“Good” news but not “too good” set off a Friday stock market rally as major U.S. indexes posted weekly gains

Major U.S. stock market indexes rallied on Friday after the monthly Non Farm Payroll Report showed modest employment gains while unemployment climbed from 7.5% to 7.6%.

The last few weeks in the stock market have been all about good news/bad news. Is good news “good” or is bad news “good” as investors try to determine the next moves by the Federal Reserve in regards to its quantitative easing program?

For the week, the Dow Jones Industrial Average (DIA) added 0.9%, the S&P 500 (SPY) climbed 0.8% and the Nasdaq (QQQ) climbed o.4%.

On My ETF Radar

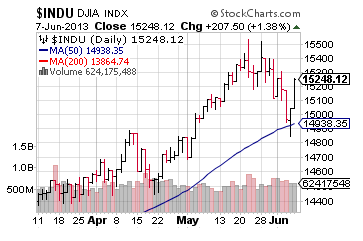

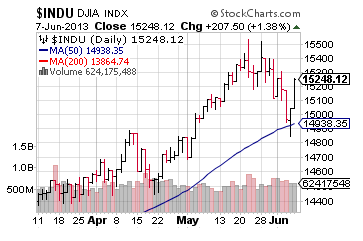

While major U.S. stock market indexes rallied, the overall action remains tepid on mediocre volume, flattening momentum and within the confines of the recent trading range. A glance at the chart of the Dow Jones Industrial Average (DIA) tells the story.

In this simple chart, we can see how the Dow Jones Industrial Average (NYSEARCA:DIA) has been correcting since reaching its recent high in late May and now has bounced off its 50 day moving average (blue line) which is always seen as significant support.

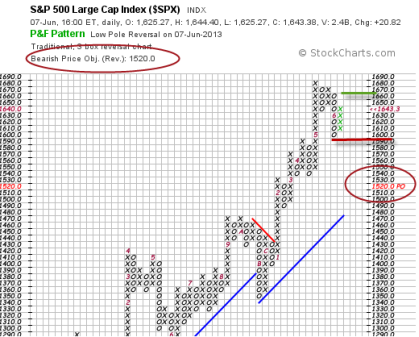

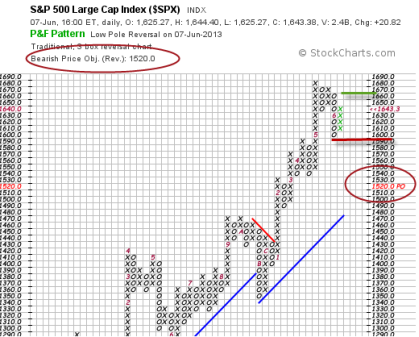

Nevertheless, in the chart of the S&P 500 (NYSEARCA:SPY) below, we can see what the bigger picture has to say.

Recent stock market action has generated a “sell” signal in the S&P 500 (NYSEARCA:SPY) with a downside price objective of 1520, 7.5% below Friday’s closing price. Strong support is at 1600 while a break above 1660 would mark the resumption of the recent uptrend.

All of this will depend upon the stock market’s reaction to the Federal Reserve’s impending withdrawal of its easy money programs and if “good” news is good or “good” news is bad as the stock market’s good news/bad news joke continues.

Since today’s stock market is all about the Fed, all the time, recent developments point to the end of quantitative easing coming into view.

Fed Chairman Bernanke started the discussion during his recent testimony before Congress and on Friday, famed Fed reporter, Wall Street Journal’s John Hilsenrath, penned an article headlined,”Fed On Track To Ease Up On Bond Buying Later This Year” in which he said that “Federal Reserve officials are likely to signal at their June policy meeting that they’re on track to begin pulling back their $85-billion-a-month bond-buying program later this year, as long as the economy doesn’t disappoint.” (WSJ)

The next meeting is June 18-19 and so that could be a pivotal period for U.S. stock markets.

Tapering moves have also been recently supported by Atlanta Fed President Dennis Lockhart, among others, who are lining up against continuation of quantitative easing. Legendary Former Fed Chairman Paul Volcker recently gave a speech titled “Central Banking At A Crossroad” in which he described the benefits of quantitative easing as being limited and diminishing over time while declining confidence and trust of the financial world and Government is “palpable.”

Current Fed President John Williams of San Francisco recently joined Fed Presidents Richard Fisher, Charles Plosser and Jeffrey Lacker in calling for cutbacks to quantitative easing which Richard Fisher recently described as “monetary cocaine.”

It seems clear that the Fed is telegraphing its next moves in an attempt to begin its process of disengagement from quantitative easing without roiling financial markets, however, most analysts agree that it will be a complicated and high risk maneuver with markets so dependent and habituated to easy money.

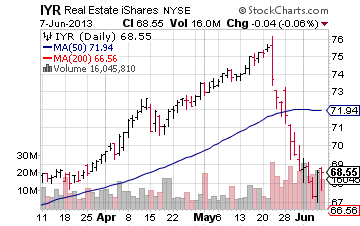

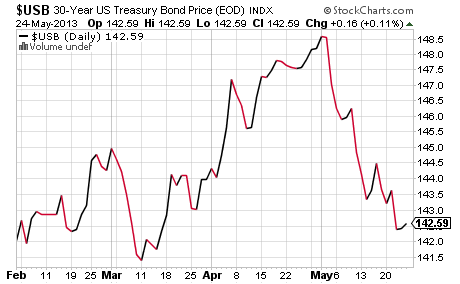

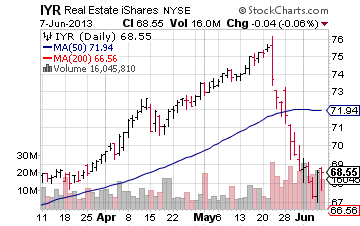

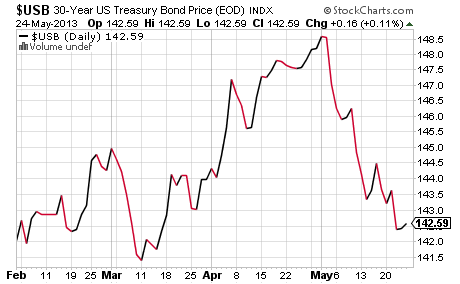

To date some markets clearly don’t like the news as evidenced in the charts of iShares Real Estate Trust (IYR) and the 30 Year U.S. Treasury Bond. (TLT)

For the week, “good” news was found in the U.S. Non Farm Payrolls report and home prices which increased, falling initial jobless claims and U.S. PMI which posted 52.3 and beat expectations.

Bad news came in the form of a shocking U.S. ISM manufacturing report which dropped to 49, missing expectations and putting the U.S. manufacturing sector back into contraction territory, the first contractionary reading since 2009.

U.S. construction spending and April factory orders were weak and missed expectations.

Japan remains in chaos as the Nikkei Index (EWJ) approaches bear market territory and over the weekend, China reported slowing exports growth and declining imports. Exports climbed 1% in May, widely missing a forecast gain of 7%, and imports fell 0.3% instead of meeting forecasts of a 6% gain. Exports to the United States and Europe, China’s top two trading partners, fell 1.6% and 9.7%, respectively, logging in a full quarter of declining numbers.

The country’s producer price index declined 2.9% for May, larger than expected, and data on lending, property investment and industrial production, while all positive numbers, showed trends towards decline or leveling off as China’s economy continues to cool.

Back at home, next week brings major U.S. domestic economic news on Thursday with May Retail Sales and a wave of reports on Friday that include producer prices, industrial production and consumer sentiment.

Bottom line: Will “good” news be bad or will “bad” news be good as we head into summer and the Fed meeting approaches?

Disclaimer: The content included herein is for educational and informational purposes only, and readers agree to Wall Street Sector Selector's Disclaimer, Terms of Use, and Privacy Policy before accessing or using this or any other publication by Wall Street Sector Selector or Ridgeline Media Group, LLC.

Major U.S. stock market indexes rallied on Friday after the monthly Non Farm Payroll Report showed modest employment gains while unemployment climbed from 7.5% to 7.6%.

The last few weeks in the stock market have been all about good news/bad news. Is good news “good” or is bad news “good” as investors try to determine the next moves by the Federal Reserve in regards to its quantitative easing program?

For the week, the Dow Jones Industrial Average (DIA) added 0.9%, the S&P 500 (SPY) climbed 0.8% and the Nasdaq (QQQ) climbed o.4%.

On My ETF Radar

While major U.S. stock market indexes rallied, the overall action remains tepid on mediocre volume, flattening momentum and within the confines of the recent trading range. A glance at the chart of the Dow Jones Industrial Average (DIA) tells the story.

In this simple chart, we can see how the Dow Jones Industrial Average (NYSEARCA:DIA) has been correcting since reaching its recent high in late May and now has bounced off its 50 day moving average (blue line) which is always seen as significant support.

Nevertheless, in the chart of the S&P 500 (NYSEARCA:SPY) below, we can see what the bigger picture has to say.

Recent stock market action has generated a “sell” signal in the S&P 500 (NYSEARCA:SPY) with a downside price objective of 1520, 7.5% below Friday’s closing price. Strong support is at 1600 while a break above 1660 would mark the resumption of the recent uptrend.

All of this will depend upon the stock market’s reaction to the Federal Reserve’s impending withdrawal of its easy money programs and if “good” news is good or “good” news is bad as the stock market’s good news/bad news joke continues.

Since today’s stock market is all about the Fed, all the time, recent developments point to the end of quantitative easing coming into view.

Fed Chairman Bernanke started the discussion during his recent testimony before Congress and on Friday, famed Fed reporter, Wall Street Journal’s John Hilsenrath, penned an article headlined,”Fed On Track To Ease Up On Bond Buying Later This Year” in which he said that “Federal Reserve officials are likely to signal at their June policy meeting that they’re on track to begin pulling back their $85-billion-a-month bond-buying program later this year, as long as the economy doesn’t disappoint.” (WSJ)

The next meeting is June 18-19 and so that could be a pivotal period for U.S. stock markets.

Tapering moves have also been recently supported by Atlanta Fed President Dennis Lockhart, among others, who are lining up against continuation of quantitative easing. Legendary Former Fed Chairman Paul Volcker recently gave a speech titled “Central Banking At A Crossroad” in which he described the benefits of quantitative easing as being limited and diminishing over time while declining confidence and trust of the financial world and Government is “palpable.”

Current Fed President John Williams of San Francisco recently joined Fed Presidents Richard Fisher, Charles Plosser and Jeffrey Lacker in calling for cutbacks to quantitative easing which Richard Fisher recently described as “monetary cocaine.”

It seems clear that the Fed is telegraphing its next moves in an attempt to begin its process of disengagement from quantitative easing without roiling financial markets, however, most analysts agree that it will be a complicated and high risk maneuver with markets so dependent and habituated to easy money.

To date some markets clearly don’t like the news as evidenced in the charts of iShares Real Estate Trust (IYR) and the 30 Year U.S. Treasury Bond. (TLT)

For the week, “good” news was found in the U.S. Non Farm Payrolls report and home prices which increased, falling initial jobless claims and U.S. PMI which posted 52.3 and beat expectations.

Bad news came in the form of a shocking U.S. ISM manufacturing report which dropped to 49, missing expectations and putting the U.S. manufacturing sector back into contraction territory, the first contractionary reading since 2009.

U.S. construction spending and April factory orders were weak and missed expectations.

Japan remains in chaos as the Nikkei Index (EWJ) approaches bear market territory and over the weekend, China reported slowing exports growth and declining imports. Exports climbed 1% in May, widely missing a forecast gain of 7%, and imports fell 0.3% instead of meeting forecasts of a 6% gain. Exports to the United States and Europe, China’s top two trading partners, fell 1.6% and 9.7%, respectively, logging in a full quarter of declining numbers.

The country’s producer price index declined 2.9% for May, larger than expected, and data on lending, property investment and industrial production, while all positive numbers, showed trends towards decline or leveling off as China’s economy continues to cool.

Back at home, next week brings major U.S. domestic economic news on Thursday with May Retail Sales and a wave of reports on Friday that include producer prices, industrial production and consumer sentiment.

Bottom line: Will “good” news be bad or will “bad” news be good as we head into summer and the Fed meeting approaches?

Disclaimer: The content included herein is for educational and informational purposes only, and readers agree to Wall Street Sector Selector's Disclaimer, Terms of Use, and Privacy Policy before accessing or using this or any other publication by Wall Street Sector Selector or Ridgeline Media Group, LLC.