Earlier this week we sent this message to members and I wanted to share it with our viewership today.

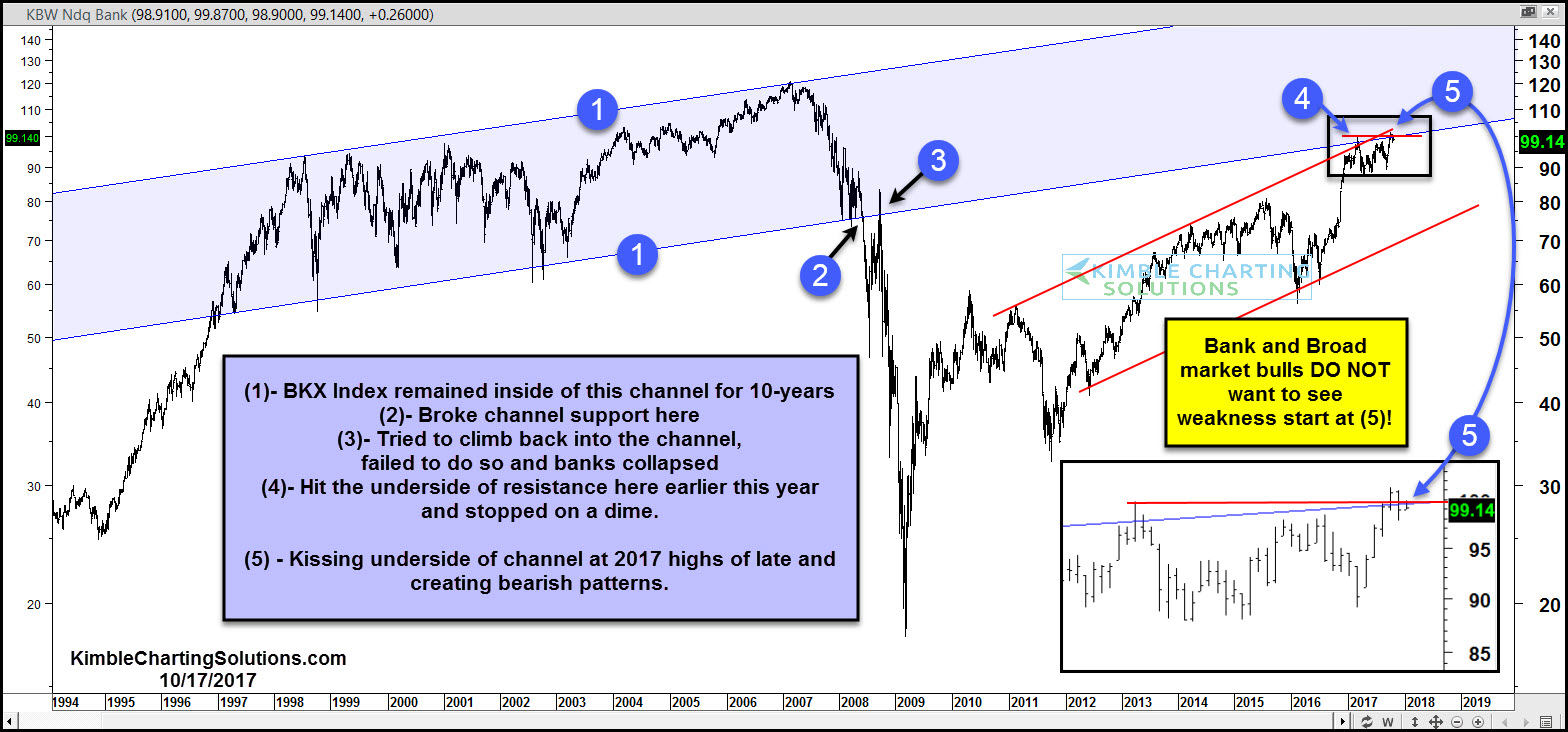

Below looks at the Bank Index over the past 20 years and why the Power of the Pattern feels this could become a very important price point for the bulls.

As mentioned in the chart above, the Bank Index is testing the underside long-term rising channel (1) again. At the start of this year, the bank index hit the underside of rising channel (1) at (4) and banks then proceeded to trade sideways for 7-months.

The rally in banks of late has the index testing the underside of channel (1) again at (5), which also could be a 2017 double top, at the underside of the long-term channel.

Stock bulls should get a little nervous should weakness start taking place at (5). This is a price point that bulls would not want to see selling start!

We now know what stock bulls don’t want to see, what would stock bulls like to see? Bank and broad market bulls want/need to see a breakout at (5), NOT selling pressure or a double top.

We humbly feel what Banks do at this key price point, could impact portfolio construction going into the end of the year.