The Sterling is so far the weakest major currency next to the yen. The selloff in the pound seems accelerating after reports on the referendum on Scottish independence. It's reported that a YouGov poll showed jump in the support from pro-independence to 47% this week. That compared to 53% support of anti-independence. So, the case of independence is becoming a possibility to the markets. It's perceived that independence of Scotland would create both political and economic uncertainties. And, the future of Sterling is a major focus of debate as Scottish first minister Salmond insisted the continuation of pound in case of independence. But three other main political parties rejected that idea. There would be much more volatility in the pound ahead of the ballot on September 18.

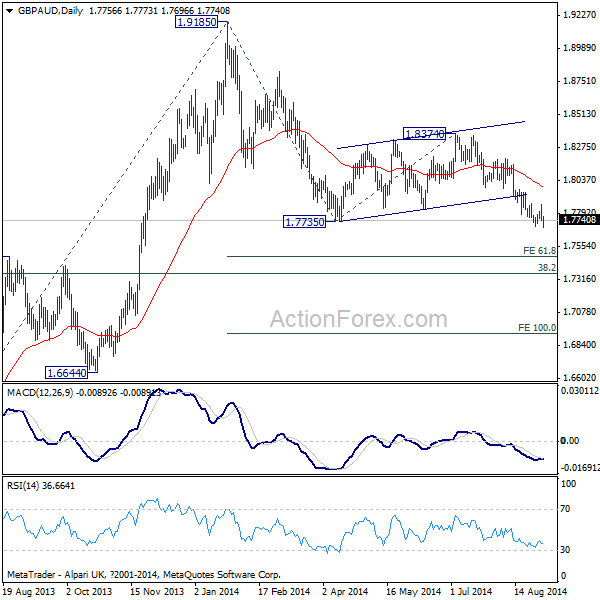

We've covered the GBP/AUD in recent report and outlook is unchanged. Fall from 1.8374 is viewed as extension of the corrective decline from 1.9185 and is still in progress. Deeper fall should be seen to 61.8% projection of 1.9185 to 1.7735 from 1.8374 at 1.7478. Nonetheless, we're expecting strong support from 38.2% retracement of 1.4380 to 1.9185 at 1.7349 to at least bring a rebound.

BoC rate decision is a major focus today. BoC is widely expected to keep the benchmark overnight interest rate at 1.00%. And correspondingly, the bank rate will be held at 1.25% and deposit rate will be kept at 0.75%. The central bank would very likely maintain its neutral stance "with respect to the timing and direction of the next change to the policy rate". And, there wouldn't be much change in the economic assessment. That is, growth is expected to reach full capacity only around mid-2016. And inflation would stay below target in medium term after some near term fluctuations.

On the data front, UK BRC shop price dropped -1.6% yoy in August. China non manufacturing PMI rose to 54.4 in August while HSBC chines services PMI rose to 54.1. Australia GDP slowed to 0.5% qoq in Q2 but beat expectation of 0.4% qoq. In European session, Eurozone services PMI, retail sales and UK PMI services will be released. US will release factory orders and Fed's Beige Book economic report.