Jeff: Joining me on the Stock Exchange is my colleague Todd E. Hurlbut, CMT, Chief Investment Officer at Incline Investment Advisors, LLC. Todd is the creator of the Emerald Bay model featured in this column. He is known as “Trending Todd.” And yes, that is a hint about his trading style.

Summary

One important consideration related to investing is the need to separate process and outcome. Making an investment decision based on one’s proven process yet losing money can be a painful experience, yet par for the course. Separating decisions from outcomes is necessary to understanding process. A recent article in the Wall Street Journal What Investors Can Learn from the Best Poker Players quoting successful poker player Annie Duke discusses such behavior:

‘To deal with uncertainty, she says, traders and poker players must develop resilience and learn not to be guided too much by “results-based behavior.” Put another way, they must learn that it is possible to do everything right and have a bad outcome; and it is possible to do everything wrong—maybe by throwing a dart at a list of stocks—and win big.’

The Stock Exchange is all about trading. Each week, we do the following:

Discuss an important issue for traders,

Highlight several technical trading methods, including current ideas,

Feature advise from top traders and writers, and

Provide a few (minority) reactions from fundamental analysts.

We also have some fun. We welcome comments, links and ideas to help us improve this resource for traders. If you have some ideas, please join in!

Review: Is Sentiment a Factor in Your Trading

Our previous Stock Exchange reviewed the relevance of sentiment for a trading time frame. We reviewed some of the sentiment indicators and offered our own viewpoint: A new market high speaks for itself. Thanks to readers who joined in with comments about their own methods.

This Week:

Most investors find the pain of losing significantly worse than the pleasure of winning, what behavioral economists call loss aversion. Therefore, investors are conditioned to seek out an investment process that wins most of the time to avoid the unpleasant feeling of losing. Or they add additional rules to their process to avoid the most recent painful trade. Seeking out ways to avoid the pain of loss is antithetical to a robust investment process. Ken Tropin, a highly successful systematic investment manager, put it best:

“In order for a system to be successful, it has to be what I call robust. Robust means that I can test that system in a market I designed it around. Say I’m using it in the treasury bonds, and then if I switch that market and I try that system in the Euro, it still works. And if I change its parameters, it still works. And if I switch it over to corn — something totally different than treasury bonds — it still works. And if I look at some data that was out of sample from what I designed it around, it still works. Then I have something that might be interesting and have a chance of living in the future. Because the nature of data is it changes a little all the time. And so the key to success in systems trading is to have what I call a loose fitting suit. I can’t have a suit that’s so tight and perfectly proportioned to me that if I gain two pounds, it won’t fit the data anymore.”

Investors will always look for the “holy grail” strategy that will win all the time allowing for them to avoid the inevitable pain of loss. However, history demonstrates that utilizing a robust strategy and becoming more comfortable with the inevitable losing periods is the key to successful investing over time. What do you think? We welcome comments and discussion from other traders.

Expert Picks from The Models

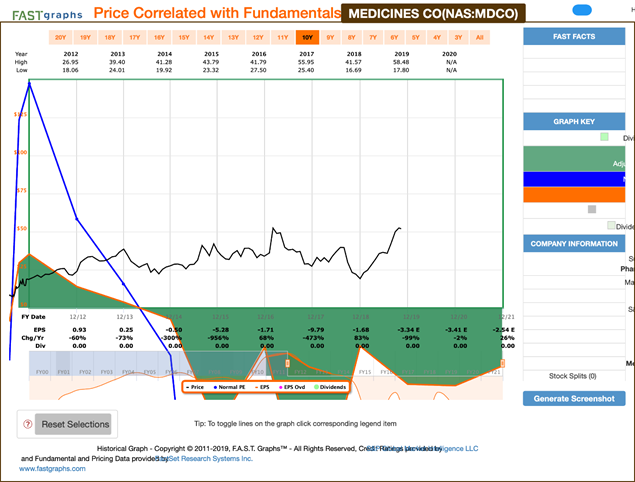

Holmes: I bought shares of the Medicines Company (MDCO) on November 14th.

TT: How do you feel about the trade?

Holmes: I purchased for technical reasons. Specifically, I am a short-term dip buyer, and I like to buy attractive pullbacks, as you can see in the chart above.

TT: I see the pullback you’re talking about, and it looks attractive so long as you believe the stock can bounce from here.

Holmes: As a technical trader, with a holding period typically around 6 weeks, I don’t care too much about long-term fundamentals. I sold this position for a 2% gain the next day 11/15.

TT: That was a very quick and attractive gain, thanks for sharing Holmes.

Road Runner: Interesting discussion guys. I recently purchased shares of ASML Holding NV (ASML) on 11/11. Any comments or questions?

TT: Why’d you buy it?

RR: I like to buy attractive momentum stocks in the lower end of a rising channel, as you can see in the following chart.

TT: It seems like a rounded consolidation within a rising channel and trading at a multiyear high price. Attractive stock indeed.

RR: That’s correct. There are a few more data points that go into each trade, but essentially, yes–you got it.

TT: Okay, I think this trade has potential. Thanks for sharing. And how about you, Athena–any trades to share this week?

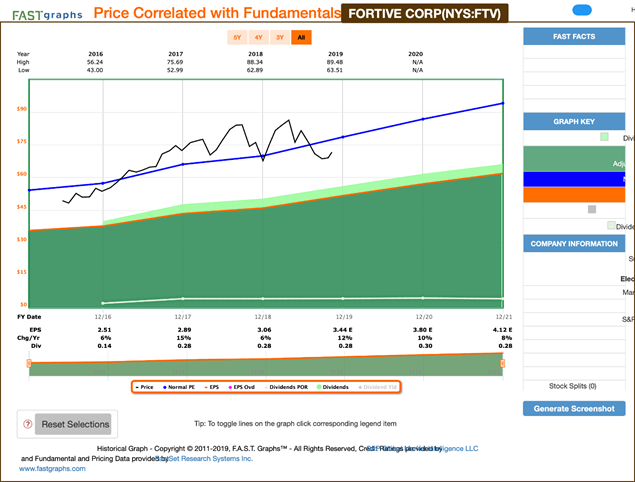

Athena: I bought shares of Fortive Corp (FTV) on November 15th.

TT: Looks like it’s breaking out of the recent downtrend.

Athena: I look for stocks having strong positive trends and then select only those with the very strongest trends (“king of the hill”), constantly replacing the ones with weaker trends. It should not surprise anyone that I bought Fortive. A quick look at the chart should make the strength of the trend obvious. And I generally continue to hold my positions until either the strength of the trend abates or a stock with an even higher trend strength comes along. I don’t have a set “holding period” for a position. I will exit only when either a stronger stock comes along or if market conditions dictate a strong potential for loss – capital preservation remains the key driver in all situations.

TT: Thanks for sharing. And how about you, Emerald Bay?

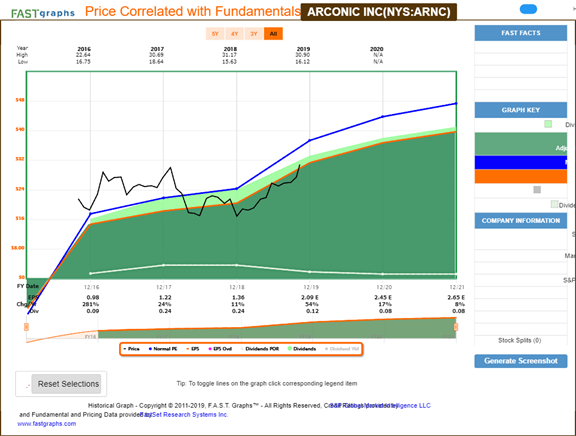

Emerald Bay: I bought shares of Arconic (ARNC) on November 13th.

TT: It looks like these shares have been rising steadily in a tight channel for months before you purchased.

EB: I seek exposure to the highest momentum names in our large cap equity universe, adjusted for volatility. Specifically, I like to base my position sizes on volatility with more capital invested in the less-volatile stocks.

TT: You’ve been doing quite well since purchasing this position and I suspect you’ll hold it until the trend changes. Thank you for sharing.

Jeff: This time a good chart is supported by good earnings. As long as you are not a dividend investor, this is fine.

Conclusion

Successful long-term investing requires a robust investment process to be executed over time. Periods of poor performance and losses are inevitable and the unavoidable cost implementing a successful robust investment strategy.