Upcoming US Events for Today:

- ADP Employment Report for February will be released at 8:15am. The market expects 150,000 versus 175,000 previous.

- PMI Services Index for February will be released at 8:58am.

- ISM Non-Manufacturing Index for February will be released at 10:00am. The market expects 53.5 versus 54.0 previous.

- Weekly Crude Inventories will be released at 10:30am.

- The Fed’s Beige Book will be released at 2:00pm.

Upcoming International Events for Today:

- German PMI Services for February will be released at 3:55am EST. The market expects 55.4 versus 53.1 previous.

- Euro-Zone PMI Services for February will be released at 4:00am EST. The market expects 51.7 versus 51.6 previous.

- Great Britain PMI Services for February will be released at 4:30am EST. The market expects 57.9 versus 58.3 previous.

- Euro-Zone GDP for the Fourth Quarter will be released at 5:00am EST. The market expects a year-over-year increase of 0.5% versus a decline of 0.4% previous.

- Euro-Zone Retail Sales for January will be released at 5:00am EST. The market expects a year-over-year decline of 0.2% versus a decline of 1.0% previous.

- Bank of Canada Rate Announcement will be released at 10:00am. The market expects no change in rates at 1.0%.

The Markets

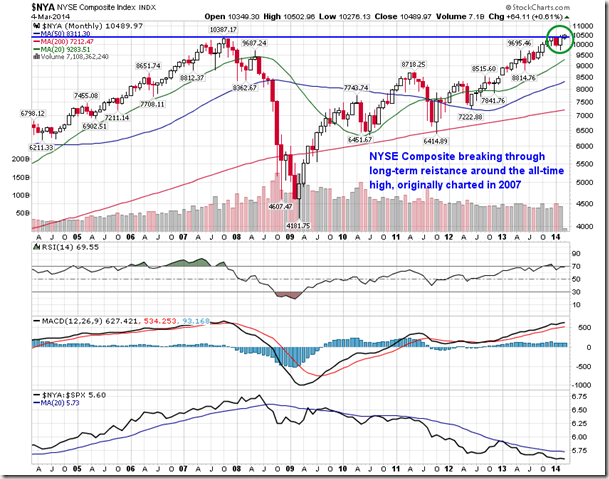

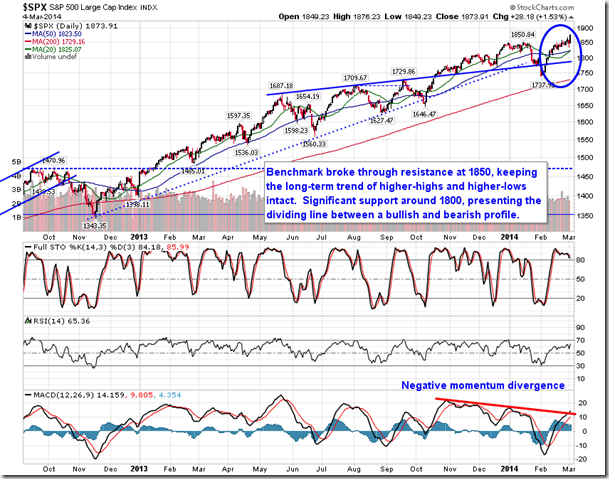

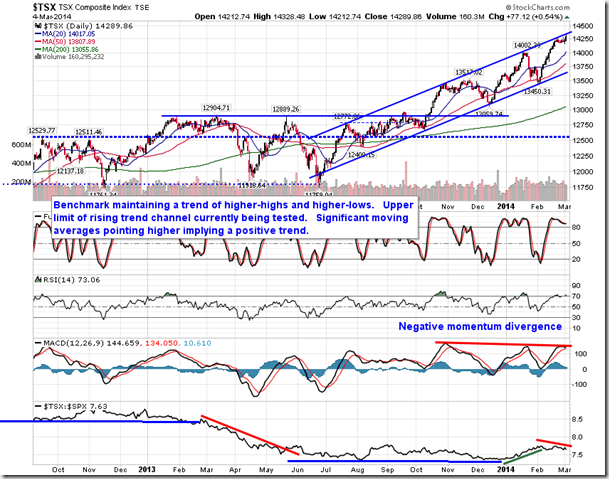

Stocks surged on Tuesday as fears subsided pertaining to the tensions between Ukraine and Russia. Just one day following a plunge of stocks based on headlines that Russian troops had tightened their grip on the Crimea region of Ukraine, the risk trade was back on, pushing the S&P 500 Large Cap Index, the S&P 400 Mid cap Index, and the S&P 600 Small Cap Index to new all-time closing highs. Even the NYSE Composite, which had been struggling over recent months around the all-time high originally charted in 2007, broke above the apparent long-term level of resistance.

One important momentum indicator that was once negatively diverging from the equity market price action is starting to confirm the recent strength. The percent of S&P 500 stocks trading above 50-day moving averages had been declining since October of last year, diverging from the price action of the S&P 500. Tuesday’s surge in stock prices pushed the technical indicator above the declining trendline that has remained evident for around the past five months. However, a longer-term negative divergence with respect to the percent of stocks trading above 200-day moving averages remains.

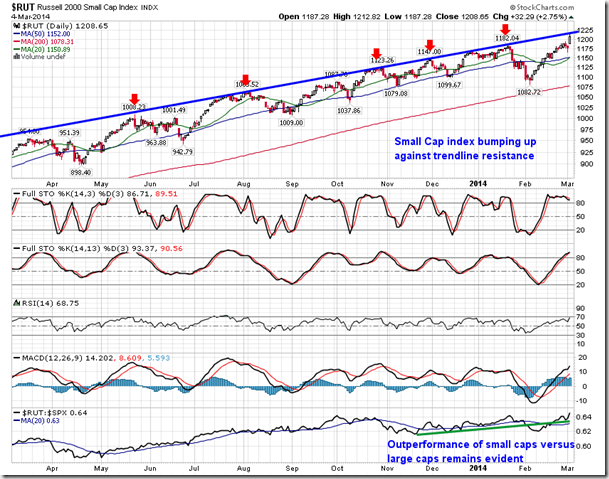

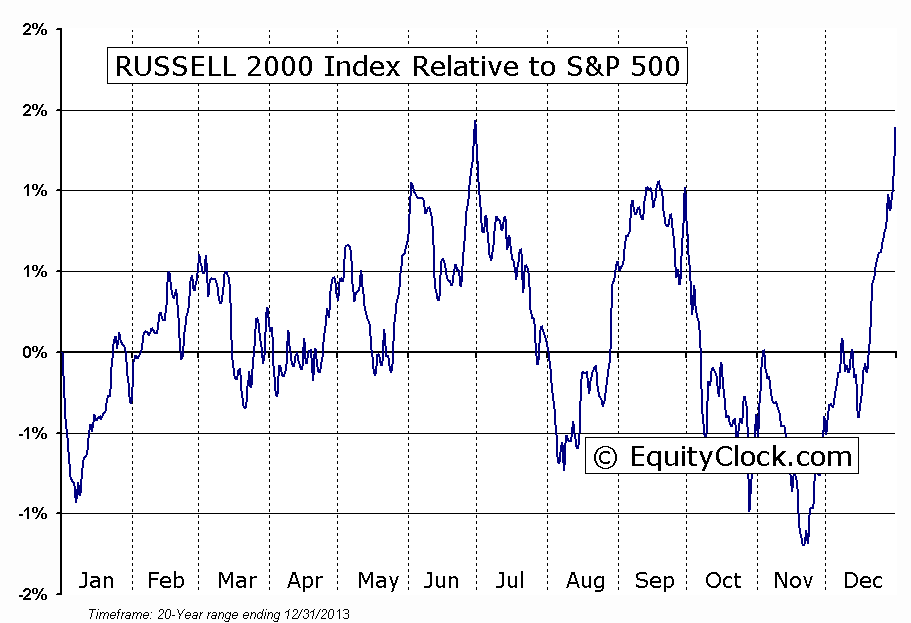

Risk sentiment of the equity market remains strong, as indicated by the outperformance of the risker small cap stocks. The Russell 2000 Small Cap Index surged 2.75% on Tuesday, outpacing the returns of all other major equity benchmarks on the session. The benchmark is now pushing up against trendline resistance that has constrained the rising trend for well over a year. The Russell 2000 Small Cap Index seasonally outperforms the S&P 500 Large Cap Index from mid-November through to the beginning of March, a trend that has played out yet again this year. Relative performance versus the large cap benchmark typically trades flat to negative, compared to the S&P 500, between now and May.

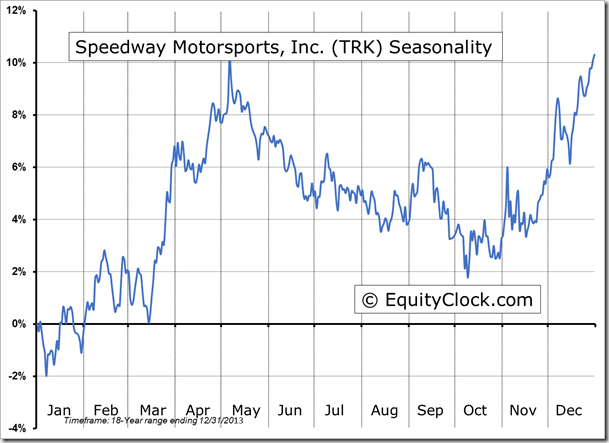

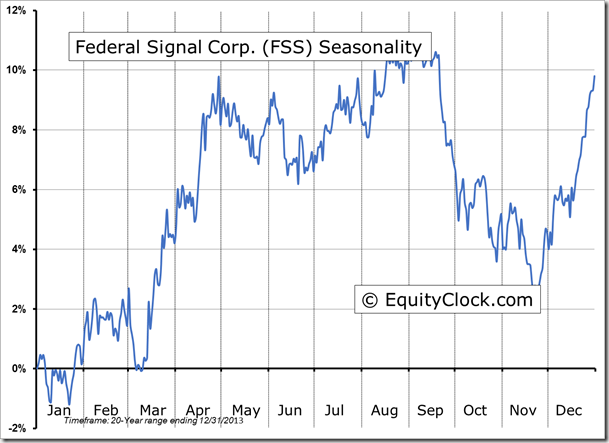

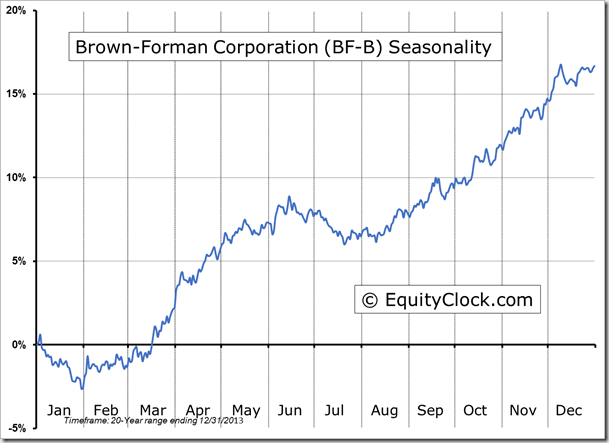

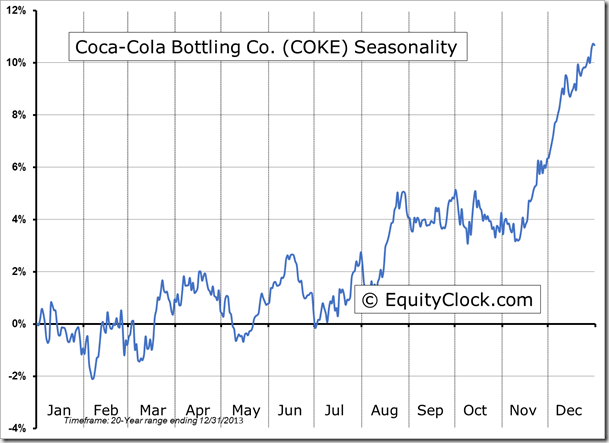

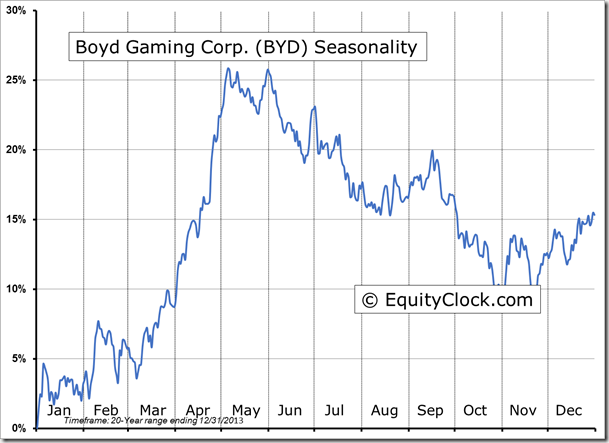

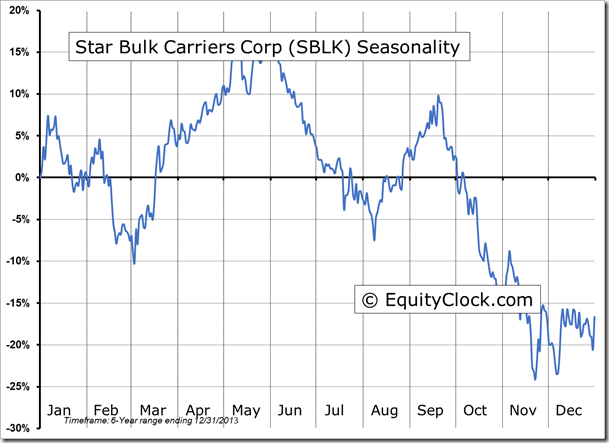

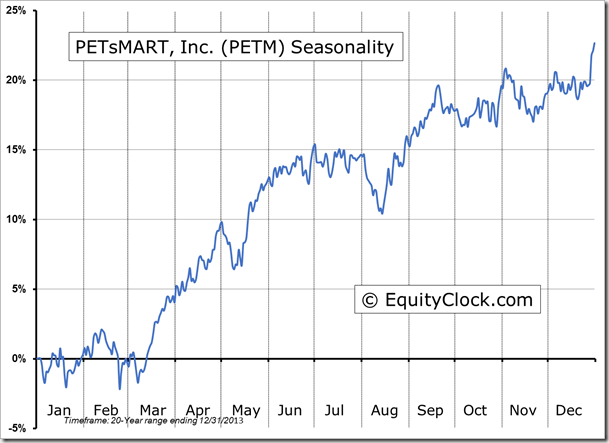

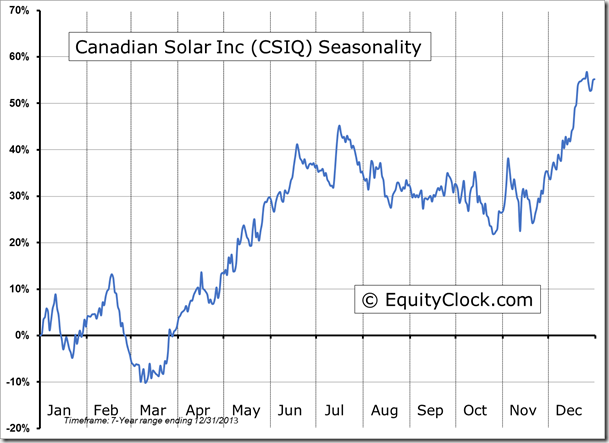

Seasonal charts of companies reporting earnings today:

Sentiment on Tuesday, as gauged by the put-call ratio, ended bullish at 0.80.

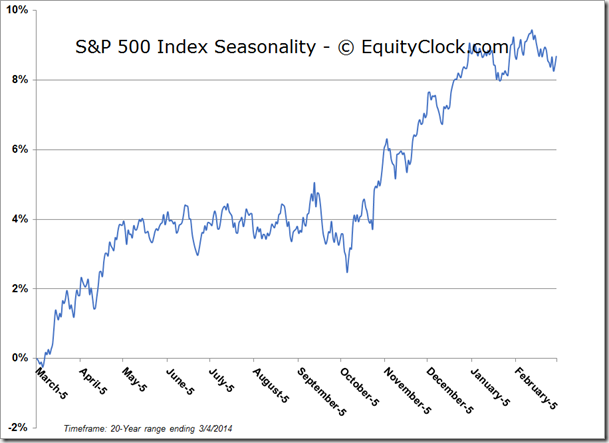

S&P 500 Index

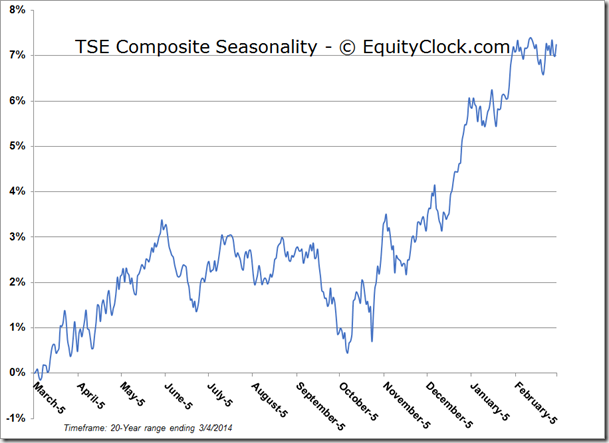

TSE Composite

Horizons Seasonal Rotation ETF (TSX:HAC)

- Closing Market Value: $14.50 (up 1.54%)

- Closing NAV/Unit: $14.51 (up 1.44%)

Performance*

| 2014 Year-to-Date | Since Inception (Nov 19, 2009) | |

| HAC.TO | 1.47% | 45.1% |

* performance calculated on Closing NAV/Unit as provided by custodian

Click Here to learn more about the proprietary, seasonal rotation investment strategy developed by research analysts Don Vialoux, Brooke Thackray, and Jon Vialoux.