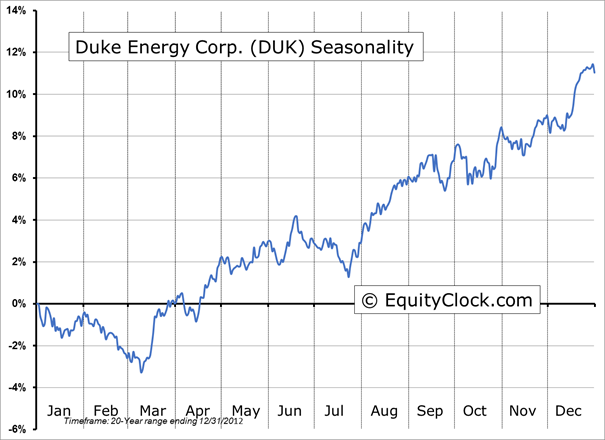

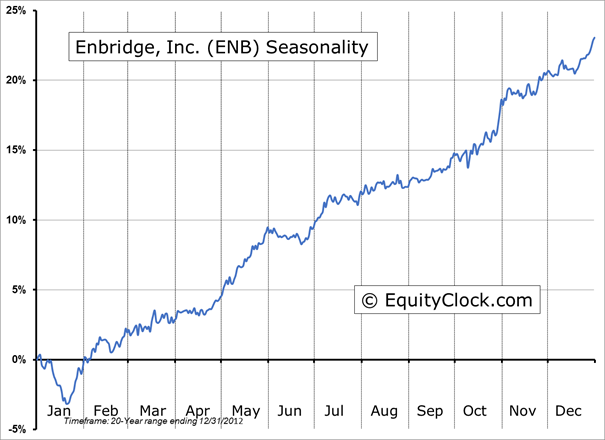

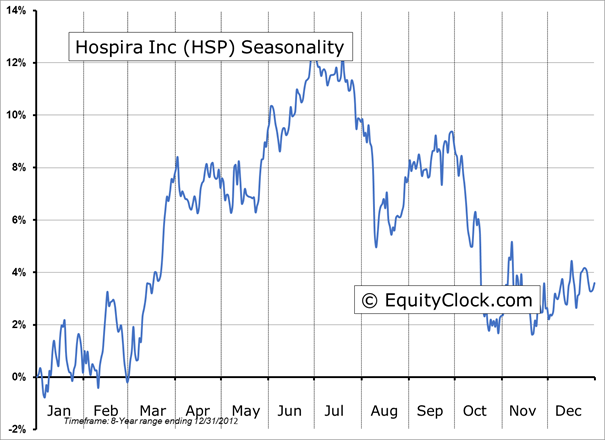

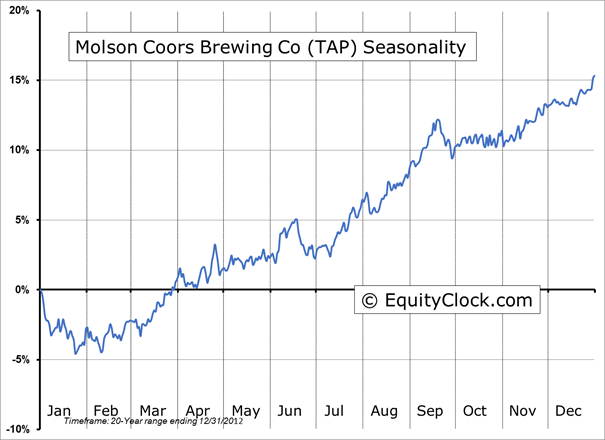

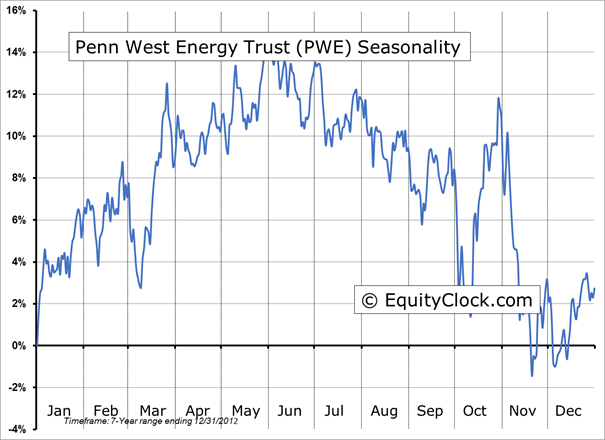

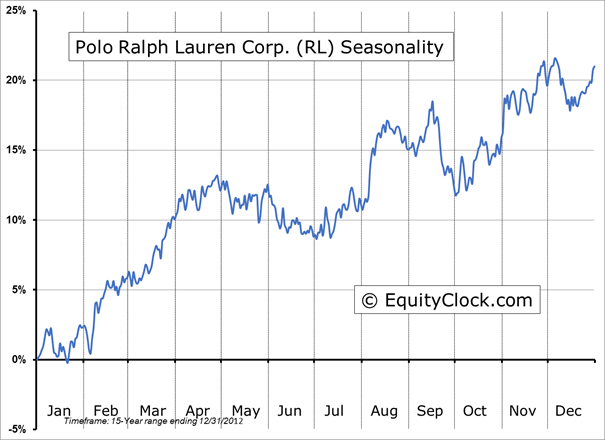

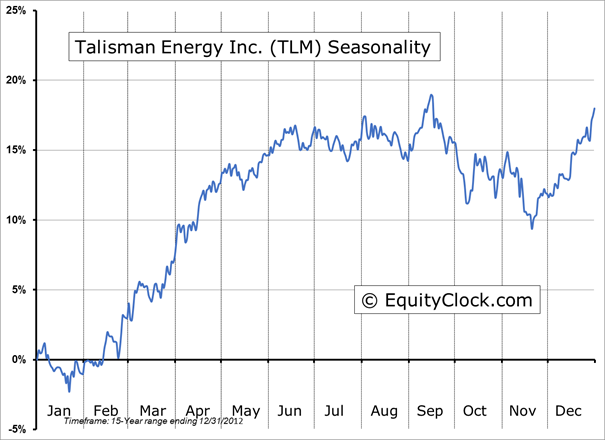

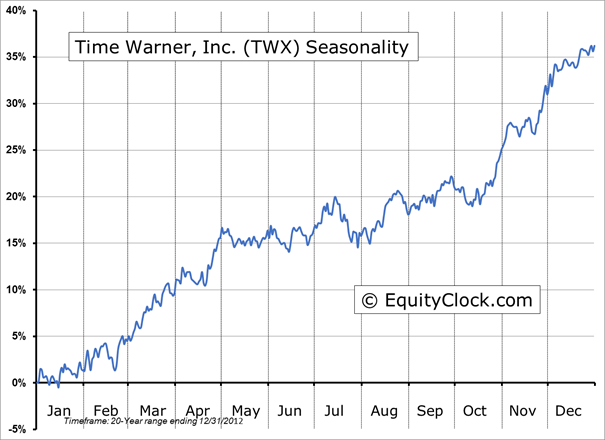

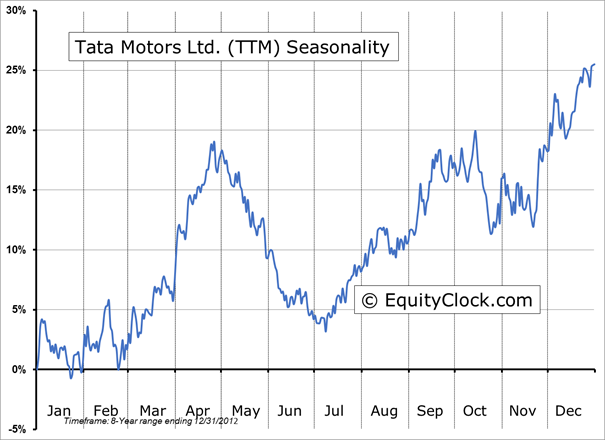

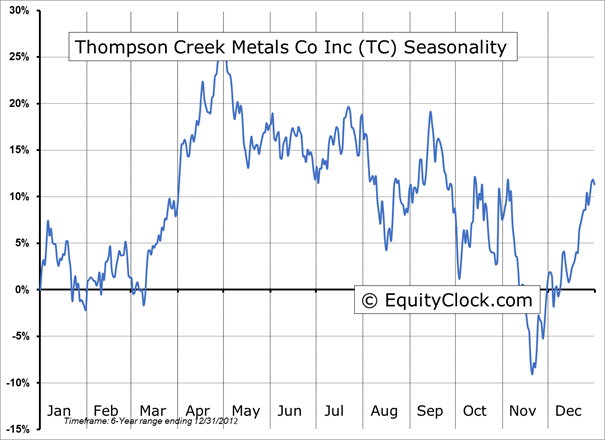

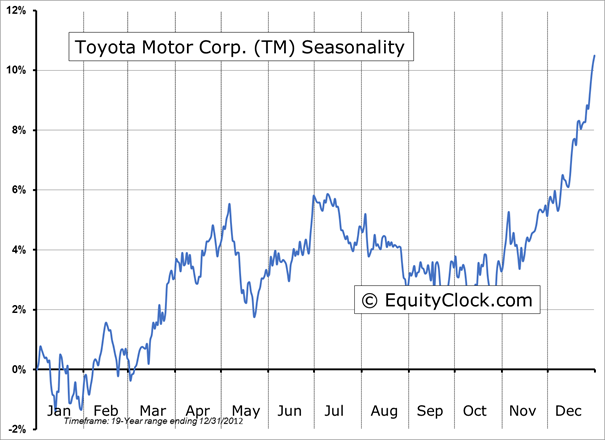

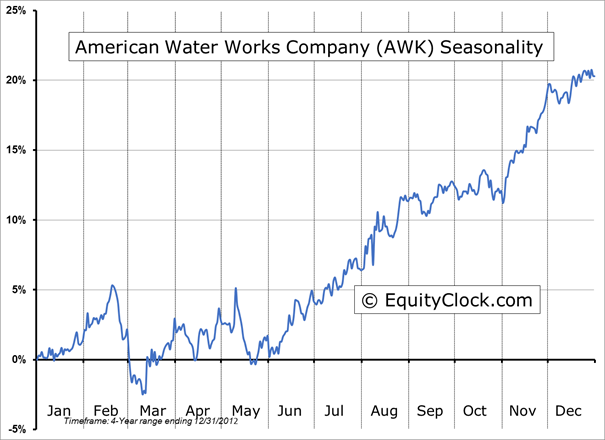

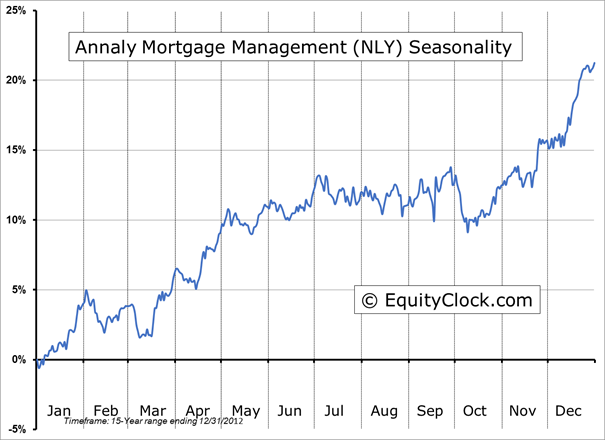

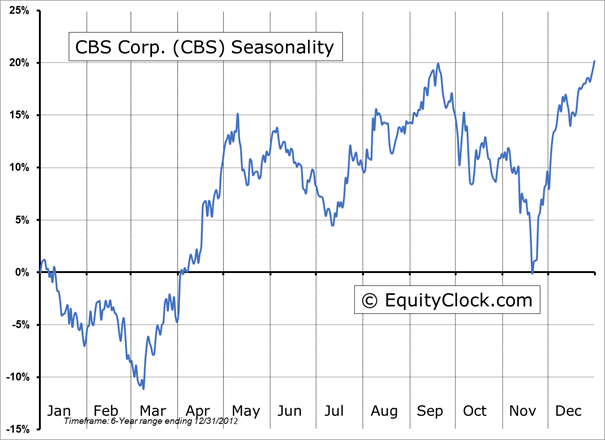

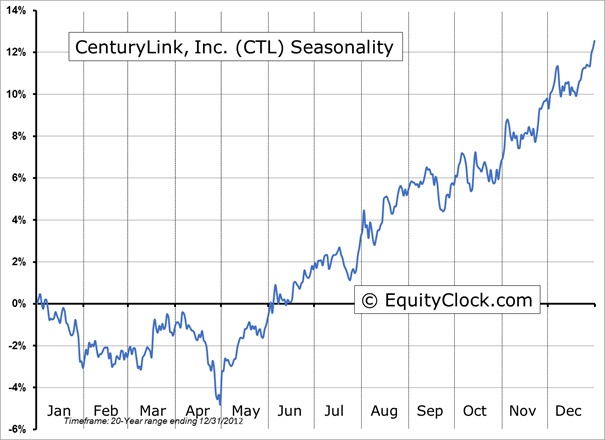

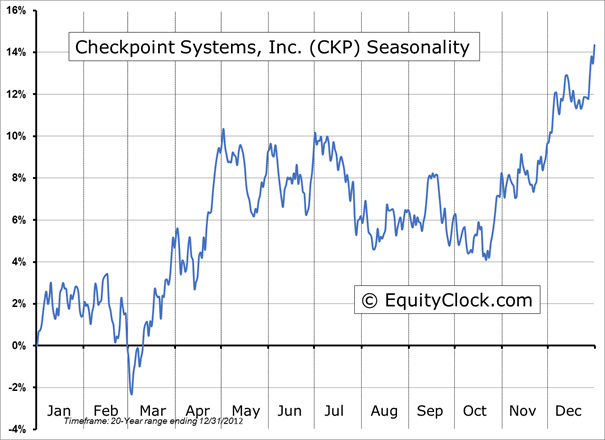

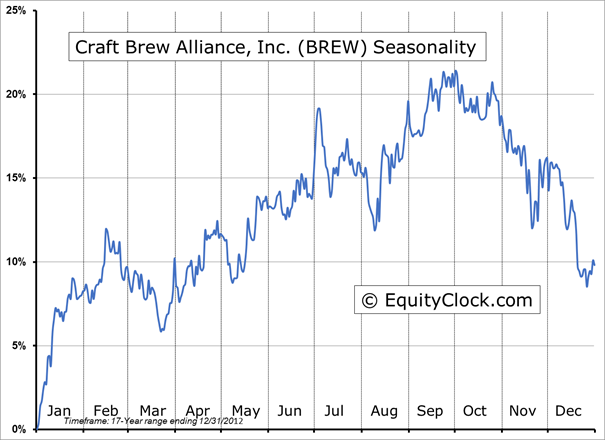

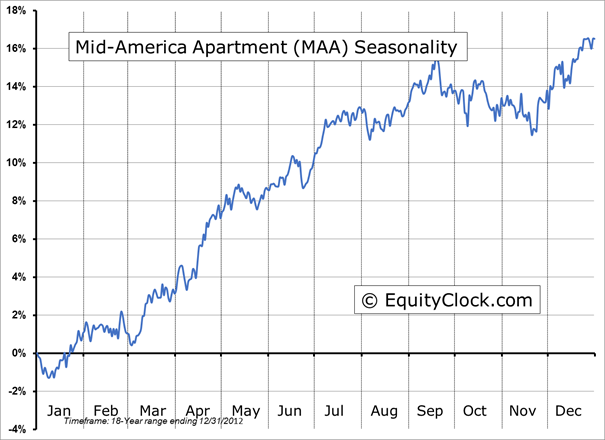

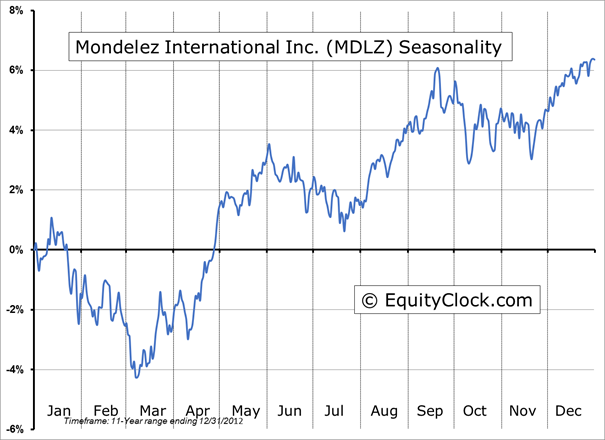

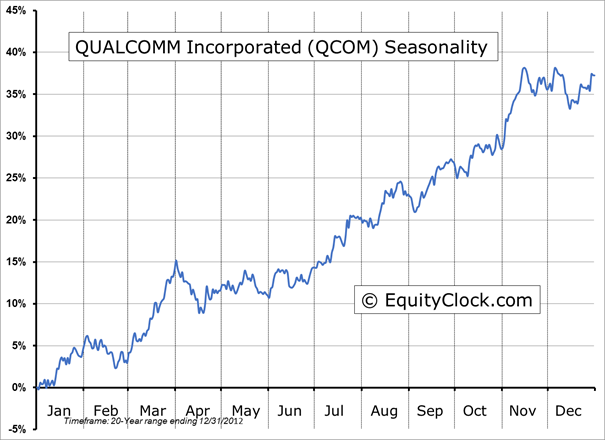

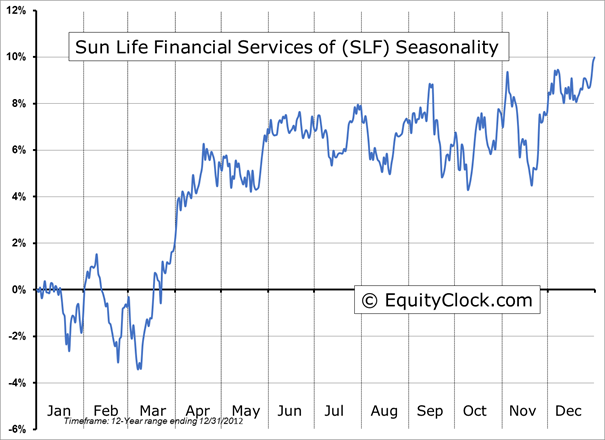

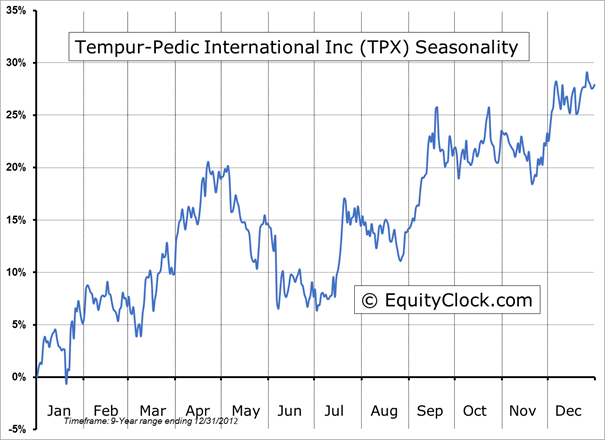

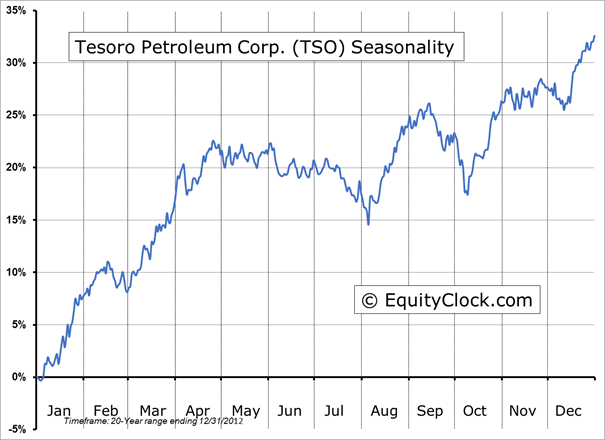

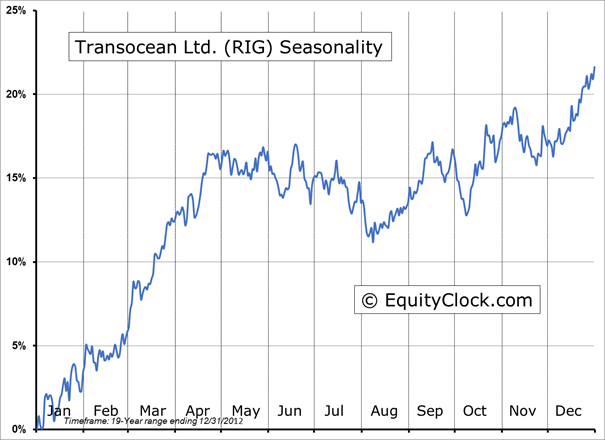

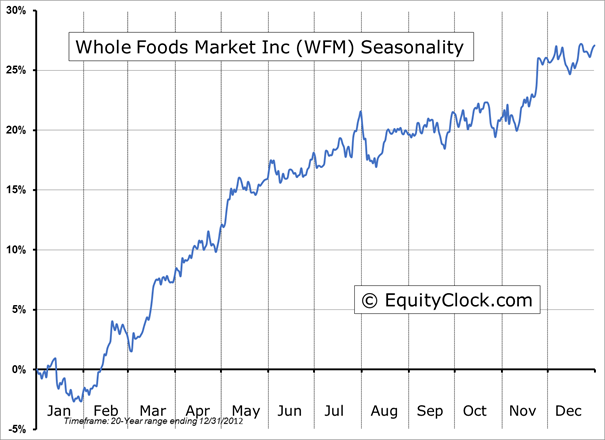

Seasonal charts of companies reporting earnings today:

Sentiment on Tuesday, as gauged by the put-call ratio, ended bullish at 0.78.

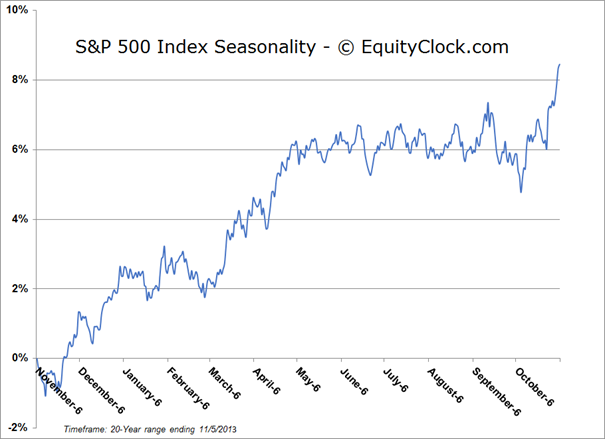

S&P 500 Index

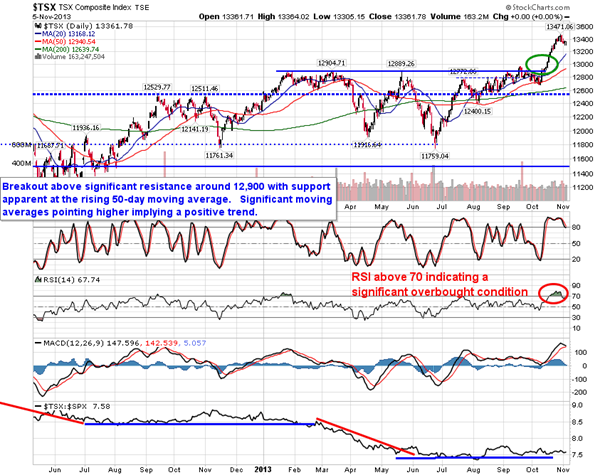

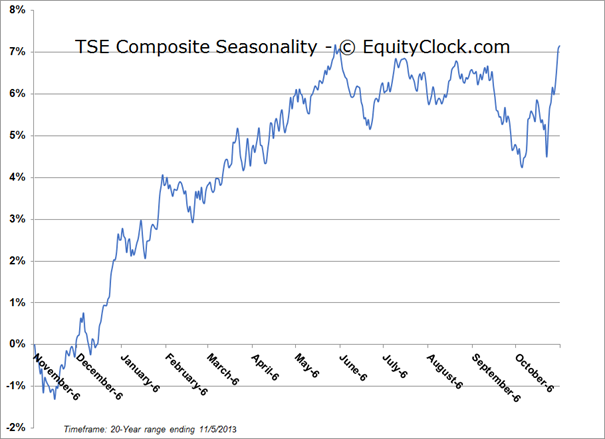

TSE Composite

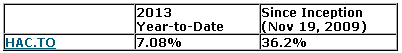

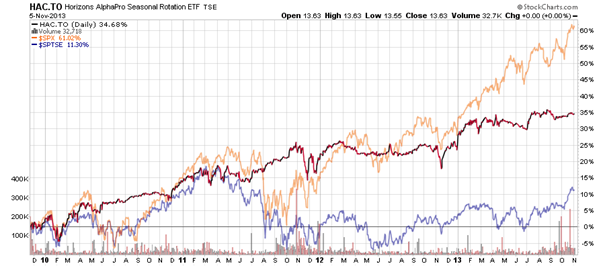

Horizons Seasonal Rotation ETF (TSX:HAC)

- Closing Market Value: $13.63 (unchanged)

- Closing NAV/Unit: $13.62 (down 0.04%)

Performance*

* performance calculated on Closing NAV/Unit as provided by custodian

Click Here to learn more about the proprietary, seasonal rotation investment strategy developed by research analysts Don Vialoux, Brooke Thackray, and Jon Vialoux.

Below you may find the video.