Each week Felix and Oscar host a poker game for some of their friends. Since they are all traders they love to discuss their best current ideas before the game starts. They like to call this their “Stock Exchange.” Their methods are excellent, as you will learn if you join us for a few weeks. Since the time frames and risk profiles differ, so do the stock ideas. You get to be a fly on the wall from my report. I am the only human present, and the only one using any fundamental analysis.

The result? Several expert ideas each week from traders, and a brief comment on the fundamentals from the human investor. The models are named to make it easy to remember their trading personalities. Each week features a different expert.

I have placed more background at the end of the article. Comments, dissent, and specific stock questions are welcome!

This Week—Be Fussy with Felix

This week’s featured expert is Felix. Vince (our modeling guru) designed Felix to be an opportunistic, long-term trader with a time horizon of more than a year. This does not mean “buy-and-hold.” Felix is very fussy about new positions and aggressively drops those that are not working. Felix does not do much trading, so he can be a bit boring. To make up for that, Felix is our leader in answering reader questions. With nothing better to do, each week he generates a rating for every stock in the universe.

Here are the ideas for this week, beginning with Felix, our featured expert.

Felix

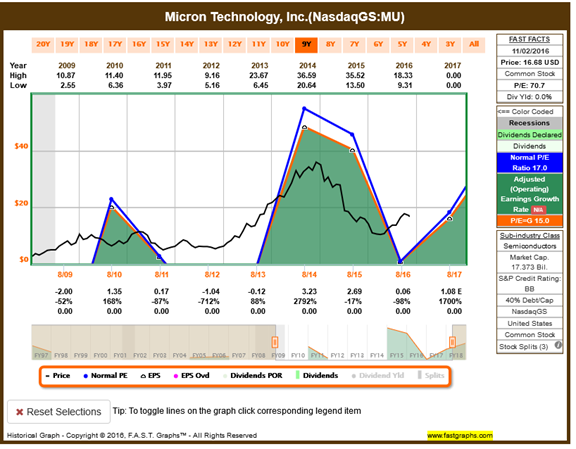

I look for long-term themes, and I have a great one this week. I am enjoying the long drive of tech. Let’s pick Micron Technology (NASDAQ:MU) as an example. The chart looks like my heart monitor when Oscar comes home and makes himself a salami sandwich after I just cleaned up the kitchen. Sky-rocketing!! The ups and downs well make up the overall value of this one.

[J] This is yet another pick from you guys that is totally unsupported by earnings! Look at Chuck Carnevale’s basic chart for the stock.

[F] The earnings may be light this year—

[J] Try almost non-existent.

[F] But the market is forward-looking. You can see that expected earnings for 2017 are much better. That is just the start.

[J] 2017?

[F] Only professors focus on past earnings. Think ahead!

[Felix] I’ve had a question this week from A Dash of Insight:

Energy- have heard from others this sector is “emerging” i.e., getting stronger. As such, how about XLE (NYSE:XLE) and OIH (NYSE:OIH)?

Seems to me that growth in this sector will depend on higher oil prices which I do not see coming unless OPEC makes and enforces an agreement to limit production (not likely, IMO).

[Felix] I have looked at XLE and OIH and they rate as middling on my scale. Energy has been low for so long that, yes, it is getting stronger. It is just at a very minimal level right now. OPEC is now finally making some changes (after years of sitting back). The effects might be a bit slower than we’d like, but there are a lot of changes now and in my opinion the future.

[J] Energy stocks are out of the danger range right now. Potential added production seems to provide a cap in the low 50’s for oil prices, but demand remains solid. These are probably reasonable long-term plays.

[F] I’m glad that you agree with me about something. Readers — please keep your questions coming. I get paid for each answer. Jeff makes Jack Benny look like a spendthrift and I need the money.

Oscar

I’ll be the first to admit I’m not a fan of tennis. All that jumping back and forth makes the game hard to follow – gives me a headache, really. At first glance, that might be what you see when you check the chart for Swift Transportation Company (NYSE:SWFT), a member of my current favorite sector. I use my own sector baskets rather than ETFs, and trucking has a very high rating. Look to the individual stocks for some good ideas. SWFT is on a solid four-month upswing. I would be perfectly comfortable holding onto this one for another month or so.

[J] Why not ETFs?

[O] Intra-day pricing does not seem to reflect the underlying positions. I have a great basket with individually weighted members. I do not compete with the HFT models.

[J] That makes sense, but I expected you to have something inspired by the World Series.

[O] Have you ever seen the old Chicago stockyards? This business reflects the heartland, and the celebration is extending all over town. I am taking the day off tomorrow to attend the parade.

[J] You mean that you are skipping your regular day at Hawthorne? No sure things?

[O] I’ll call in if you need me.

Holmes

I am the rebound specialist. If you like to buy dips and sell rips, I’m your dog. I am also logical, deductive and careful. I cap my risk with stops setting up for good gains but small losses. This week I bought Biomarin Pharmaceutical (NASDAQ:BMRN) closed today at 80.90. This stock is displaying a classic pattern of distribution and consolidation and it looks like it’s ready to move towards it 50d MA (86.60). If it gets there, I’d look for it to march even higher towards its 200d MA (91.50). I’ll keep this on a tight leash with 76.00 stop. These strategies don’t always work but the long-run risk/reward record is excellent.

[J] Didn’t you hear anything about the election? If Clinton wins, health care and biotech will get crushed.

[H] What election?

[J] What? No one in my team of models is discussing the Presidential election?

[H] The stock prices tell you everything you need to know about upcoming events, including this election. If a Clinton victory is expected and is negative for health care, that is already reflected in the stock price. My trade works if this sentiment is overdone, and it works big if Mr. Trump wins.

[J] I agree that the health care selloff is overdone, but we might not see improved pricing until February.

Athena

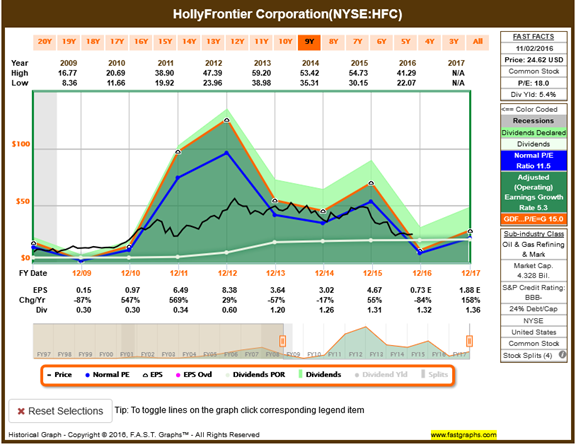

Usually I like to pick stocks that already have more momentum, but this is too good to pass up. HollyFrontier Corporation (NYSE:HFC) looks to be bottoming out here, and I expect to ride this one out for a decent run. The clue here is a long solid base, providing attractive support. Most of my current positions are from April, and they are all doing well.

[J] The near-term earnings look very unattractive.

[A] As I try to teach you each week Jeff, you need to look farther into the future.

Background on the Stock Exchange

What is this about? Since launching this series I have had good questions on three general themes. Here are the questions and some brief answers.

- The model characters are fun, but please tell me more about what they do.

I include the general personality of the model at the end of each article. I will begin featuring one approach each week with more detail, and soon provide a reference page for readers.

- Why don’t you show a track record on performance?

I understand that those trying to sell a newsletter or chat room often provide some sort of time-stamped real-time record. You will find that most of these people are not subject to compliance rules. The “track records” tell you nothing, since they do not have enough trades to get into the “long run.” Confidence in a model comes from knowing how it is developed and tested. I would rather ask a few questions to a developer than see a few months of real-time picks. It is easy to spot the amateurs.

- Why should I care about these model picks?

You probably read many articles with stock ideas. Some are a single idea based upon technical analysis from a source you do not know about. At the Stock Exchange, you get four different recommendations from technical “experts” as well as some fundamental commentary as a rebuttal. I am not trying to sell anything. We are developing an institutional product. The results are good enough that I am willing to share and discuss with readers. Some of my clients are invested in these models, so I am not going to provide every trade in real time. It is supposed to be interesting and fun! Look at the ideas and do your own research.

Questions

If you want an opinion about a specific stock or sector, even those we did not mention, just ask! Put questions in the comments. Address them to a specific expert if you wish. Each has a specialty. Who is your favorite? (You can choose me, although my feelings will not be hurt very much if you prefer one of the models).

Cast of Characters

Felix is fussy, precise, and very cautious. He looks for what is working, but it also must have upside potential. He is an investor who thinks long term. Felix will not usually announce new picks, but he will answer questions, saying what he thinks about specific stocks. He will also comment on favorite themes and sectors.

Oscar is naturally optimistic and a bit excitable. He likes to go with winners, and focuses on a one-month time frame. He trades either sector ETFs, or a basket of stocks (equally weighted) that reflect a sector. Oscar will mention a favorite sector each week, and will also answer questions about sectors.

Holmes is a trader, but a cautious one. Holmes emphasizes asset protection through profit taking, stops, and trailing stops. He is careful in selecting new positions, and generally looks at an intermediate time frame. While he does not know the definition of “mean reversion” he loves rebounds! There is no set holding period, but two or three months is not unusual. Holmes will tell us one stock recommended that week. For those who sign up for his email list (no charge, privacy respected, holmes at newarc dot com) he will report exits with a one-day delay.

Athena trades more frequently than the others, but still limits risk. Her inspiration helps to find good ideas. Her excellent quant skills find attractive risk/reward opportunities. Her wisdom leads her to exit trades that are not working. Athena will provide a new idea each week.

Jeff usually has some comments about stock or market fundamentals. Unlike the other witty participants, he sounds like an old prof.

The conversation is light-hearted, but the stock analysis is serious. We own positions in each of the stocks mentioned.

And finally, you can learn about the eternal debate between technical analysts and those using fundamentals.