Each week Felix and Oscar host a poker game. We listen in on current trading ideas in the few minutes before the game starts. They like to call this their “Stock Exchange.” I am the only human present, and the only one using fundamental analysis. Their methods are excellent, as you will learn if you join us for a few weeks. Since the time frames and risk profiles differ, so do the stock ideas.

Background on the Stock Exchange

What is this about? Since launching this series I have had good questions on three general themes. Here are the questions and some brief answers.

- The model characters are fun, but please tell me more about what they do.

I include the general personality of the model at the end of each article. I will begin featuring one approach each week with more detail, and soon provide a reference page for readers.

- Why don’t you show a track record on performance?

I understand that those trying to sell a newsletter or chat room often provide some sort of time-stamped real-time record. You will find that most of these people are not subject to compliance rules. The “track records” tell you nothing, since they do not have enough trades to get into the “long run.” Confidence in a model comes from knowing how it is developed and tested. I would rather ask a few questions to a developer than see a few months of real-time picks. It is pretty easy to spot the amateurs.

This is a brief answer, and I promise to follow up with a longer post. Meanwhile, here is our model developer, my partner Vince Castelli, in his Popular Science feature from 2002. It is one of the few projects he worked on that are now in the public record. He has applied his scientific knowledge to finance for decades.

- Why should I care about these model picks?

You probably read many articles with stock ideas. Some are a single idea based upon technical analysis from a source you do not really know about. At the Stock Exchange you get four different recommendations from technical “experts” as well as some fundamental commentary as a rebuttal. I am not trying to sell anything. We are developing an institutional product. The results are good enough that I am willing to share and discuss with readers. Some of my clients are invested in these models, so I am not going to provide every trade in real time. It is supposed to be interesting and fun! Look at the ideas and do your own research.

This Week’s Ideas—Focus on Holmes

This week’s featured expert is Holmes. Vince designed Holmes to be a trader, but one that would be safe enough for average investors. It is not a crazy, day-trading program. Holmes looks for stocks that have sold off, formed a base, and have promising rebound potential. The criteria are strictly technical, so the stocks may not be appealing for long-term investors. Holmes is very cautious in making new picks and aggressively dumps losers. Like most traders, Holmes also includes profit-taking and trailing stops. The average holding period is a few weeks. There may be as many as sixteen positions at one time – all from our universe of 700 liquid stocks.

Holmes reduces risk in three ways:

- Going completely to cash when market conditions are poor;

- Reducing the number of positions when indicated;

- Using stops and trailing stops on individual holdings.

I analyze the risk of each of our strategies. While it is partly subjective, I rate Holmes as lower risk than buy-and-hold for the overall market.

Here are the ideas for this week, beginning with Holmes.

Holmes

I am the rebounding specialist. I love great stocks that investors/traders have bailed on. My Bounce Play of the Week is NIKE (NYSE:NKE). This mega sports apparel and sneaker maker just keeps running a marathon while investors treat it like a sprinter. Coming off its highs of 67 in early 2016, this stock has been consolidating, digesting, and hanging out at the bottom of its channel. I see a good chance to power back up a few percent or more. I also love the risk/reward aspects of this trade. I would use 48 as hard stop, so I’m risking 3.8 to make 10 or more points. Like Nike says: “Just Do It.”

This is definitely a “bounce” play. It is close to the lower edge of the channel. I’ll be happy with a few percent.

J: Valuation is reasonable, but it is not exciting based upon the fundamentals.

H: The chart shows the rebound potential. Most of my ideas are quick winners. I’ll cut bait and move on if this does not work.

Felix

I still like energy and have added a new position last week. Some current holdings are dipping dramatically and some are rising out of those dips, but the long-term strength appeals to me. You can see the sector strength in VanEck Vectors Oil Refiners (NYSE:CRAK).

J: Oil prices are still in a trading range. I think that it is the sweet spot for the economy. I agree with the long-term potential.

F: Oil appears to be making a slow bullish move going into Winter in the Northern Hemisphere. There have already been a number of long range weather forecasters who are calling for a severe Winter in the US this year.

J: Since when do you pay any attention to weather forecasts?

F: My selections are always based upon the charts, but I also am interested in the message of the market.

And to my many fans: Please keep your questions coming. I could use the overtime pay! Ask about a specific stock, or perhaps an ETF. I am interested in sectors, but need a representative ETF to help.

Oscar

This week I like Oil & Gas exploration, illustrated below by Cimarex Energy Co (NYSE:XEC). Sure, the stock’s been hanging around yearly highs for a while now. But would you have bet against World Heavyweight Champ Joe Louis? I see at least a couple months of progress hanging around here.

This is a wonderful textbook example of momentum! It looks like a real long-term winner in the making.

J: That seems crazy. The PE multiple is over 300. Where did you get such an idea?

O: My turf accountant also has stock picks.

J: You take stock advice from your bookie??

O: He is better than one of those robo-advisors. He says that 2017 earnings will be a lot better.

J: Sixty-eight cents this year, but 3.34 in 2017. I still think it is expensive.

O: As usual, I’ll either cash or go for a small loss.

Athena

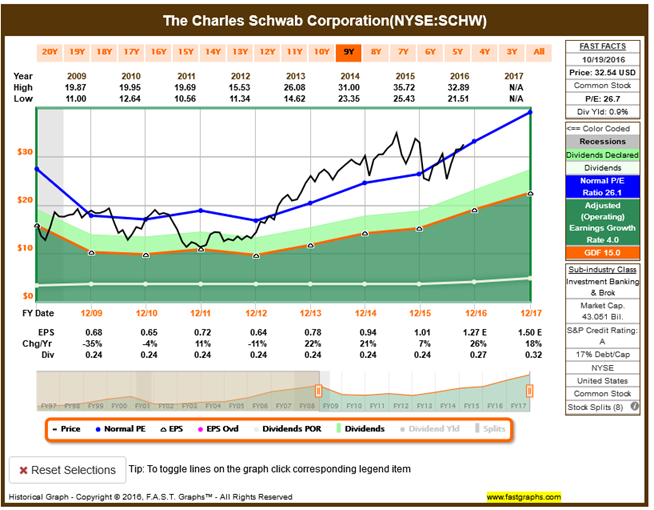

Following some steep losses in January and June, Charles Schwab (NYSE:SCHW) has spent the last few months on a rebound. The forward average suggests it’s leveling off, but I think there’s room to catch a few points just before the peak here.

What a great recovery from a major pullback. Very strong! This could have a long run.

J: This is trading around the long-term P/E ratio and earnings are rising. In that sense it is fairly valued. Here is Chuck Carnevale’s FastGraph, which shows why I still think it is expensive.

A: You and Chuck are just too cautious. If you want a big reward, you have to take some chances.

Questions

If you want an opinion about a specific stock or sector, even those we did not mention, just ask! Put questions in the comments. Address them to a specific expert if you wish. Each has a specialty. Who is your favorite? (You are allowed to choose me, although my feelings will not be hurt very much if you prefer one of the models).

Cast of Characters

Felix is fussy, precise, and very cautious. He looks for what is working, but it also must have upside potential. He is an investor who thinks long term. Felix will not usually announce new picks, but he will answer questions, saying what he thinks about specific stocks. He will also comment on favorite themes and sectors.

Oscar is naturally optimistic and a bit excitable. He definitely likes to go with winners, and focuses on a one-month time frame. He trades either sector ETFs, or a basket of stocks (equally weighted) that reflect a sector. Oscar will mention a favorite sector each week, and will also answer questions about sectors.

Holmes is a trader, but a cautious one. Holmes emphasizes asset protection through profit taking, stops, and trailing stops. He is careful in selecting new positions, and generally looks at an intermediate time frame. While he does not know the definition of “mean reversion” he loves rebounds! There is no set holding period, but two or three months is not unusual. Holmes will tell us one stock recommended that week. For those who sign up for his email list (no charge, privacy respected, holmes at newarc dot com) he will report exits with a one-day delay.

Athena trades more frequently than the others, but still limits risk. Her inspiration helps to find good ideas. Her excellent quant skills find attractive risk/reward opportunities. Her wisdom leads her to exit trades that are not working. Athena will provide a new idea each week.

Jeff usually has some comments about stock or market fundamentals. Unlike the other witty participants, he sounds like an old prof.

Disclosure: The conversation is light-hearted, but the stock analysis is serious. We own positions in each of the stocks mentioned.