Warren Buffett and Berkshire (BRK.A) colleagues are publicly complaining about the absence of stock bargains. What they should be saying is that broad-based equity investors were wrong to cheer the Federal Reserve’s economic downgrade and subsequent continuation of its money-printing, bond-buying program; in particular, lower economic forecasts by the Fed will likely be accompanied by reduced revenue and lower earnings at the corporate level.

Nevertheless, investors are now conditioned to believe that stocks are the only place for one’s money. Many participants have learned to view bonds with disdain since “taper talk” began in late May; they view bonds as too risky because of the threat of future tapering/rising rates or because of the paltry reward (ultra-low yields) relative to the risk.

What’s missing from the assessment, however, is the logic behind choosing more stock exposure. Bonds are terrible so, by default, stocks are terrific? The Fed all but guarantees stock gains? Fundamental value folks typically cringe at the idea of trailing 12-month P/Es of 18.1 on the S&P 500. Even Forward P/Es of 15.3 may not accurately reflect the likelihood of sub-par earnings growth. And yet, there are very few naysayers on adding more stock.

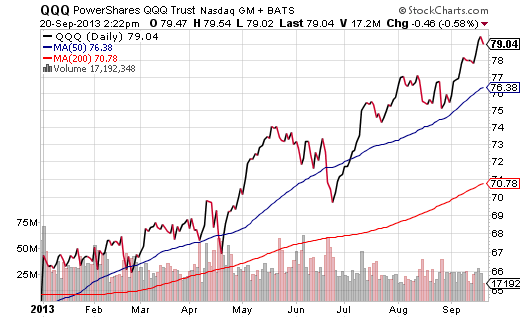

Is the NASDAQ 100’s 1.5% yield and 20.5 P/E worthwhile? Is its Forward P/E of 17.3 under-priced? More likely, the PowerShares NASDAQ 100 (QQQ) primarily represents irrational excitement for quantitative easing (QE).

In practice, there’s nothing wrong with riding the QE jet plane higher. You simply need an unemotional discipline for stepping aside; you need to know the circumstances under which you would protect yourself from extreme harm. In other words, foolish folks may be ignoring signals (e.g., valuation, economic weakness, etc.) as they chase Fed-fueled performance, but you require a plan to gracefully leave the rodeo before the stampede. Stop-limit loss orders, trendlines, hedges, put options — whatever your method, make sure that you have a concrete exit strategy.

While QQQ is a bit worrisome, I couldn’t help but notice the super-sized institutional buying on weakness of household technology names. Roughly $1.7 billion in money flow entered 4 companies on Friday, 9/20: Apple (AAPL), Microsoft (MSFT), Intel (INTC) and Cisco (CSCO). “Old tech” may be gathering interest from the asset management community now that Microsoft committed to a dividend hike and a share buyback.

What is more intriguing to me is the reality that “old tech” is fairly valued or even undervalued on a trailing 12-month basis. Consider First Trust NASDAQ Technology Dividend (TDIV). Whereas the S&P 500 has slower earnings growth, a trailing P/E of 18 and a dividend yield of approximately 2%, TDIV has a trailing P/E of 14, reasonable earnings growth potential as well as a 2.9% SEC 30-day dividend yield. The top four holdings? They are the very same above-mentioned companies that institutional buyers scooped up on Friday via block trade.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Stock ETFs Overvalued? 'Old Tech' Begs To Differ

Published 09/22/2013, 02:55 AM

Stock ETFs Overvalued? 'Old Tech' Begs To Differ

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.