- Wholesale Trade for July will be released at 10:00am. The market expects a month-0ver-month increase of 0.3% versus a decline of 0.2% previous.

- Weekly Crude Inventories will be released at 10:30am.

- German CPI for August will be released at 2:00am EST. The market expects a year-over-year increase of 1.5%, consistent with the previous report.

- Great Britain Jobless Claims Change for August will be released at 4:30am EST. The market expects a decline of 21.0K versus a decline of 29.2K previous.

- Reserve Bank of New Zealand Rate Decision will be released at 5:00pm EST. The market expects no change at 2.50%.

- Japan Machine Orders for July will be released at 7:50pm EST. The market expects a year-over-year increase of 7.5% versus an increase of 7.7% previous.

- Australian Unemployment Rate for August will be released at 9:30pm EST. The market expects 5.8% versus 5.7% previous. Employment is expected to increase by 10.0K versus a decline of 10.2K previous.

The Markets

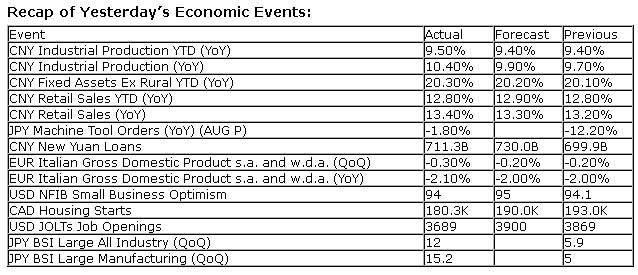

Stocks gained for a sixth day as investors welcomed a potential resolution to the situation in Syria, and better than expected industrial production data from China. The Industrial sector topped the market leader board as investors speculated upon a change of trend in the year-over-year growth figures for industrial production.The year-over-year growth of the economic indicator had been charting a bottom for over a year, and now a breakout is becoming apparent. The breakout from an apparent long-term bottoming pattern is consistent with the activity within the Baltic Dry Index, which continues to push above a long-term trading range. The period of seasonal strength for manufacturing and industrial production is realized more into the Fall, suggesting an earlier than normal start to this economic segment based on data released around the world over recent weeks.

The gains on the session pushed the S&P 500 firmly back above its 50-day moving average, and a resistance at 1685 is now being tested. Beyond this, the all-time high just below 1710 is the level to overcome to keep the long-term bull market intact. Momentum indicators are presently overbought following the six session positive move, but signs of peaking have yet to be realized. The intermediate-term negative divergence with respect to MACD that initially suggested waning buying pressures remains intact, leaving confidence low that a breakout to new highs will be realized. A positive catalyst would be required to fuel a breakout, particularly during the period of seasonal weakness ahead.

Seasonal charts of companies reporting earnings today:

Sentiment on Tuesday, as gauged by the put-call ratio, ended bullish at 0.76. Albeit well off of Monday’s low, complacency continues to be suggested.

S&P 500 Index

TSE Composite

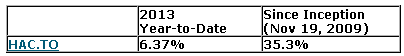

Horizons Seasonal Rotation ETF (TSX:HAC)

- Closing Market Value: $13.53 (down 0.59%)

- Closing NAV/Unit: $13.53 (down 0.75%)

*

performance calculated on Closing NAV/Unit as provided by custodian