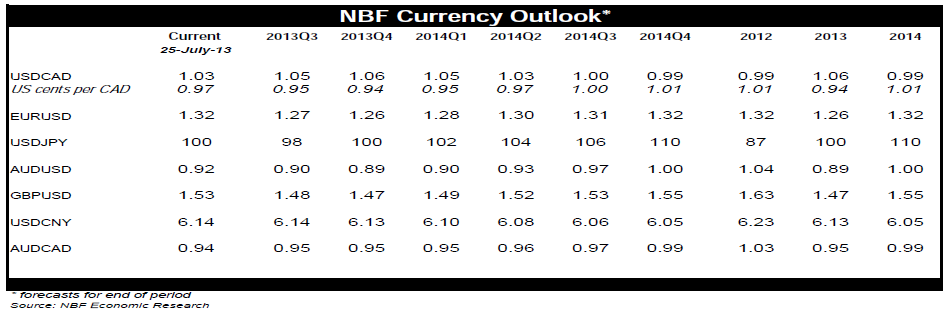

Despite recent dovish talk from Chairman Bernanke, the Fed remains on course to taper down the size of its asset purchase program before year-end. Modest US growth in the first half of 2013 is expected to be followed by a pick-up in economic momentum in the second half, providing added lift to a labour market that’s already on an upswing, and leaving the door open for the Fed to curb its balance sheet starting in Q4. With a winding down of debasement policies in the cards, the US dollar has room to recapture some of the ground it lost recently. Other major currencies, particularly those whose central banks remain in easing mode, are unlikely to be spared. The Bank of Japan is steadfast in its ambitious asset purchase program, a stance that was no doubt reinforced by a government that now fully controls parliament. We continue to expect USDJPY to depreciate to around 110 by the end of next year. The European Central Bank has committed to maintain its policy rate low or lower for an extended period, while the Bank of England signalled a leaning towards forward rate guidance as a way of controlling expectations along the yield curve. Those, coupled with Fed tapering, should keep downward pressure on the pound and the euro. The only adjustment we’ve made this month is to our AUDUSD targets to reflect the recent sharper-than-expected currency slump down under.

Higher rate expectations along with a reduction of net short positions helped the Canadian dollar regain its footing a bit in July. But those expectations could be pared back if, as we expect, Q3 Canadian data falls short of the high bar set for the quarter by the Bank of Canada in its latest Monetary Policy Report. We are keeping unchanged our USDCAD targets, expecting depreciation towards 1.06 before year end.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Still On Course For QE Tapering

Published 07/29/2013, 08:02 AM

Updated 05/14/2017, 06:45 AM

Still On Course For QE Tapering

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.