During the Monday session, we have seen a lot of back and forth in the British pound, which of course makes sense considering that we are so oversold. Quite frankly, there will come a point in time where there aren’t that many people left to sell. Looking at the GBP/USD pair is crucial, because it is essentially the “benchmark” of the British pound strength globally.

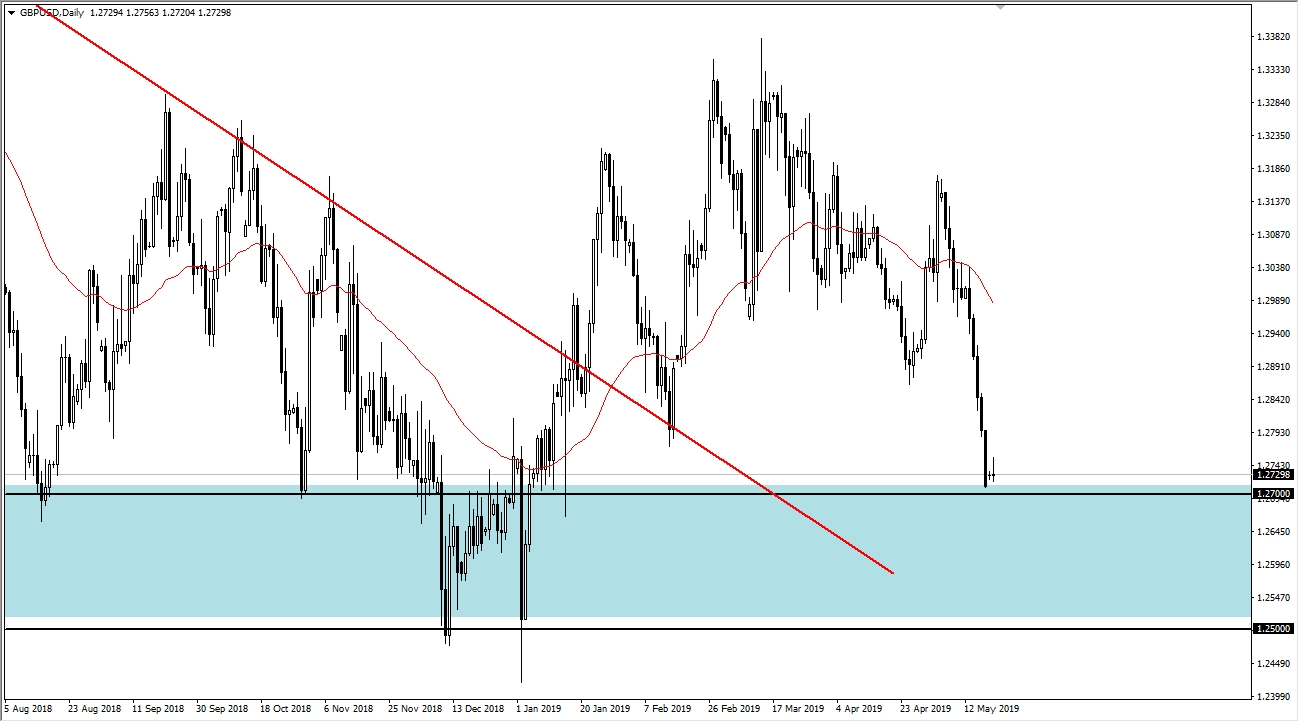

Simply put, if this pair rallies, it will send other GBP/XXX pairs higher as a general rule. So for example, if we rally here we can look for opportunities to go to the GBP/JPY pair. That being said, we are on top of a major support level that I believe extends about 200 pips lower. The fact that the 1.27 level is offering a bit of support is a good sign, and I think that it’s only a matter of time between here in the 1.25 level that we find buyers coming in to pick up value. After all, the British pound is trading at extraordinarily low levels from a historical perspective.

If we do break down below the 1.27 level I suspect that there will be buyers near the 1.25 level looking for extreme value. Alternately, if we can break above the highs of the Monday session it’s likely that this pair may go looking towards the 50 day EMA which is just a bit underneath the 1.30 level. The precipitous fall has been overdone by just about any metric you use and was essentially done due to the fear of what could happen after Theresa May steps away. At this point, that’s just conjecture and therefore it’s possible that we see a complete reversal and in quick order if she either doesn’t, or there is a suitable replacement that sues the markets.