We are taking a look at Steve Madden (SHOO) this week, a name that popped up in Avondale’s proprietary quantitative value screen. The screen looks at historical financial data to potentially identify high quality companies trading at low valuations. The screen is an important part of Avondale’s investment process, but this post should not be taken as an investment recommendation.

Fundamental Data:

Price: $38.22

Market Cap: $2.59 B

Income statement

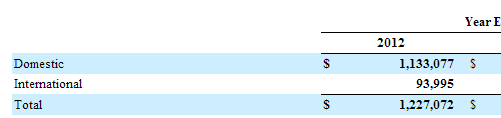

Revenue: $1.23 B

EBIT: $179 M

Gross Margin: 37%

Operating Margin: 14.6%

Balance Sheet

Cash: $168 m

Notes from 10-K

Design, source, market and sell fashion-forward name brand and private label footwear for women, men and children and name brand and private label fashion handbags and accessories and license our trademarks for use in connection with the manufacture, marketing and sale of various products of our licensees.

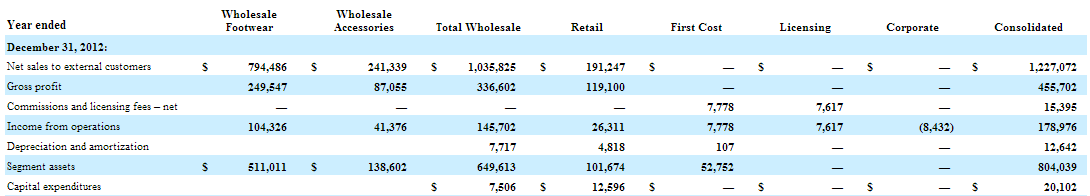

Our business is comprised of five distinct segments: Wholesale Footwear, Wholesale Accessories, Retail, First Cost and Licensing.

Wholesale Footwear Segment(64% of Revs, 31% GM, 13% OM):

Our Wholesale Footwear segment includes the following brands: Steve Madden Women’s, Madden Girl, Steve Madden Men’s, Steven, Betsey Johnson shoes, Olsenboye (under license), Stevies, Superga (under license), Elizabeth and James (under license), Madden, Report, l.e.i. (under license), and includes our private label and International businesses.

We currently sell to over 4,400 doors of 15 department stores throughout the United States and Canada. Our major accounts include Macy’s, Nordstrom, Bloomingdale’s, Dillard’s and Lord & Taylor.

We currently sell to specialty store locations throughout the United States. Our major specialty store accounts include DSW, Famous Footwear and Journeys.

Wholesale Accessory segment (20% of revs, 36% GM, 17% OM):

Our Wholesale Accessories segment includes Steve Madden, Steven by Steve Madden, Big Buddha, Betseyville, Betsey Johnson, Cejon and, through license agreements, Daisy Fuentes® and Olsenboye® accessories brands and includes our private label business.

Retail Segment (16% of Revs, 62% GM, 14% OM):

109 retail stores including 91 Steve Madden full price stores, eleven Steve Madden outlet stores, two Steven stores, one Report store, one Superga store and three e-commerce websites

In 2012, our retail stores generated annual sales in excess of $890 per square foot

A typical Steve Madden store is approximately 1,400 to 1,600 square feet and is located in a mall or street location that we expect will attract the highest concentration of our core demographic, style-conscious customer base.

$188 m lease obligations

Our stores are also a marketing tool that allows us to strengthen brand recognition and to showcase selected items from our full line of branded and licensed products.

We operate three Internet website stores

First Cost Segment (7.8m op income):

The First Cost segment represents activities of a wholly owned subsidiary of the Company that earns commissions for serving as a buying agent for footwear products under private labels and licensed brands (such as Candie’s®) for many of the large mass-market merchandisers, shoe chains and other mid-tier retailers. As a buying agent, we utilize our expertise and our relationships with shoe manufacturers to facilitate the production of private label shoes to our customers’ specifications

our First Cost segment serves as a buying agent for the procurement of women’s, men’s and children’s footwear for large retailers, including Kohl’s, K-Mart, Sears and Bakers.

Licensing (7.6m op income):

We license our Steve Madden® and Steven by Steve Madden® trademarks for use in connection with the manufacture, marketing and sale of sunglasses, eyewear, outerwear, bedding, hosiery and women’s fashion apparel, jewelry and luggage.

Notes

We believe that our future success will substantially depend on our ability to continue to anticipate and react to changing consumer demands in a timely manner. To meet this objective, we have developed what we believe is an unparalleled design process that allows us to recognize and respond quickly to changing consumer demands. Our design team strives to create designs which it believes fit our image, reflect current or future trends and can be manufactured in a timely and cost-effective manner. Most new Steve Madden products are tested in select Steve Madden retail stores. Based on these tests, among other things, management selects the Steve Madden products that are then offered for wholesale and retail distribution nationwide

We believe that our design and testing process and flexible sourcing models provide the Steve Madden brand with a significant competitive advantage allowing us to mitigate the risk of incurring costs associated with the production and distribution of less desirable designs.

We do not own or operate manufacturing facilities; rather, we use agents and our own sourcing office to source our products from independently owned manufacturers in China, Mexico, Brazil, Taiwan, Italy and India.

Our products are available in many countries and territories worldwide via several retail selling and distribution agreements.

We compete with specialty shoe and accessory companies as well as companies with diversified footwear product lines, such as Nine West, Jessica Simpson, Guess, Ugg and Aldo.

We believe effective advertising and marketing, favorable brand image, fashionable styling, high quality, value and fast manufacturing turnaround are the most important competitive factors and intend to continue to employ these elements as we develop our products.

Principal marketing activities include product placements in lifestyle and fashion magazines, personal appearances by our founder and Creative and Design Chief, Steve Madden, and in-store promotions.

Noteworthy Risks: Constantly Changing Fashion Trends and Consumer Demands. Consolidation Among Retailers. The trend-focused nature of the fashion industry and the rapid changes in customer preferences leave us vulnerable to an increased risk of inventory obsolescence.

On January 3, 2012, the Company and its Creative and Design Chief, Steven Madden, entered into an amendment, dated as of December 31, 2011, to Mr. Madden’s then existing employment agreement with the Company. The amended agreement, which extends the term of Mr. Madden’s employment through December 31, 2023, provides for a base salary of approximately $5,416,000 in 2012, approximately $7,417,000 in 2013, approximately $9,667,000 in 2014, approximately $11,917,000 in 2015 and approximately $10,698,000 per annum for the period between January 1, 2016 through the expiration of the term of employment…

Back of the Envelope Math

Retail Segment Math

$191 m in sales from 109 locations => implies $1.75 m per location

$92 m in operating expense => implies $844 k op-ex per store

$890 sales per square foot => $554 gross profit per sqft => $122 operating profit per sqft

$890 sales per square foot => implies 214 k square feet total retail space

Wholesale Segment math

$1,035 m total revs in 4,400 doors (at department stores) => less than $235 k in sales per location (variable based on number of specialty locations) => if you assume 80% of wholesale revs were generated at department stores then 188k per location.

If SHOO generates the same sales/sqft at a wholesale location as it does in one of its retail stores, that implies that SHOO has 1.1 m sqft of selling space at wholesale, and is allocated somewhere less than 264 sqft of selling space per department store.

Valuation based on estimated sqft

EV = $2.4 B

Estimated Sqft of selling space ~ 1.3 m sqft

=> Currently valued at $1,846 EV per square foot (take with grain of salt–very, very rough estimate)

=> if SHOO continues to generate $122 in op inc per sqft, and you assume that it trades at a LT EBIT multiple of 9x, then $2.4 B EV implies 2.2 m sqft of selling space.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Steve Madden: High Quality, Trading At Low Valuation

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.