A positive housing report boosted U.S. stocks and ETFs in front of the much anticipated European summit meeting scheduled for Brussels on Thursday.

For the day, the Dow Jones Industrial Average (NYSEARCA:DIA) rose 0.26%, the S&P 500 (NYSEARCA:SPY) gained 0.48% and the Russell 2000 (NYSEARCA:IWM) added 0.41%.

Volume was light and the range was tight.

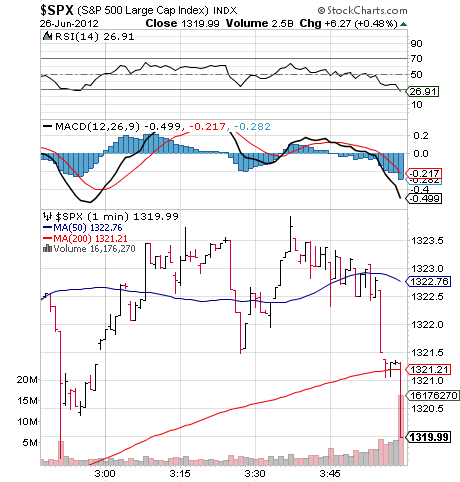

Most notably, the major indexes took a sharp dive into the close as depicted in the chart below.

Apparently the professional trading crew didn’t want to be short overnight and during early morning European trading.

Case/Shiller reported that U.S. housing prices rose 1.3% while June consumer confidence fell.

Spanish and Italian bond yields spiked and the eurodollar dropped again as investors worried about Europe and the actions or inaction coming from the week’s summit meeting in Brussels. Ratings agency Egan-Jones slapped another downgrade on the region by cutting Germany’s credit rating from A+ from the previous AA- on concerns that the country’s economic strength could be sapped by its weaker neighbors or a breakup of the European Union.

German Chancellor Angela Merkel stuck to her guns regarding Germany’s not taking on more debt to support the weaker countries in Europe and no doubt she’ll face strong opposition from Spain, Italy and even France in the upcoming summit meeting.

Gold (NYSEARCA:GLD) was lower for the day while oil (NYSEARCA:USO) was mostly flat.

Today brings durable goods orders and pending home sales and the likelihood of a Supreme Court ruling on Obamacare. Also, rumors abound that Moody’s will be soon downgrading Spain’s sovereign debt which will add further uncertainty to already nervous markets.

Bottom line: Global markets remain on a hair trigger as Europe dithers.

Disclosure: Wall Street Sector Selector actively trades a wide range of exchange traded funds and positions can change at any time.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Stock Indexes Rise On Day, Dump Into Close

Published 06/27/2012, 01:10 AM

Updated 05/14/2017, 06:45 AM

Stock Indexes Rise On Day, Dump Into Close

Major U.S. stock indexes posted small gains for the day yesterday but fell hard in the last minutes of trade

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.