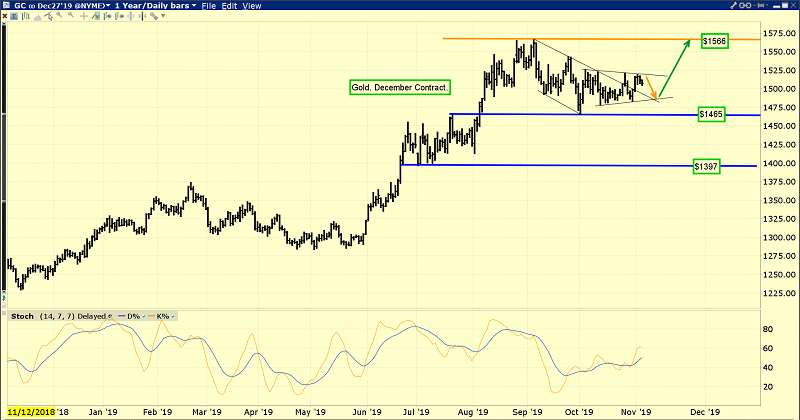

Gold continues to consolidate with sideways price action after reaching the $1500-$1550 resistance zone.

Investor patience is required when the price arrives at a major support or resistance zone like $1500-$1550.

The good news is that for the current gold market reaction, this patience can be measured in terms of months rather than years.

The massive bull patterns on this weekly chart suggest gold will be the world’s top performing asset for the next several decades.

In the medium term, the $1465 and $1397 support zones should be the main areas of focus for investor buying.

I’ve suggested that a close over $1525 should produce a fast surge to the $1566 resistance zone.

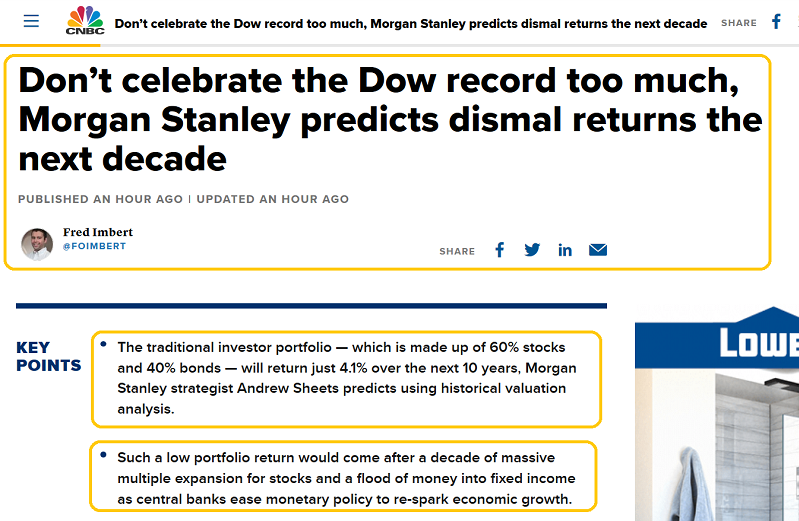

Excessive optimism by stock market investors is common at all market highs, especially late in the business cycle.

This time is no different. Trump is pro-business, but America lacks the demographics to produce the 1950s or 1880s type of economy that nostalgic investors want to see.

For the next decade, Morgan Stanley (NYSE:MS) predicts about 4% annual gains for a typical stock and bond portfolio.

From a performance standpoint, that prediction is in sync with my suggestion that America is at a time somewhat like 1966; inflation begins to appear, growth stagnates, and gold stocks rally solidly higher for the next 10 to 15 years.

In the 1970s, an oil price shock added to inflation in a big way.

In the current market, oil is unlikely to spike higher because of a supply shortage. A glut of oil and a stagnant price related to failing global demand is my preferred oil market scenario.

This time, the coming inflation is likely to be caused by global government debt.

Ominously, QE has reached the endpoint of its ability to stimulate the real economy. It’s only function now is to keep the stock market and government bond market from collapsing. As a tool, QE is becoming more inflationary than deflationary. This transition is slow but relentless.

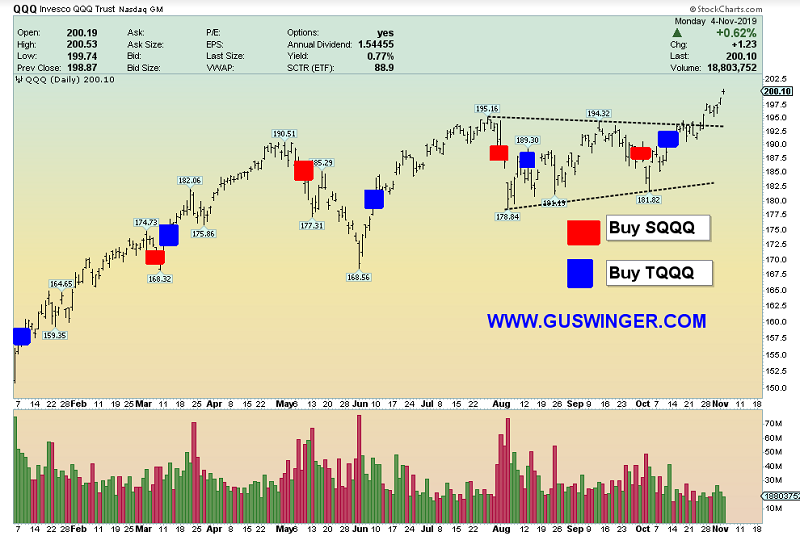

TheNasdaq index ETF chart.

Whether the US stock market goes higher, lower or sideways, myguswinger.com swing trades provide a simple approach to make large potential profits with limited drawdowns.

The current buy signal has been a gravy train for traders. I added money to my Nasdaq trading account on Friday, based on the profitable action!

The stock market tends to trend well in the November-December period, and this year the trend appears to be to the upside.

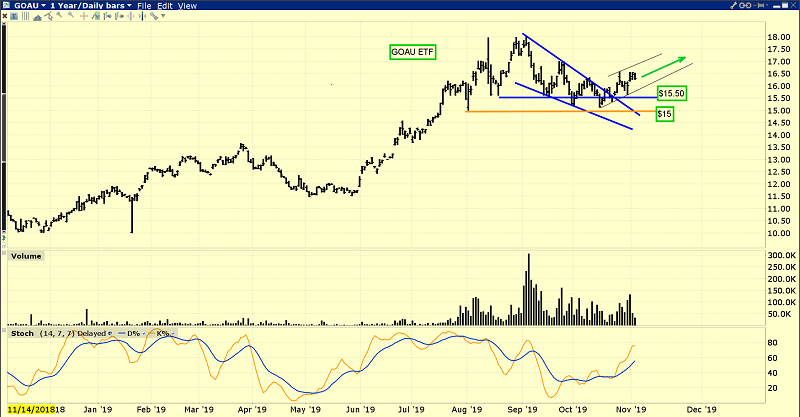

Regardless, the miners are where most investors should have their focus.

Frank Holmes’ GOAU ETF has performed solidly during this gold price consolidation. Volume has surged on rallies and subsided on declines.

That’s the sign of a very healthy market!

I outlined the $15.50 area as a key buy zone, with an optional stoploss just under $15. This trade is looking quite good already, and a close above $16.50 targets the $18 highs.

A move over $18 targets the $21 zone. The GOAU ETF, and most of its component stocks, should perform incredibly well over the next 10 to 15 years.

I recommend owning both VanEck Vectors Gold Miners ETF (NYSE:GDX) and GOAU. That’s because GDX tends to have less drawdowns on gold price reactions, and GOAU is the clear outperformer on the big rallies!