The fog started rolling in around my home last night and it looks a lot like this as I am writing. The murkiness got me thinking about how hard it is to find clarity when forecasting, especially with something as complex as inflation. I do not envy Janet Yellen and her FOMC teammates as they try to look through the fog to forecast job growth, economic growth and inflation. The major focus lately has been on inflation with the unemployment rate creeping towards historic lows.

So what does Chairman Yellen and her crew see? They have consistently told us that they expect inflation to move to long run expectations near 2% soon. But how long can you say soon before it turns into a career? Some of the messaging is clearly targeted at raising expectations in the market place. Expected inflation begets actual price rises, is the theory. But what does the data say?

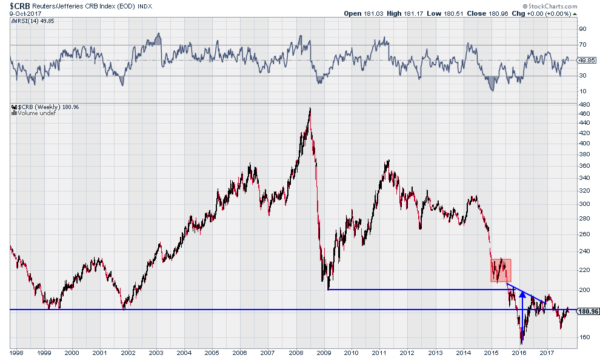

The chart above shows weekly price changes in the Thomson Reuters/CoreCommodity CRB Excess Return, a broad measure of commodity inflation. It does not cover everything but includes everything you eat, wear, build with and use to transport yourself. What is it saying? The chart shows a large run higher off of a double bottom in 2001 to a peak at the height of the financial crisis.

A swift pullback followed and a bounce to a lower high in 2011. Since then the CRB index has moved lower, slowly at first then accelerating from 2014 into 2016. The bounce set up a possible reversal with an Inverse Head and Shoulders Pattern as 2016 ended. But that was negated with the mid-2017 dip. Now back testing the prior support area from the double bottom 18 years ago, it is failing to rise again.

A few take aways: 1. Commodity inflation is at historic lows. Outside of the blip in 2016 you need to go back over 20 years to see these levels. 2. Commodity inflation is falling, not rising. 3. Expecting a snapback because it is historically low is not forecasting but guessing.

There is no evidence that inflation will rise. Lets see what the FOMC minutes say Wednesday.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.