- Housing Starts for July will be released at 8:30am. The market expects 900K versus 836K previous. Building Permits are expected to show 935K versus 911K previous.

- Productivity for the Second Quarter will be released at 8:30am. The market expects a quarter-over-quarter increase of 0.6% versus an increase of 0.5% previous.

- Consumer Sentiment for August will be released at 9:55am. The market expects 85.5 versus 85.1 previous.

- Euro-Zone CPI for July will be released at 5:00am EST. The market expects a year-over-year increase of 1.6%, consistent with the previous report.

- Euro-Zone Merchandise Trade for June will be released at 5:00am EST.

- Canadian Manufacturing Sales for June will be released at 8:30am EST. The market expects a month-over-month increase of 0.3% versus an increase of 0.7% previous.

The Markets

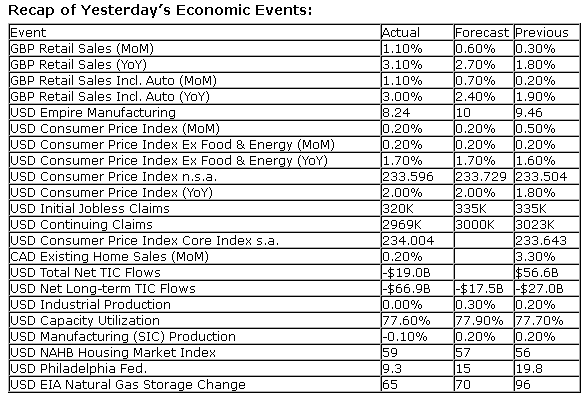

Investors shrugged off strong economic data on Thursday and sent the market lower over concerns that a change in the current accommodative monetary policy would soon be necessary. Weekly initial jobless claims, often a leading indicator of the monthly employment situation report, recorded a new recovery low at 320K. Solid results were also recorded in two key gauges of manufacturing in the US: the Philly Fed Index and the Empire Manufacturing Survey. Strength in employment and manufacturing is not typical, from a seasonal perspective, at this time of year as a result of factory shutdowns into the end of summer. The strong economic data increases the likelihood that the Fed will cut back on bond purchases sooner than later, which investors feel is unfavourable to equity markets. The S&P 500, Dow Jones Industrial Average, and NASDAQ Composite all ended lower by over 1.4% on the day in what amounted to the largest one day drop since the middle of June.

The decline in equity markets pushed the S&P 500 decisively through short-term support that was evident around 1685, completing the bearish descending triangle that was highlighted in yesterday’s report. The implied target of the bearish pattern at 1660 was hit at the lows of the session as the 50-day moving average was tested as support. The large cap index has now retraced the entire amount of the breakout move the led into earnings season in July; a break below previous resistance, now support, at 1654 could see a swift move lower to below 1600 to test the mid-June low at 1560. Negative momentum divergences on the charts suggest downside pressures remain.

Two key broad market benchmarks are confirming double-top resistance. The NYSE Composite and the FTSE All-World Index are both rolling over at their mid-May peaks, emphasizing the significance of this level. Yet, despite the declines from a level of resistance that appear likely to lead to further selling pressures, outperformance compared to the S&P 500 is becoming apparent in both of these benchmarks.

Similar outperformance is becoming apparent on the benchmark of the MSCI World ex US as investors reallocate away from many of the high-flying American/domestically focused stocks into more international opportunities, such as Europe. The S&P 500 recently hit a peak year-to-date gain of 20%, while the MSCI World ex US recently peaked at a gain of 10%, implying that valuations may be less stretched outside of the US. Seasonal tendencies for many international equity benchmarks are significantly negative between now and the end of September.

'Sentiment on Thursday, as gauged by the put-call ratio, ended close to neutral at 0.96. Despite the significant negative move in equity markets, a neutral range remains evident for the ratio.

S&P 500 Index

TSE Composite

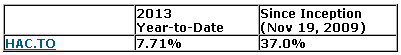

Horizons Seasonal Rotation ETF (TSX:HAC)

- Closing Market Value: $13.68 (up 0.22%)

- Closing NAV/Unit: $13.70 (up 0.49%)

*

performance calculated on Closing NAV/Unit as provided by custodian

Click Here to learn more about the proprietary, seasonal rotation investment strategy developed by research analysts Don Vialoux, Brooke Thackray, and Jon Vialoux.