The Stock Exchange is all about trading. Each week we do the following:

- Discuss an important issue for traders;

- Highlight several technical trading methods, including current ideas;

- Feature advice from top traders and writers; an d,

- Provide a few (minority) reactions from fundamental analysts.

We also have some fun. We welcome comments, links, and ideas to help us improve this resource for traders. If you have some earnings season ideas, please join in!

Review

Our previous Stock Exchange considered whether the bull market was slowing. If you missed it, a glance at your news will show that the key points remain relevant.

This Week – Using Discipline When Entering and Exiting Trades

To frame this week’s discussion, here is quote about using stops to exit your trades from a recent edition of Charles Kirk’s, The Kirk Report:

“I do not adjust my stops after they are set, especially not on the fly based on some outside risk event… I don’t like that kind of approach because it introduces a discretionary element into your risk management… At the end of the day, it isn’t up to me to decide whether the market is wrong or right. After all, the market is always right. The stop is there to protect my capital when the position is wrong.”

For some additional perspective on trading strategies, Valeriy Zakamulin adds a little order to the chaos in the field of market timing with moving averages in this article from Alpha Architect:

Trend-Following with Valeriy Zakamulin: Anatomy of Trading Rules

Further still, Alpha Architect provides more insightful information in this article:

Volatility Premium, Covered Call Selling, and Knowing What You Own

Specifically, the article defines the concept of “volatility premium” and then goes on to describe several ways to capture that premium when you enter your trades.

Expert Picks from the Models

This week’s Stock Exchange is being edited by our frequent guest: Blue Harbinger (also known as Mark D. Hines). Blue Harbinger is a source for independent investment ideas focused on value and income opportunities.

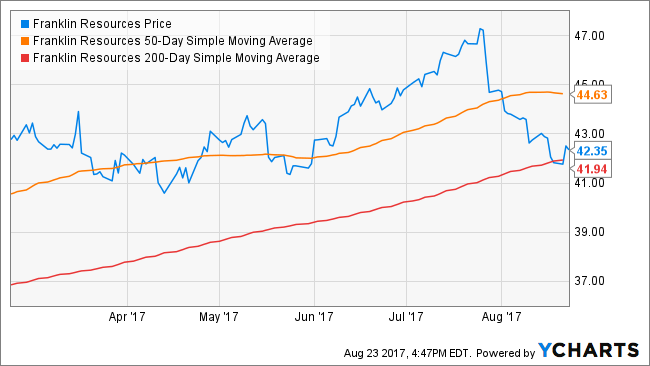

Homes: This week I like Franklin Resources (NYSE:BEN). This stock’s dip over the last month is the sort of set up I like to see. From the chart below you can see BEN is below its 50-day moving average, and just above its 200-day moving average. It’s also received support at $42 twice now, and the price has moved up this week. With limited downside and plenty of upside potential, I hope I’ve brought the humans a solid pick.

Blue Harbinger: BEN is an interesting business Holmes. It’s largely an active asset manager targeting mainly retail investors, as well as some institutions. Asset managers make money based on the amount of assets under management (“AUM”) they have (i.e. their fees are often a percent of AUM). So when the market goes up, BEN’s revenues go up. The trouble with Franklin Resources is that there is this huge and continuing wave of assets moving away from active funds and into passive funds, this is NOT good for BEN.

Holmes: That a nice story about Franklin Resources, Blue Harbinger. But my style is dip-buying mean reversion, my average holding period is six weeks, I exit when my price target is achieved, and I control risks based on macro factors and stops.

BH: Well Franklin Resources delivered slightly disappointing earnings on July 28th, and that’s why the shares have sold off. The company’s AUM was up $2.8 billion during the quarter. Specifically, AUM was up $10.1 billion due to net market change, but then lost $7.3 billion in net outflows—you know, investors moving their money elsewhere. Holmes, have you considered a nice passive manager, like BlackRock (BLK)?… their assets under management will continue to benefit from investors moving to low-cost passive funds like the iShares they offer.

Holmes: I could counter your argument by pointing out active managers (including Franklin Resources) have been increasingly beating their benchmarks this year, and also that the retail mutual funds business has an enormous contingent of relationship-driven clients that will never go to the cold, bare bones, solutions offered by BlackRock. But instead, I’ll just remind you that my edge is based on quantifiable mean-reversion and dip-buying, and I’ll stick to that. How about you RoadRunner, what do you like this week?

RoadRunner: My most recent pick is RH (formerly Restoration Hardware) (RH). I look for stocks that are at the bottom of a rising trading channel, and if you look at the chart below you can see why I like RH. It’s been in a steady rising channel for months and may easily rise over $75 soon. I get in at opportune times, but only hold my position for so long—usually about four weeks.

Blue Harbinger: RoadRunner, might I remind you that you have picked RH in the past, on both July 28th and on May 19th. Is there any particular reason you keep bringing RH to our attention?

RR: Well aside from the reasons I just told you (it’s at the bottom of a rising channel, and it looks good for the next four weeks) my quantitative system has a profitable track record of getting in and out of these names at the right time.

BH: Ok RoadRunner, then I’m just going to remind you of some of the things I pointed out last time you recommended. First, I don’t like RH. It’s a luxury home furnishings company that just completed an extraordinarily aggressive share buyback program. Specifically, they bought back nearly 50% of the shares outstanding in less than six months, and that drove the price to more than double, and it caused the price-to-earnings ratio to also increase dramatically.

The company’s actions just seem very aggressive to me, especially considering they used some expensive debt to buy back the shares. And the market also believes there’s something odd going on here considering short interest is still over 50%! I just feel like this company could tank under even the slightest recession.

RR: Feelings are important, but not when it comes to my disciplined and repeatable process. RH is attractive. Anyway, how about you Felix—what have you got?

Felix: I like Yelp (YELP). This stock has some powerful momentum on its side.

BH: Interesting pick, Felix. It’s nice to see you finally bring an idea to the table after you had nothing for us last week.

Felix: Unlike you humans, I don’t get frustrated and try to force things when the opportunities simply aren’t there. On average, I hold my positions for 66 weeks. I’ll exit when my price target is achieved, and I use stops to manage risks.

BH: Yelp is interesting because revenues are growing rapidly, but so too are SG&A expenses. Your 66 week average holding period seems a little long compared to the rest of the gang, but I suppose that will give Yelp time to keep growing its business.

Yelp is basically an online platform to help people find highly regarded local businesses. It’s got a huge addressable market, so if it keeps growing revenues, and it finds a way to control costs (eventually it won’t have to spend so heavily on SG&A expenses), Yelp could turn into a highly profitable cash cow.

Felix: That’s an interesting story. However, I’m just here to pick winners.

BH: That’s why we like you Felix. Do you have an updated rankings list for us?

Felix: Yep. Here you go…

Conclusion

The trading process can often appear chaotic, especially if you are a newcomer to the field. However, there are methods behind the madness in determining when to enter and exit positions. For example, there are disciplined quantitative processes behind the selections of Felix, RoadRunner and Holmes (as well as Athena and Oscar). Further still, there are disciplined risk controls and exit methodologies in place. And having a disciplined process for entry and exit points is often what separates the most successful traders from the rest of the pack.

Background on the Stock Exchange

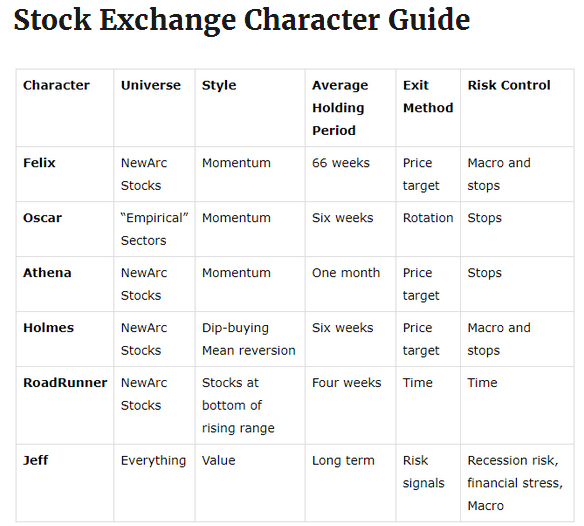

Each week, Felix and Oscar host a poker game for some of their friends. Since they are all traders, they love to discuss their best current ideas before the game starts. They like to call this their “Stock Exchange.” (Check it out http://dashofinsight.com/background-stock-exchange/ for more background). Their methods are excellent, as you know if you have been following the series. Since the time frames and risk profiles differ, so do the stock ideas. You get to be a fly on the wall from my report. I am usually the only human present and the only one using any fundamental analysis.

The result? Several expert ideas each week from traders, and a brief comment on the fundamentals from the human investor. The models are named to make it easy to remember their trading personalities.

Getting Updates

We have a (free) service for subscribers of our Felix/Oscar update list. You can suggest three favorite stocks and sectors. Sign up with email to “etf at newarc dot com”. We keep a running list of all securities our readers recommend. The “favorite fifteen” are top ranking positions according to each respective model. Within that list, green is a “buy,” yellow a “hold,” and red a “sell.” Suggestions and comments are welcome. Please remember that these are responses to reader requests, not necessarily stocks and sectors that we own. Sign up now to vote your favorite stock or sector onto the list!