Investing.com’s stocks of the week

Upcoming US Events for Today:

- Treasury Budget for December will be released at 2:00pm EST. The market expects $44.0B versus –$135.2B previous.

Upcoming International Events for Today:

- No significant economic events scheduled.

The Markets

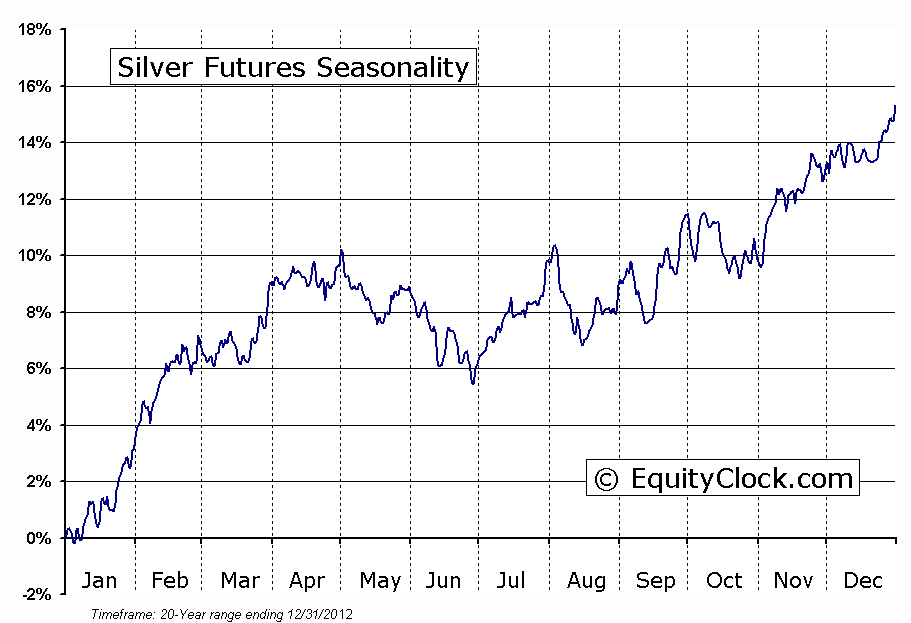

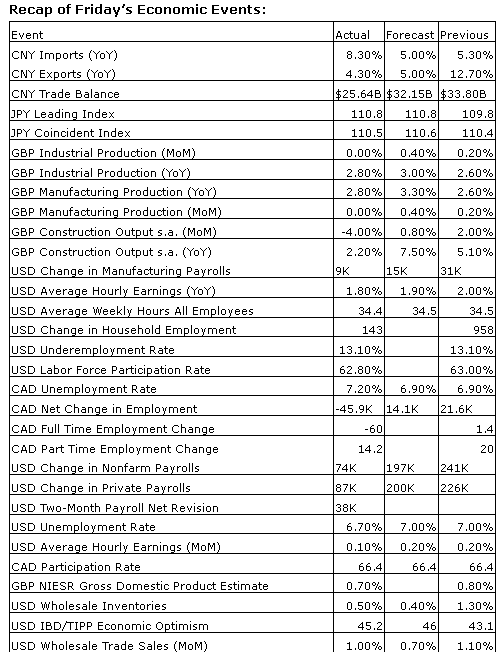

Stocks were generally higher on Friday as investors were left perplexed by the latest employment report. Non-Farm Payrolls in the US increased by a mere 74,000 in December, missing estimates calling for an increase of 200,000. Despite the increase in payrolls that was significantly less than expectations, the Unemployment Rate still managed a rather pronounced decline, moving from 7.0% to 6.7% due to a sharp drop in the labour force. Stocks swung between gains and losses following the result; immediate reaction was evident in the price of Gold and Silver as the inflation trade caught a bid due to speculation the the Fed would restrain further tapering following such a dismal report. Gold ended the day higher by 1.77%, while Silver closed up by 3.20%. Silver has been showing signs of charting a basing pattern since the beginning of December with support presented around $19 and resistance evident around $20.50; a break of either of these levels would likely lead to a bearish or bullish outcome, respectively. Metals, including silver, remain in a period of seasonal strength through February.

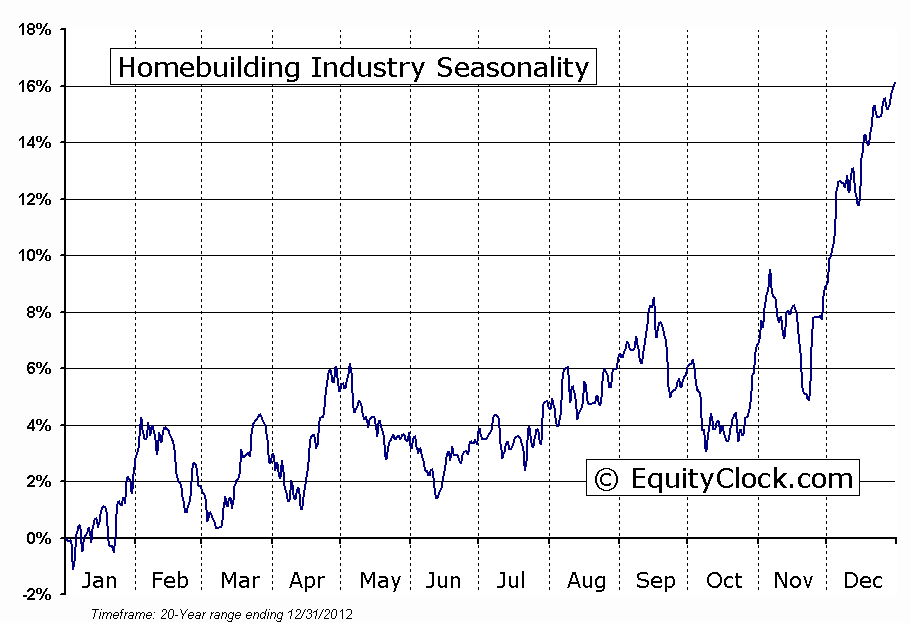

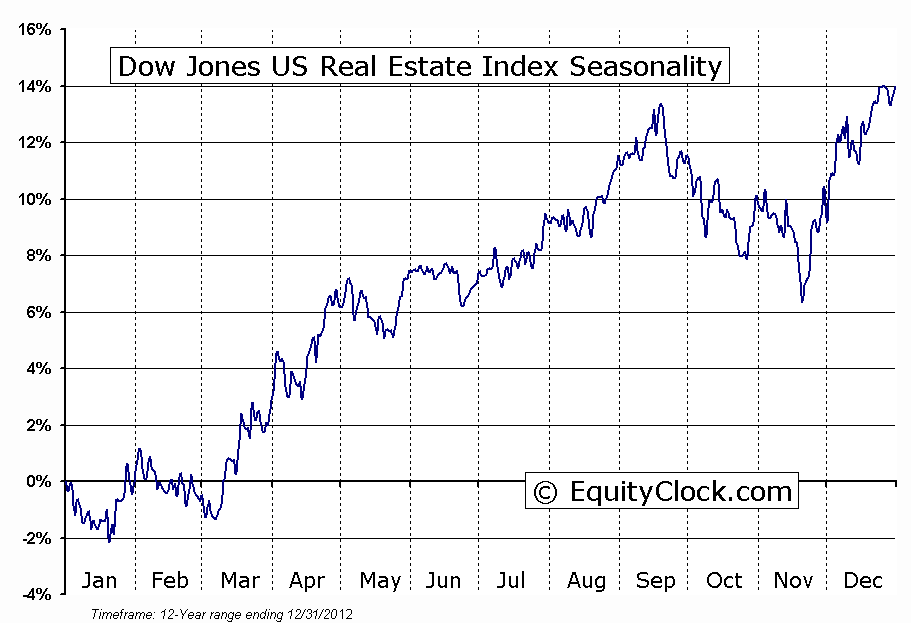

Elsewhere, in equity markets, reaction was prominent in interest rate sensitive stocks as treasury yields took a nosedive. REITs, Utilities, and Homebuilding stocks were all up over 1% on the session due to the decreased cost of borrowing. Each of these sectors are showing signs of charting a short-term low around present levels, despite seasonal tendencies that are generally negative for these stocks that derive their value based on the trend of bond yields. Bonds seasonally decline between now and April, placing pressure on interest rate sensitive stocks into the month of March. Homebuilding stocks conclude their period of seasonal strength at the beginning of February. REITs, on the other hand, begin a period of seasonal strength not long after the seasonal trend for homebuilders end; Real Estate Investment Trusts, or REITs, seasonally gain from March through to May.

Bond prices broke out above the intermediate trend, offering the potential for a higher longer-term low that could suggest a more substantial change in direction of the beaten up fixed income asset class. Momentum indicators, including MACD and Stochastics, recently provided “buy” signals.

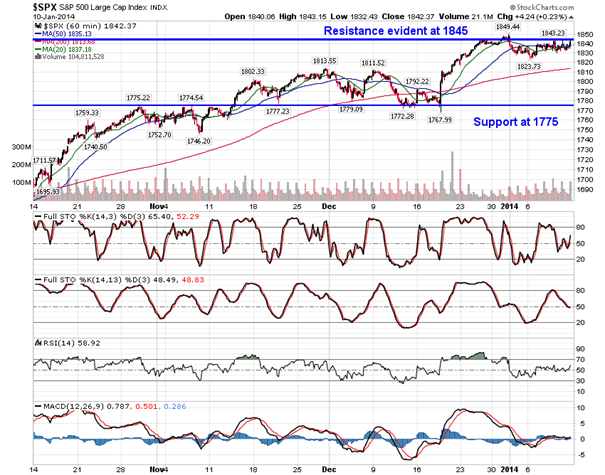

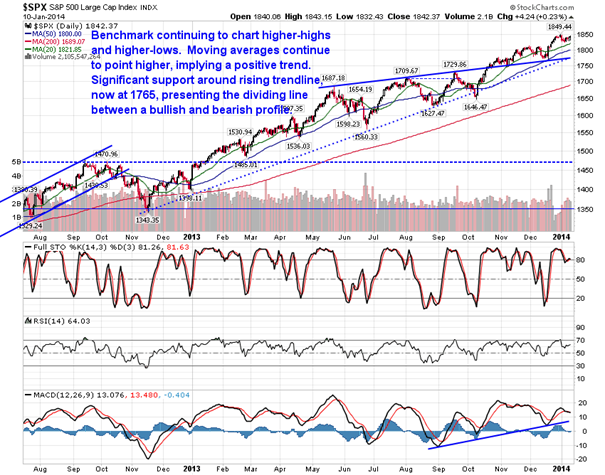

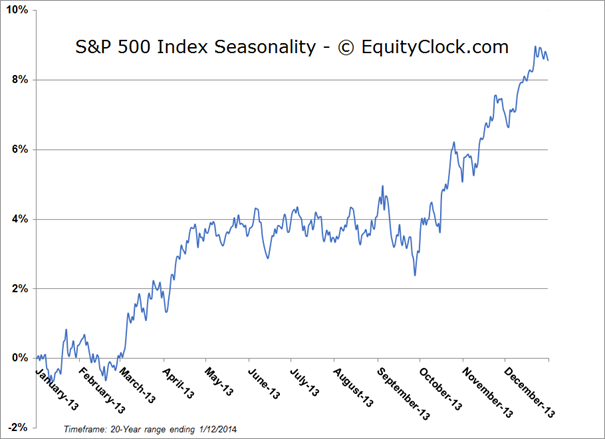

Turning to the US equity market, the S&P 500 remains in a flat range that has defined trading activity since the year began. Resistance is evident at 1845, which is constraining the intermediate upside momentum and leaving the door open to a more substantial pullback toward support at 1775. The long-term trend of the market remains positive, defined by a series of higher-highs and higher-lows. Volatility remains typical surrounding first quarter earnings season, which just began last week; the next sustained seasonal up-leg for equities begins closer to the end of February. A positive catalyst, perhaps earnings related, is required to break resistance directly overhead.

Sentiment on Friday, as gauged by the put-call ratio, ended bullish at 0.76.

S&P 500 Index

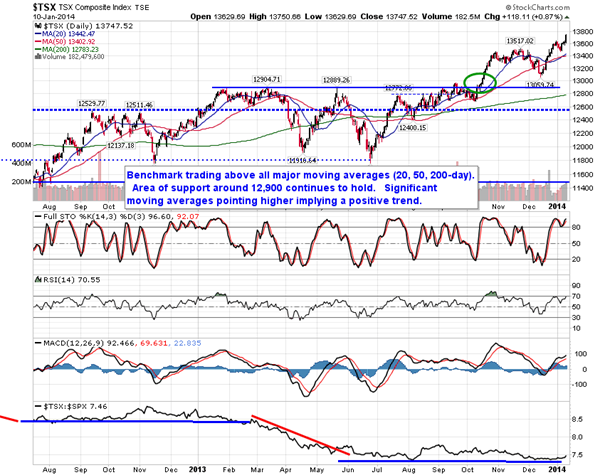

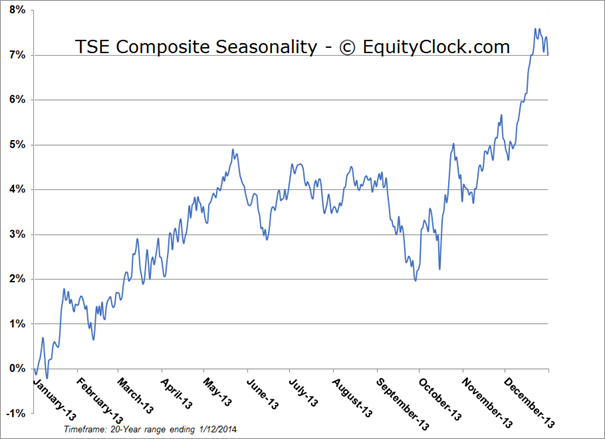

TSE Composite

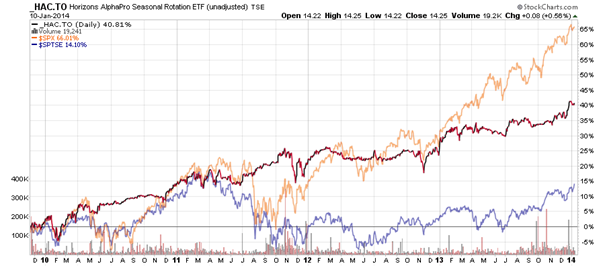

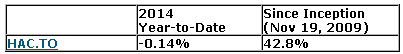

Horizons Seasonal Rotation ETF (TSX:HAC)

- Closing Market Value: $14.25 (up 0.56%)

- Closing NAV/Unit: $14.28 (up 0.74%)

Performance*

* performance calculated on Closing NAV/Unit as provided by custodian

Click Here to learn more about the proprietary, seasonal rotation investment strategy developed by research analysts Don Vialoux, Brooke Thackray, and Jon Vialoux.