Every trader has a method linked to a time frame. Our group has some new ideas, but the members are sticking to their guns on some positions.

Long-term viewpoints emphasize an economic rebound, with materials and energy stocks leading.

Short-term methods show opportunities in financial stocks and software.

Review

Our last Stock Exchange discussed contrarian trading – why it is admired and how to do it intelligently. The group suggested three ideas. If you missed it, you will enjoy the topic and the ideas.

Market Tech Take

I hope to do something along the lines of a weekly review of important technical indicators. Our own key indicator, the Market Health Index (MHI), remains positive. Watch this space! Suggestions about your own favorite indicators are most welcome. If you have something good, we will run it on our special universe. You will get a result that you cannot see elsewhere.

Let’s turn to this week’s ideas.

This Week—Best Ideas Vary with the Time Frame

Holmes

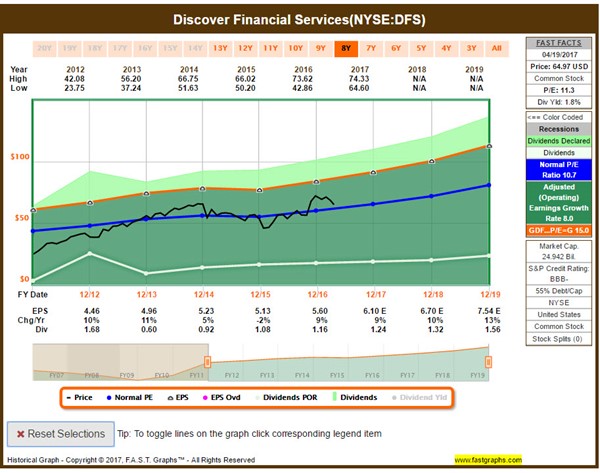

This week I’m buying Discover Financial Services (NYSE:DFS) a Credit Service company in the U.S. (65.30).

This one looks a little tricky. This stock languished in mid to high 50’s for a long time before establishing a new range in the mid 60’s to low 70’s. I’ve been watching this name pull back for a while and when I sense it is bottoming I jump in. I admit this pick make me nervous. I would be inclined to bail out if drops below 63.50, but I’m hoping it can revisit the recent highs of 73.

My biggest worry is whether that rally in that stock from 57 to 73 was real buying, establishing a new range to accumulate and not some low-volume short covering based on who knows what information that isn’t in the charts. My best protection is a tight leash on this puppy, and a willingness to bail on any new weakness.

J: Tight leash on the puppy? I thought you favored dog emancipation!

H: I do. It is just an expression that humans use.

J: You have some support on this idea. The fundamental valuation is solid, as the FastGraphs chart shows.

J: I especially like your ideas when there is good, fundamental support as well. But aren’t you worried about the upcoming earnings announcement?

H: That could well be a source of opportunity. The chart is sending a message.

J: To my eyes, it looks like a mixed message. Meanwhile, you are the source of our overall market status indicator. How do things look?

H: Still very positive—breadth, momentum, and risk. It is not quite as strong as a couple of months ago, but still OK.

Oscar

My newest holding is software. While I have my own basket, you can get the idea from considering the software SPDR S&P Software & Services (NYSE:XSW).

If you’re following the market closely, which I do right after checking out the sports section, you don’t need me to tell you things have been a little flat lately. That doesn’t mean I’m gonna just give up and go to cash. I’d only do that if I thought a significant downturn were imminent. Let’s take a closer look at software:

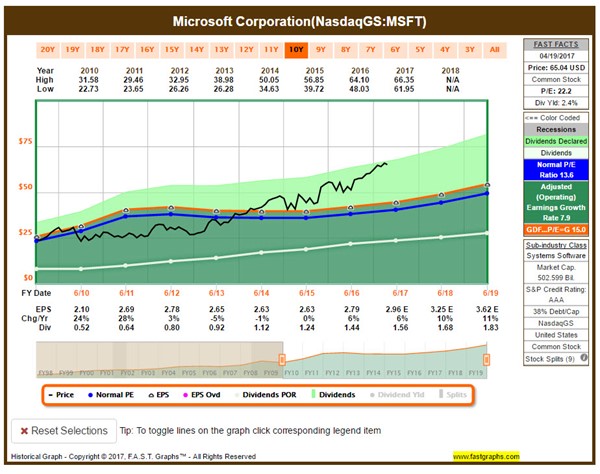

You wouldn’t know it based on the moving averages, but the average price for this ETF has been trending down slightly over the past month. There have been a couple blips up above $58.50, but I’m comfortable with that. I still think there’s opportunity for significant growth here, very much like what we saw back in February. This is particularly true with individual holdings, like Microsoft (NASDAQ:MSFT):

Slight decreases have brought the stock down from 2017 highs, creating a potential buying opportunity for savvy investors. If you shop around a bit, you might just find some other bargains in this sector.

J: MSFT earned the reputation as a “cash cow” that did not innovate. Gradually that changed, and the annual fees for software have helped to create an earnings base. That said, the valuation is not exciting.

J: As you can see, the stock is richly valued. You are picking up the recent momentum.

J: As you can see, the stock is richly valued. You are picking up the recent momentum.

O: True. I hope it continues for a bit longer. Then I will be on to the next trade!

J: Are you following the Trump effect?

O: You are not going to fool me again! I know that the “Trump trade” is not about baseball! I am now checking out the front page after reading the scores, the racing form, and the stock page.

J: That is an improvement. What do you have to offer to our readers?

H: Here is my list of favored sectors – buy/hold/sell. Keep the questions coming!

RoadRunner

(Commentary translated from various pecks, rapid movements and beeps).

RR: I have no new ideas and few positions.

J: What? I just upgraded your diet. Do you want to go back to birdseed?

RR: You already discussed this with Vince (the Father of all our models).

J: I love your method. Find a stock in an uptrend which also has a clear trading range. Then buy when it is at the bottom of the range.

RR: I have a good method, but sometimes the market does not cooperate.

V: Yes. RR is usually fully invested, but the entry requirements are stringent. We never reach for new positions. That is why we keep risk low.

J: OK. Does that imply some overall market risk?

V: No. It just means a shortage of stocks that fit the three specific requirements.

J: That makes sense. And thanks for joining in, Vince. We’ll keep RR on the lizard diet.

RR: Thanks, Vince!

Felix

Once again, I do not have a new pick. My choices are long-term, and that perspective has not changed.

J: Again? Readers want new ideas.

F: Is there anything I can do to earn a few extra bucks?

J: What about reader questions?

F: I always appreciate reader questions. I check them all.

F: I always appreciate reader questions. I check them all.

J: Are you responding to every request?

F: I am making a list of top choices from the “reader universe.”

J: What if a reader request is not on the list?

F: Then I do not see it as an attractive long-term choice. I respond to email with more specific questions.

J: And where would that be?

F: ETF at NewArc dot com. At least until you give me my own personal email address!

J: That is another expense. We’ll do it when you earn it. Any other ideas for us? You started out with a heavy weighting in basic materials and energy. Do you still like stocks in those sectors?

F: Yes. I made some great early gains.

J: And recently?

F: Those groups have pulled back with the resumption of economic skepticism.

J: You know about that?

F: Yes. I read more news – and more relevant news – than Oscar. My time frame, unlike the rest of the group, is not a quick trade. I am playing for the long run.

J: Thanks for explaining. By the way — Where is Athena?

F: Chuck Carnevale gave her last weekend off.

J: Chuck wouldn’t say that! And besides, that was a week ago.

F: That’s what she told me to say. She has nothing new this week.

Conclusion

Your time frame matters. The issues for the economy and market in the long run are quite different from a trading perspective of a few weeks. Day traders have a more extreme problem.

As we have frequently seen in this series, there is no “right” answer in trading. Your time frame and method determine what is right. Your results are measured in the long run, not by a single trade.

Stock Exchange Character Guide

|

Character |

Universe |

Style |

Average Holding Period |

Exit Method |

Risk Control |

|

Felix |

NewArc Stocks |

Momentum |

66 weeks |

Price target |

Macro and stops |

|

Oscar |

“Empirical” Sectors |

Momentum |

Six weeks |

Rotation |

Stops |

|

Athena |

NewArc Stocks |

Momentum |

One month |

Price target |

Stops |

|

Holmes |

NewArc Stocks |

Dip-buying Mean reversion |

Six weeks |

Price target |

Macro and stops |

|

RoadRunner |

NewArc Stocks |

Stocks at bottom of rising range |

Four weeks |

Time |

Time |

|

Jeff |

Everything |

Value |

One month or long term |

Risk signals |

Recession risk, financial stress, Macro |

Background on the Stock Exchange

Each week Felix and Oscar host a poker game for some of their friends. Since they are all traders they love to discuss their best current ideas before the game starts. They like to call this their “Stock Exchange.” (Check it out for more background). Their methods are excellent, as you know if you have been following the series. Since the time frames and risk profiles differ, so do the stock ideas. You get to be a fly on the wall from my report. I am the only human present, and the only one using any fundamental analysis.

The result? Several expert ideas each week from traders, and a brief comment on the fundamentals from the human investor. The models are named to make it easy to remember their trading personalities.

Questions

If you want an opinion about a specific stock or sector, even those we did not mention, just ask! Put questions in the comments. Address them to a specific expert if you wish. Each has a specialty. Who is your favorite? (You can choose me, although my feelings will not be hurt very much if you prefer one of the models).

Getting Updates

We have a new (free) service to subscribers to our Felix/Oscar update list. You can suggest three favorite stocks and sectors. We report regularly on the “favorite fifteen” in each category– stocks and sectors—as determined by readers. Sign up with email to “etf at newarc dot com”. Suggestions and comments are welcome. In the tables above, green is a “buy,” yellow a “hold,” and red a “sell.” Each category represents about 1/3 of the underlying universe. Please remember that these are responses to reader requests, not necessarily stocks and sectors that we own. Sign up now to vote your favorite stock or sector onto the list!