The fiscal cliff steals the financial headlines on a daily basis. Yet in spite of increasing volatility and year-end uncertainty, the hot topic hasn’t moved the broader market’s needle.

Since the 11/6 election more than 6 weeks ago, the S&P 500 SPDR Trust (SPY) has effectively ended in the same place it began. Bears believe this is a sign that upcoming austerity will hamper market progress and that a failed budget negotiation may send stocks plummeting. Bulls believe that stocks are ready to explode to the upside, as long as the White House and Congress cement a deal.

Intriguingly, there are several stock ETFs that are marching to a different drumbeat than the one heard in the District of Columbia. Here’s a quick summation:

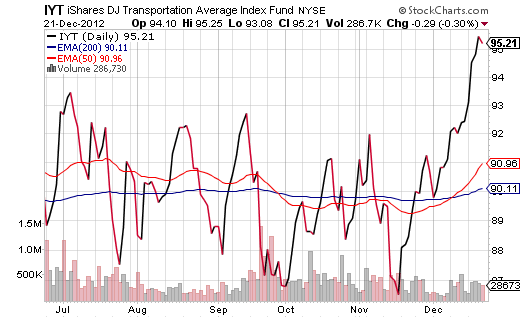

1. iShares DJ Transportation (IYT). The Dow Jones Transportation Average has been a thorn in the U.S. stock bull… all year long. Unlike the Dow Jones Industrials Average that set new bull market highs in May, September and October, the Transports stubbornly drifted lower throughout the summertime and into the fall.

Then something happened in mid-November. Not only did the exchange-traded proxy (IYT) rocket more than 10% in as little as 5 weeks, but the price hit a new 52-week high on 12/20; on Friday, 12/21, IYT only fell -0.3%.

Granted, a “Dow Theorist” might still be skeptical of the recent turn of events. After all, IYT has not yet revisited its bull market pinnacle set in July 2011. Nevertheless, the demand for the transportation of goods and services should increase markedly with greater economic stabilization in China.

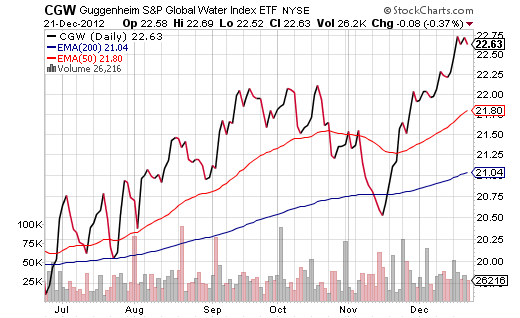

2. Guggenheim Global Water (CGW). The idea that one would see handsome profits by investing in companies that provide, purify and conserve the ultimate commodity for homes and businesses is hardly new. In fact, the theme gathered a head of steam in 2006 on the notion that developing countries would require the expertise in enhancing its infrastructure.

More recently, however, some are looking to global water companies as a sustainability play. Whereas one may choose dividend growth models as a solid indication that a company will be providing its product or services for many years to come, one can also look at the end product or service itself. Water is as essential to sustaining life and livelihood as oil; meanwhile, global water corporations rarely have to worry about demand.

On 12/21, CGW fell roughly 1/3 as much as broader domestic and global benchmarks. Equally worthy of note, the fund had hit fresh 52-week highs in the week.

Obviously, if the U.S. fails to reach an accord, it’s unlikely that stock assets of any stripe would survive the stampede for the exits. That’s why it’s critical for ETF investors to maintain an unemotional discipline for reducing downside risk. That said, the recent rise in transportation stocks and water stocks is telling me that investors are growing increasingly confident in China’s economic prospects.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Stock ETFs That Didn’t Slump On The Failure To Pass “Plan B”

Published 12/23/2012, 02:57 AM

Updated 03/09/2019, 08:30 AM

Stock ETFs That Didn’t Slump On The Failure To Pass “Plan B”

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.