Dublin, Ireland-based Allergan plc (NYSE:AGN) is engaged in the development, manufacturing, marketing, sale and distribution of branded pharmaceuticals and select over-the-counter products.

Allergan has been actively pursuing deals to expand its portfolio especially its branded products offering. Having completed the acquisition of companies like Durata and Forest, Allergan acquired Botox maker, Allergan Inc., in Mar 2015. With this acquisition, Allergan, which was previously known for its strong presence in the generics market, finds itself in the company of the top 10 pharmaceutical companies across the world based on sales.

In 2017 so far, through the accretive acquisitions of LifeCell and ZELTIQ, Allergan has expanded its medical aesthetics business into regenerative medicine and body sculpting, respectively.

Allergan sold its generics and Anda distribution business to Teva in Aug and Oct 2016, respectively.

Allergan’s earnings performance has been mixed so far, with the company beating expectations in three of the past four quarters and missing on one occasion. The average negative earnings surprise over the last four quarters is 0.27%.

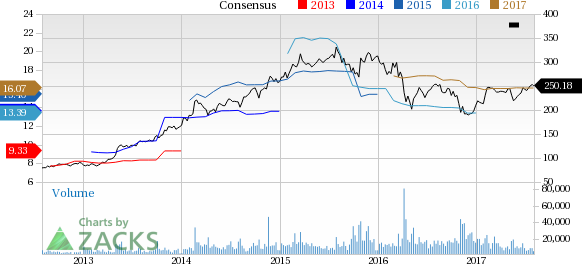

Currently, Allergan has a Zacks Rank #3 (Hold), but that could definitely change following the company’s earnings report which was just released. We have highlighted some of the key stats from this just-revealed announcement below:

Earnings Beat: Allergan’s second-quarter earnings of $4.02 per share were above our consensus estimate of $3.95 per share.

Revenues Beat: Revenues also beat expectations. Revenues came in at $4.01 billion, up 8.8% from the year-ago period, and also beat the Zacks Consensus Estimate of $3.95 billion by 1%.

2017 Outlook Up: The company raised its previously issued earnings and sales guidance for 2017.

Allergan expects total revenue in the range of $15.85 billion to $16.05 billion compared with $15.8 billion to $16.0 billion previously. Currency headwinds are now not expected to hurt revenues versus a negative impact of approximately $100 million expected previously.

Adjusted earnings are expected in the range of $16.05–$16.45 compared with $15.85–$16.35 per share previously.

Share Price Impact: Shares declined more than 2% in pre-market trading.

Check back later for our full write up on this AGN earnings report later!

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

Allergan PLC. (AGN): Free Stock Analysis Report

Original post

Zacks Investment Research