I have received a handful of emails regarding my Sugar position, so its time for an update. To answer a few questions: yes, I am still long Sugar and yes I am still extremely bullish on Sugar and yes…I still think it is a great time to buy the commodity for the long run (as long as you read the side note at the end).

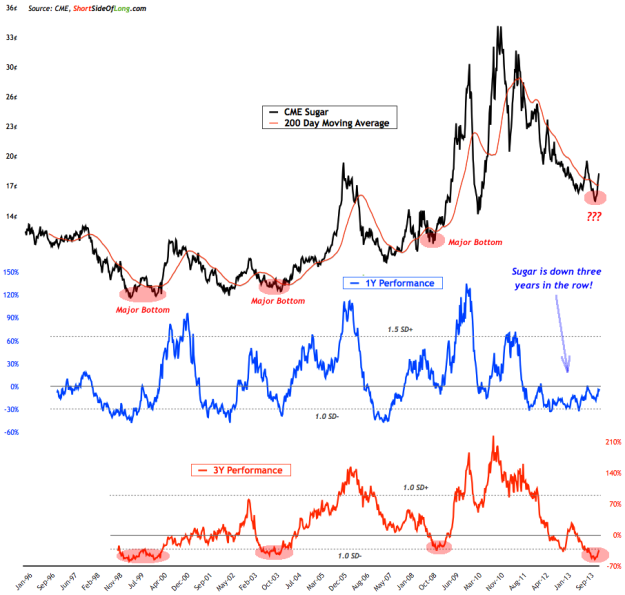

Chart 1: Sugar still remains extremely oversold & primed for bull market

I am a lot more optimistic on Sugar than many other asset classes right now, as I think the asset will surprise on the upside very soon. Sugar has been down three—yes three—years in the row. Last time that happened was in 1992.

Note that Sugar prices doubled by the end of 1994. Does that mean we can expect a doubling again? Maybe, or maybe not.

The fact is that we are at least in for a period of bullish mean reversion. Sugar performance has been awful over the last 3 years (as Chart 1, above, shows). Please note that the previous three year rolling performance this bad, has always marked a major bottom. Therefore, a mean reversion should be coming, as farmers continue to cut planting. While the market continues to think 2014/15 will be a surplus inventory story, my view is that we are going to have a deficit year.

Furthermore, if the weather situation gets worse in Brazil and India, together with potential Chinese demand increase, altogether this could be a perfect storm for Sugar prices to double or even triple from current levels. Watch the commodity closely as its overdue for a positive annual return and 2014 could be just the year.

Side note: Sugar prices have rallied over 20% in recent weeks, with a positive streak of 6 weekly gains in the row. Therefore, it would be foolish to just blindly jump into the commodity right now as it might have a pull back from short term overbought levels.