Volatility is back, are you taking advantage of it?

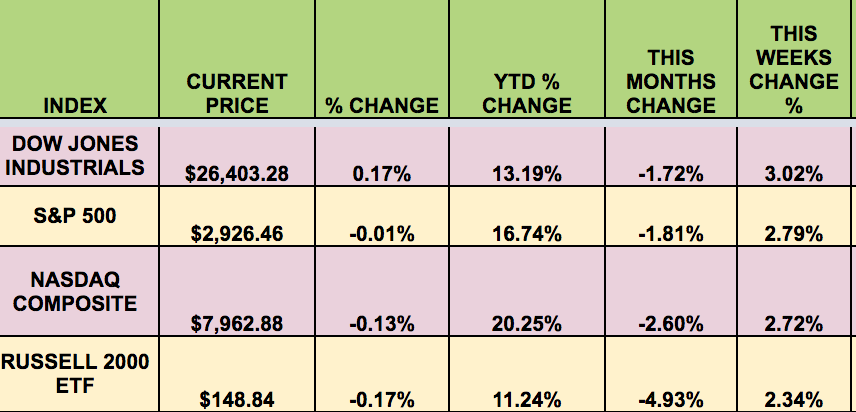

Market Indexes: It was a down month for the market, with the RUSSELL small caps losing nearly -5%, followed by the NASDAQ, the S&P, and the DOW. Continuing trade war escalation and fallout were the culprits, along with ongoing recession fears.

This Week’s Option Trades : We added covered call and put-selling trades for large cap dividend stocks MCD and MKC to our Covered Calls Table and to our Cash Secured Puts Table this week.

There are now several put-selling trades with breakevens below 52-week lows, including many large cap DOW and S&P 500 stocks, all of which have double-digit annualized yields.

Volatility: The VIX rose 2.76% this week, ending the week at $18.98, after reaching over $21.50 on Wednesday.

High Dividend Stocks: These high yield stocks go ex-dividend next week: RCI, GLOP-A, GLOP-B.

Market Breadth: 30 out of 30 DOW stocks rose this week, vs. 24 last week. 94% of the S&P 500 rose, vs. 31% last week.

FOREX: The US $ rose vs. the Loonie, Eurom, and the Aussie & NZ dollars, but fell vs. the Yen, Pound, and the Swiss Franc in August.

“Microsoft (NASDAQ:MSFT) – Nibbling At The Edges For 10% To 17% Yields” (FRIDAY)

“The Top 3 Defensive Dividend Aristocrats” (SATURDAY)

Economic Reports: Fed Chair Jerome Powell told a conference of central bankers last week that trade policy uncertainty seems to be playing “a role in the global slowdown and in weak manufacturing and capital spending in the United States.” Though Powell described the economy as being in a “favorable place,” he reiterated that the U.S. central bank would “act as appropriate” to keep the longest economic expansion in history on track.” (Reuters)

“New orders for key U.S.-made capital goods rose modestly in July while shipments fell by the most in nearly three years, pointing to continued weakness in business investment and a slowdown in economic growth early in the third quarter. Coming against the backdrop of an escalation in U.S.-China trade tensions, the report from the Commerce Department on Monday could provide more ammunition for the Federal Reserve to cut interest rates again next month.

“U.S. house prices rose solidly in June, but the pace of appreciation is slowing, which together with declining mortgage rates could boost the struggling housing market. The Federal Housing Finance Agency (FHFA) said on Tuesday its house price index increased a seasonally adjusted 4.8% in June from a year ago. That followed a 5.2% gain in May. Prices rose 0.2% on a monthly basis, matching May’s increase. They were up 1.0% in the second quarter.” (Reuters)

Week Ahead Highlights: US markets will be closed on Monday, in observance of Labor Day.

Next Week’s US Economic Reports:

Sectors: Industrials this week, with Real Estate lagging.

Futures: WTI Crude fell -5% in August, finishing the week at $55.16, while Natural Gas rose 6.7%.

“Oil futures found support Thursday as Beijing moved to tamp down fears of an immediate escalation of the U.S.-China trade war, allowing the U.S. crude benchmark to mark its highest settlement in more than two weeks. The move comes a day after U.S. government data revealed an unexpectedly large drop in domestic crude inventories.” (MarketWatch)