Rising stock prices often have a way of covering up significant woes. Many journalists and market prognosticators had all but buried the Eurozone debt crisis, declaring that bankrupt member nations had discovered a viable path forward.

Not surprisingly, the facts are starting to trip up the rhetoric. Spain’s economy shrank 0.7% in the final quarter of 2012, demonstrating that its recession is accelerating. In addition, unemployment across the entire Eurozone is stuck at an uninspiring 11.7%.

And then there’s the political uncertainty. Corruption allegations are shaking Spain’s Prime Minister Rajoy. Italy’s Prime Minister Monti is struggling to fend off a resurgent Berlusconi in the upcoming election. Meanwhile, Greek protests and strikes over austerity continue to force the current government back on its heels.

It might be easy to dismiss 1% losses in the U.S. market as a bit of profit taking on a post-Superbowl Monday. On the other hand, the volatility on unhedged European country ETFs is reminiscent of the euro-inspired risk aversion in 2010, 2011 and 2012.

At the mid-point of the trading day, the discrepancy between Eurozone member countries and the U.S. is unmistakable:

In a recent interview, Jonathan Liss asked me what global issues were most likely to adversely affect investors in 2013. I replied:

China’s economy has already stabilized and will continue to show recovery signs. I’m not on the China hard landing wagon… The Eurozone is, was, and will continue to be a major problem in my book.”

Indeed, I continue to recommend ETFs like iShares MSCI All Asia exc Japan (AAXJ). And, for euro-bears, I recently suggested that investors would benefit from shorting WisdomTree Small Cap Europe Dividend (DFE).

This is not to say that I have predictive powers… I most certainly do not! Nobody has any idea how the future will play out. What I do know is that, whatever investment decision I may make for my clients, I know how to manage the downside risk of being wrong. Investing success is less about picking the winner, but rather, keeping a loser in the small loss camp.

One last thought about the Eurozone debt crisis. On days when it creeps back into the collective conscious of the global investment community, there are a number of asset types that do not appear to react dramatically. I’m not referring to U.S. treasuries and/or “risk-free” assets that act as safe havens. Rather, I am talking about assets that may be less correlated to traditional U.S. equities and traditional fixed income.

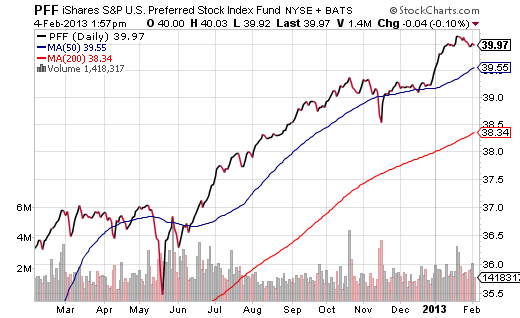

For diversifying your portfolio with less-correlated and/or non-correlated assets, consider pipeline partnerships via UBS E-Tracs Alerian MLP Infrastructure (MLPI) and/or iShares Preferred (PFF).

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Stock ETFs Rarely Fall 1% On Profit Taking Alone

Published 02/05/2013, 02:26 AM

Stock ETFs Rarely Fall 1% On Profit Taking Alone

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.