“S&P 500 companies slashed or suspended over $40 billion in dividends in the second quarter, the deepest quarterly drop since 2009.” (Dow Jones)

“Second-quarter global dividends plunged by $108 billion, or 22%, as companies scrambled to save cash during the pandemic.” (Reuters)

Volatility:

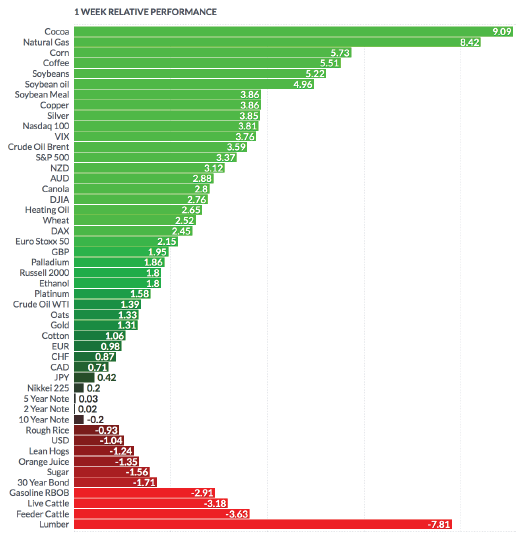

The VIX rose 4% this week, ending at $22.96, vs. $22.05 last week.

High Dividend Stocks:

These high dividend stocks go ex-dividend next week: CXP, First Financial Bancorp (NASDAQ:FFBC), Horizon Technology Finance (NYSE:HTFA), KeyCorp (NYSE:KEY), Spark Energy (NASDAQ:SPKE), Elmira Savings Bank (NASDAQ:ESBK), FNB Corporation (NYSE:FNB), Navient (NASDAQ:NAVI), American Financial TRS Inc Class A (NASDAQ:AFIN) and Golub Capital BDC (NASDAQ:GBDC).

Market Breadth:

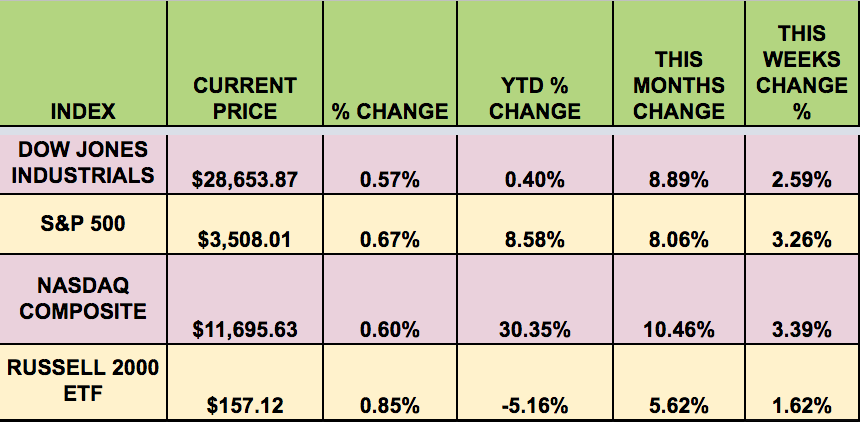

26 out of 30 DOW stocks rose this week, vs. 12 last week. 82% of the S&P 500 rose, vs. 32% last week.

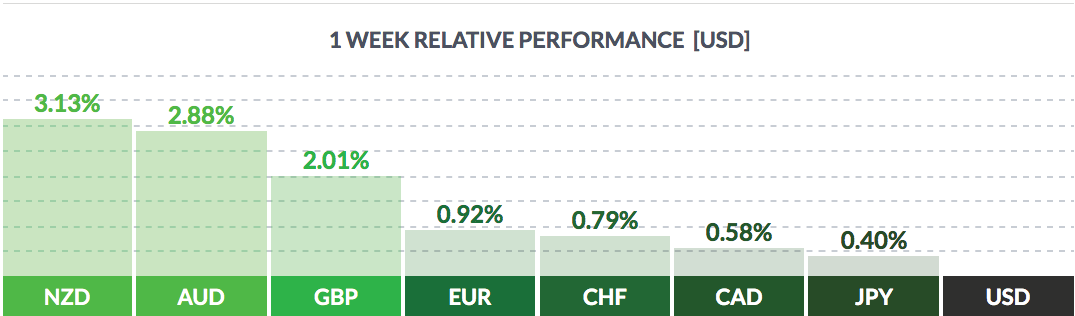

Forex:

The US dollar fell vs. most major currencies, this week, on the heels of the Fed's pivot to a higher inflation target.

"The dollar fell on Friday as the U.S. Federal Reserve’s new policy framework suggested that interest rates would remain low, while the yen surged after Japanese Prime Minister Shinzo Abe announced his resignation. Concerns about a possible shift away from Abe’s expansionary economic policy, known as Abenomics, drove the move in the safe-haven currency, investors said." (Reuters)

Economic News:

"U.S. consumer confidence fell for second straight month in August as households worried about the economic outlook. The Conference Board said on Tuesday its consumer confidence index dropped to a reading of 84.8 this month from 91.7 in July. (Reuters)

"Federal Reserve Chairman Jerome Powell unveiled a new framework of thinking for the central bank that will tolerate inflation “moderately” above its 2% target. The Fed also committed to reviewing this policy every five years.

In a speech on Thursday morning, Powell acknowledged the painful lessons of runaway inflation in the 1970’s, but warned that the persistence of low inflation over the last 8 years risks new economic difficulties.

“Many find it counterintuitive that the Fed would want to push up inflation,” Powell said. But the Fed chief warned that low inflation leads to declining inflation expectations, which has the effect of “diminishing our capacity to stabilize the economy through cutting interest rates.”

The Fed’s target for inflation is 2%, measured as core personal consumption expenditures (which excludes volatile components like energy and food prices). But since establishing that goal in its 2012 Statement on Longer-Run Goals and Monetary Policy Strategy, the Fed has averaged inflation of only ~1.6%, touching 2% only briefly in 2018." (Yahoo)

"The number of Americans filing new claims for unemployment benefits hovered around 1 million last week, suggesting the labor market recovery was stalling as the COVID-19 pandemic drags on and financial aid from the government dries up.

The claims report also showed the number of people receiving benefits after an initial week of aid dropped 223,000 to 14.535 million in the week ending Aug. 15. The so-called continuing claims data covered the week during which the government surveyed households for August’s unemployment rate.

Continuing claims declined between the July and August survey periods. Much of the decrease in continuing claims was likely because of people exhausting eligibility for benefits. At least 27 million people were receiving unemployment benefits under all programs in the week ended Aug. 8." (Reuters)

"On Thursday, the Commerce Department said gross domestic product plunged at a 31.7% annualized rate last quarter, the deepest decline in output since the government started keeping records in 1947. That was revised from the 32.9% pace reported last month. The economy slipped into recession in February." (Reuters)

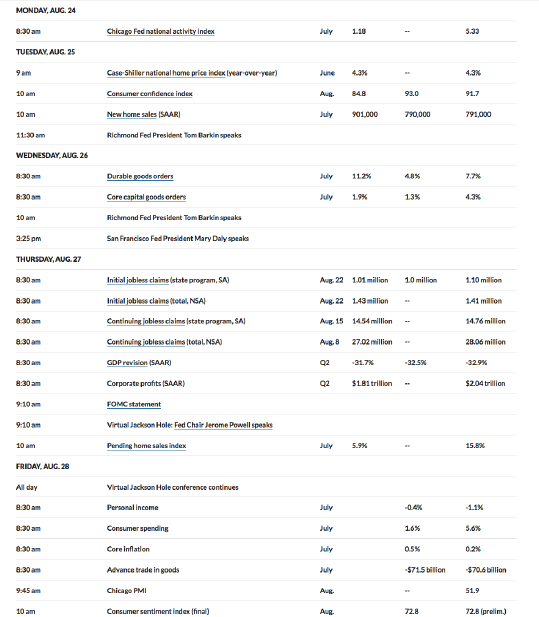

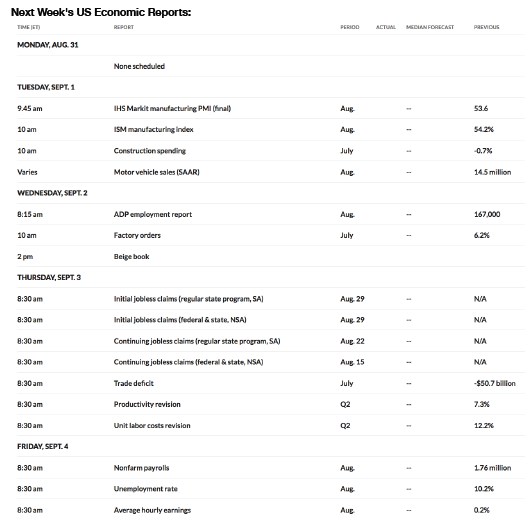

Week Ahead Highlights:

It's all about jobs next week - the ADP payrolls report comes out on Wed., and the Non-Farm Payrolls report for August will come out on Friday.

Next Week's US Economic Reports:

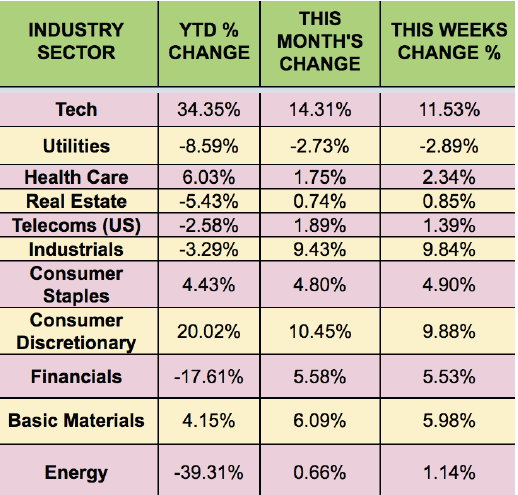

Sectors:

Tech, Industrials and Consumer Discretionary led again this week, with Utilities lagging.

Futures:

WTI rose 1.39% this week, finishing at $42.93.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

More Stocks Set To Cut Their Dividends

Published 08/30/2020, 01:15 AM

Updated 07/09/2023, 06:31 AM

More Stocks Set To Cut Their Dividends

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.