Upcoming US Events for Today:

- Trade Balance for September will be released at 8:30am EST. The market expects a deficit of $39.1B versus a deficit of $38.8B previous.

- Weekly Jobless Claims will be released at 8:30am. The market expects Initial Claims to show 330K versus 336K previous.

- Non-Farm Productivity for the Third Quarter will be released at 8:30am. The market expects a quarter-over-quarter increase of 2.3%, consistent with the previous report.

- Fed Vice Chair Janet Yellen Confirmation Hearing before the Committee on Banking, Housing, and Urban Affairs at 10:00am.

Upcoming International Events for Today:

- German Flash GDP for the Third Quarter will be released at 2:00am EST. The market expects a year-over-year increase of 0.7% versus an increase of 0.5% previous.

- Great Britain Retail Sales for October will be released at 4:30am EST. The market expects a year-over-year increase of 3.2% versus an increase of 2.2% previous.

- Euro-Zone Flash GDP for the Third Quarter will be released at 5:00am EST. The market expects a year-over-year decline of 0.3% versus a decline of 0.7% previous.

- Canadian Trade Balance for September will be released at 8:30am EST. The market expects a deficit of $1.0B versus a deficit of $1.31B previous.

The Markets

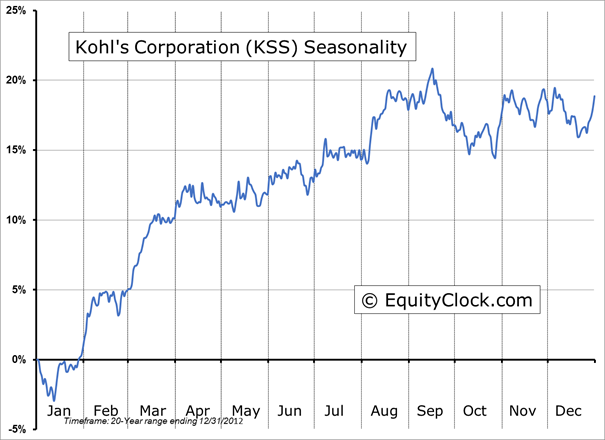

Stocks reversed earlier losses and finished strongly higher on Wednesday as investors speculated upon what Janet Yellen might say when she appears before the Senate Banking Committee on Thursday. Bond yields pushed lower along with the US dollar, which supported the afternoon surge in stock prices, pushing the S&P 500 and Dow Jones Industrial Average to new highs. Consumer stocks led the push higher as shares of Macy’s jumped over 9% following a better than expected earnings report for the third quarter. Retail stocks remain in a period of seasonal strength through to the start of December as investors digest third quarter results and speculate on earnings for the holiday season ahead. Walmart (WMT), which has a similar seasonal profile to the rest of the industry, reports today after the closing bell. Shares of WMT are testing the upper limit of a nearly seven month range. The stock recently started to show signs of outperformance versus the market, as with the rest of the industry.

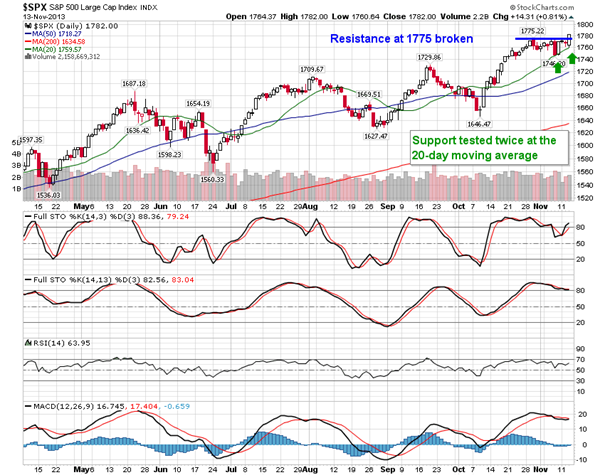

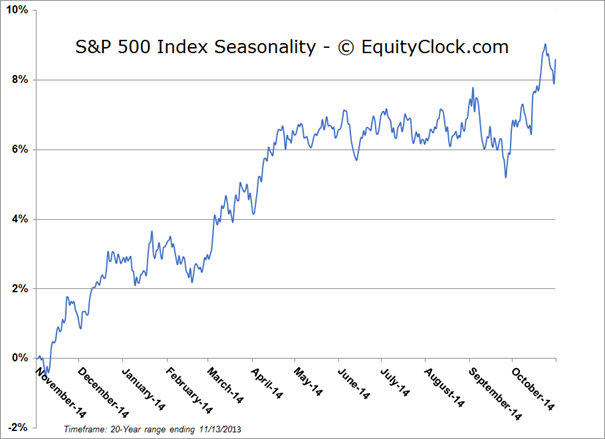

The gains on the session pushed the S&P 500 above short-term resistance at 1775 after a quick retest of support at the 20-day moving average. MACD is showing early signs of curling higher once again, suggesting renewed upside momentum. Significant moving averages, such as the 20, 50, and 200-day, continue to point higher, indicating a positive trend across short, intermediate, and long-term timescales.

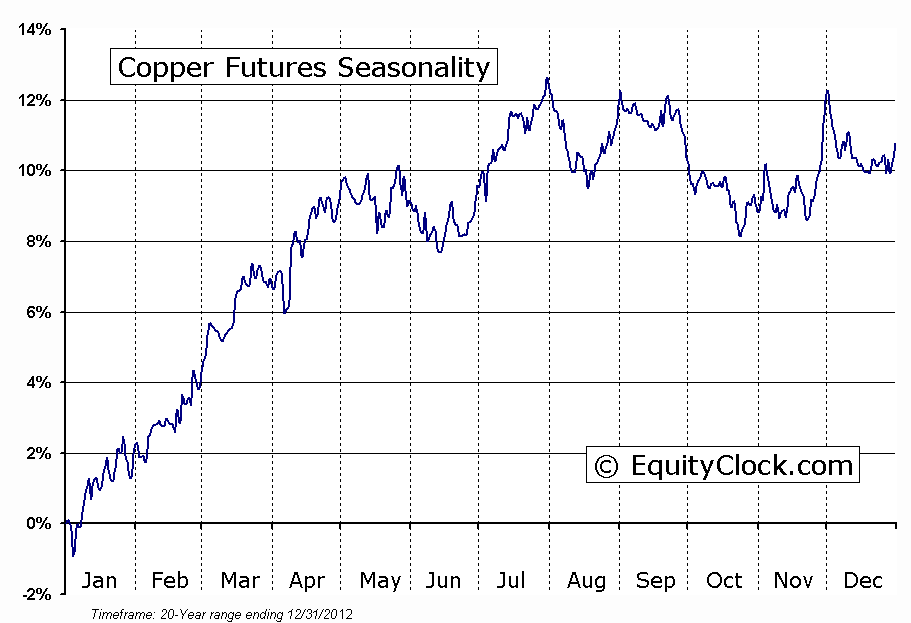

A gauge of economic strength took a hit on Wednesday as copper sank to a three month low. The price of the industrial metal broke support around $3.20 after struggling to break above the 200-day moving average for the past few months. A ratio of Copper versus the CRB commodity index continues to show a rising trend, suggesting improving risk sentiment as investors continue to hold the metal closely tied to economic growth amidst a fairly broad commodity selloff. Support for Copper can now be found around $3.04, which may provide an ideal buying opportunity for the period of seasonal strength ahead. Copper seasonally gains from the beginning of January through the month of March.

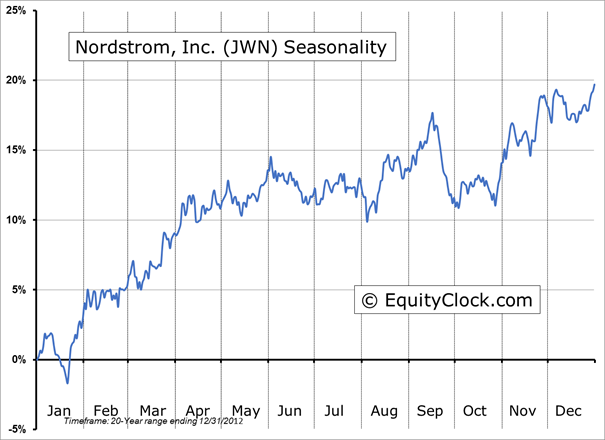

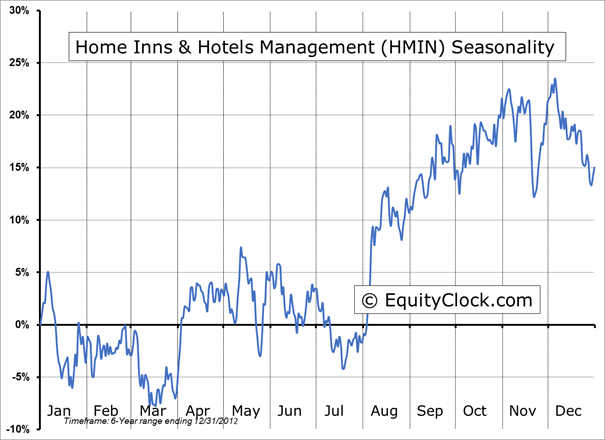

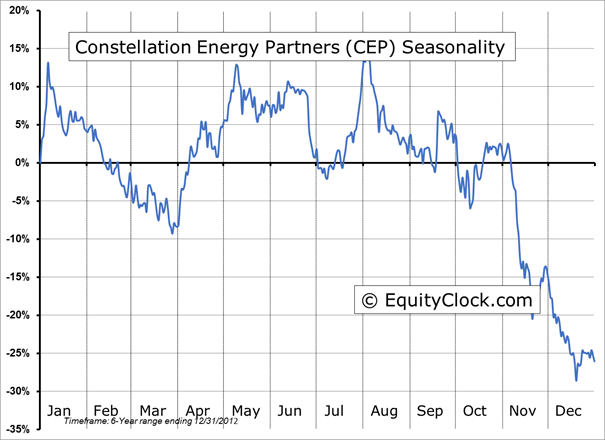

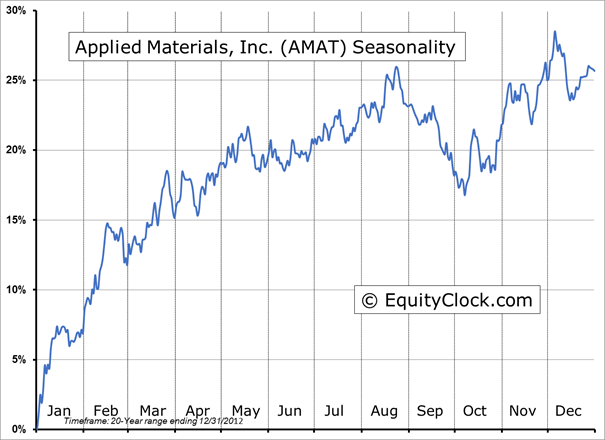

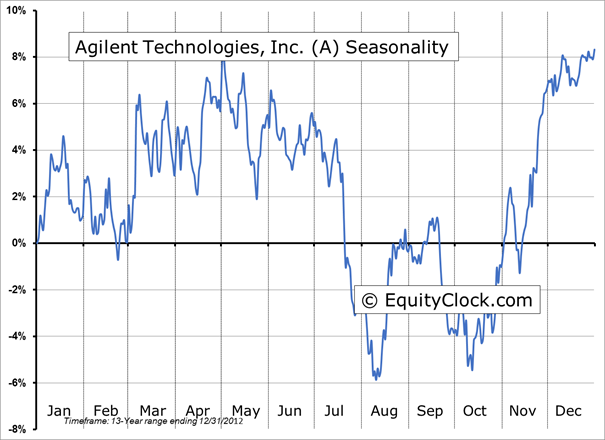

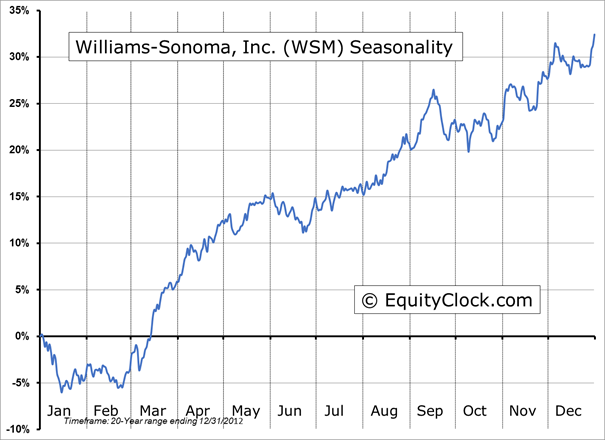

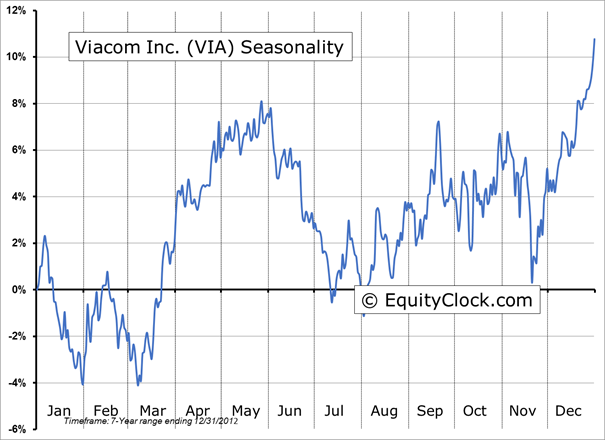

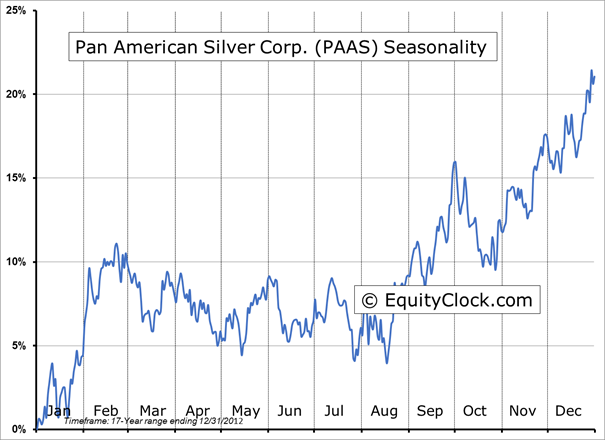

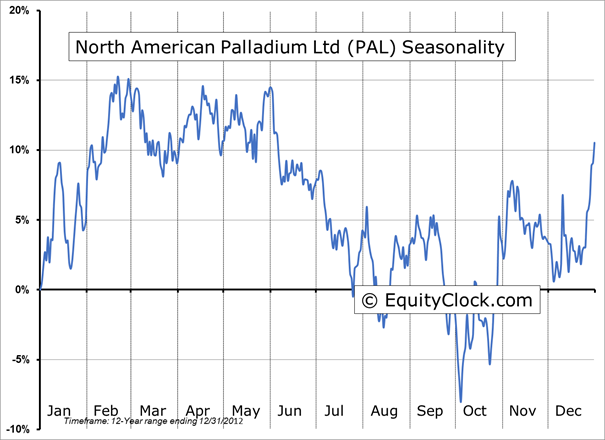

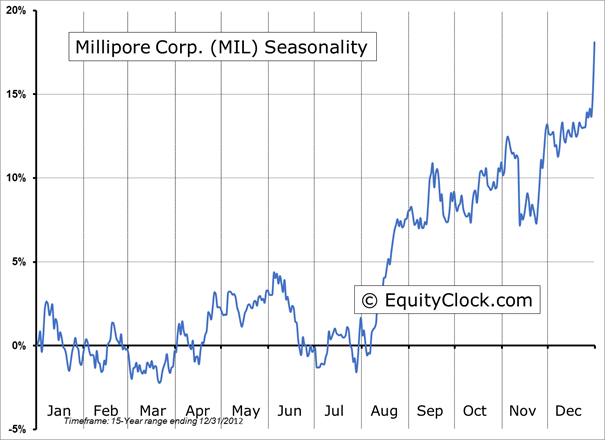

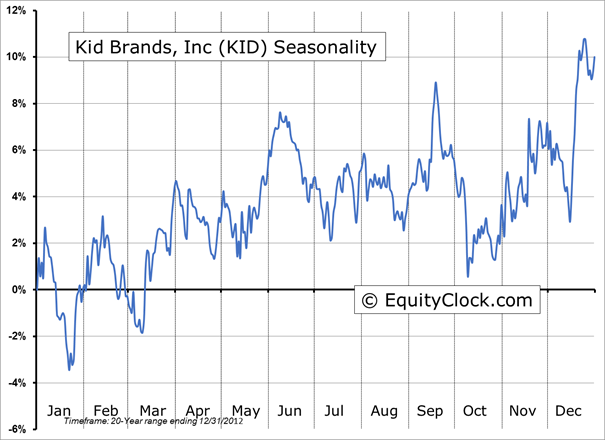

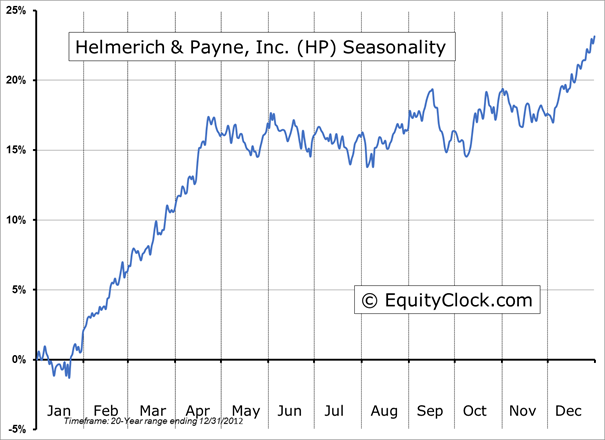

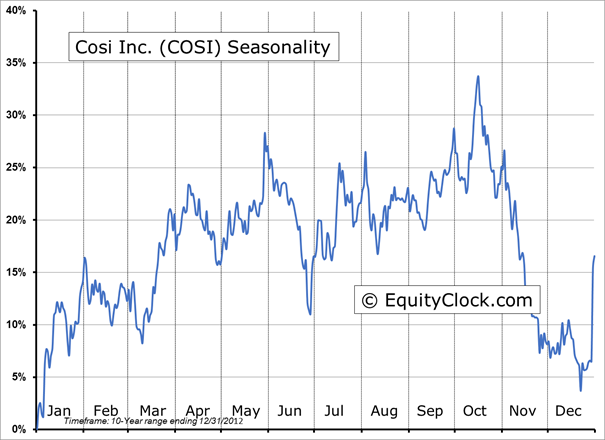

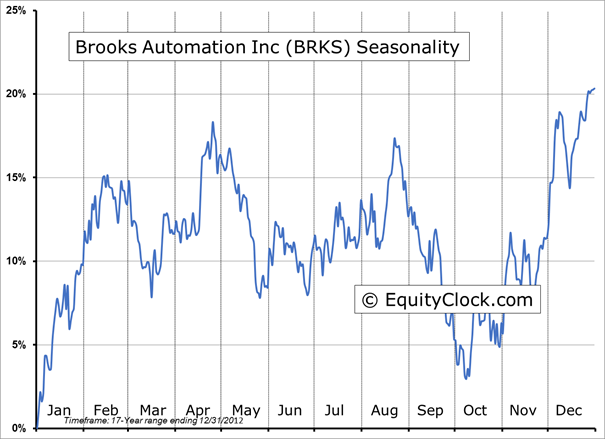

Seasonal charts of companies reporting earnings today:

Sentiment on Wednesday, as gauged by the put-call ratio, ended bullish at 0.83.

S&P 500 Index

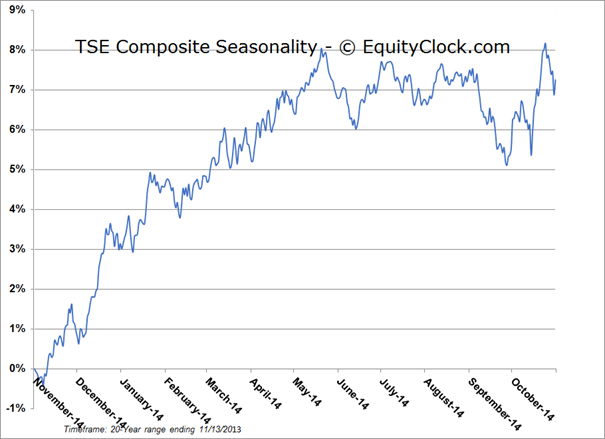

TSE Composite

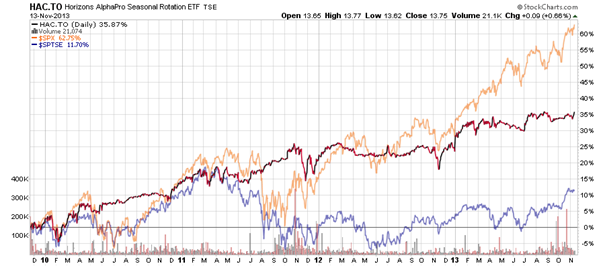

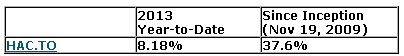

Horizons Seasonal Rotation ETF (TSX:HAC)

- Closing Market Value: $13.75 (up 0.66%)

- Closing NAV/Unit: $13.76 (up 0.73%)

Performance*

* performance calculated on Closing NAV/Unit as provided by custodian

Click Here to learn more about the proprietary, seasonal rotation investment strategy developed by research analysts Don Vialoux, Brooke Thackray, and Jon Vialoux.