Sterling Sojourn:

“GBP Second Estimate GDP q/q (0.5% v 0.5% expected)”

Pound sterling received some respite from the relentless Brexit related selling as domestic fundamentals at least showed some sort of positive after GDP printed as expected at 0.5%.

Business spending did fall and flags have been raised about the balance of the economy. Questions remain around whether the headline number actually hides the part time, low wage nature of the growth experienced and how sustainable the growth can be long term.

But for now GBP has earned respite from the Brexit risk uncertainty, backed up by the technical barrier on the chart below.

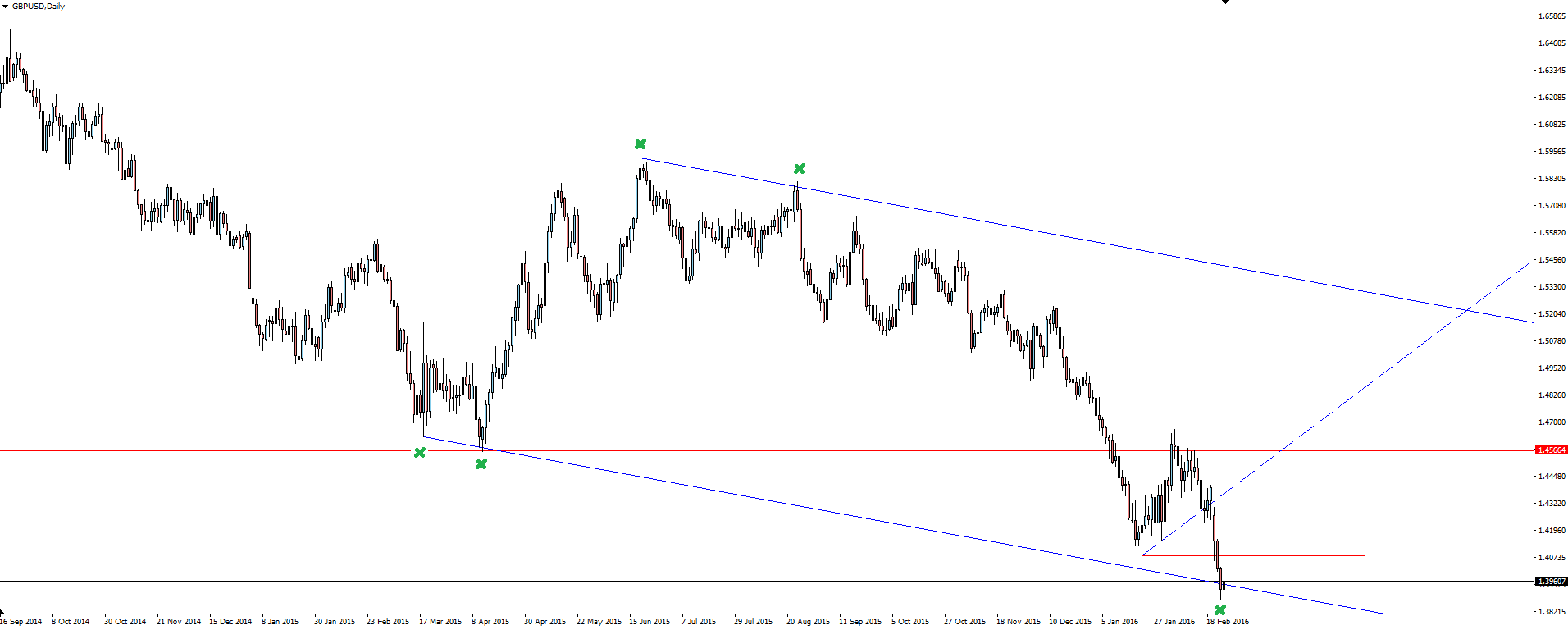

GBP/USD Daily:

There were a few ways to draw the bearish channel but either way the drop is pausing on support for now.

Yen Crossroad:

“USD Core Durable Goods Orders m/m (1.8% v 0.2% expected)”

“USD Unemployment Claims (272K v 271K)”

Moving into the US session, we saw core durable goods orders rise considerably. A rare piece of good news for the manufacturing sector!

This contributed to USD/JPY strength, bouncing out of the technical zone that we have been speaking about on the @VantageFX Twitter stream.

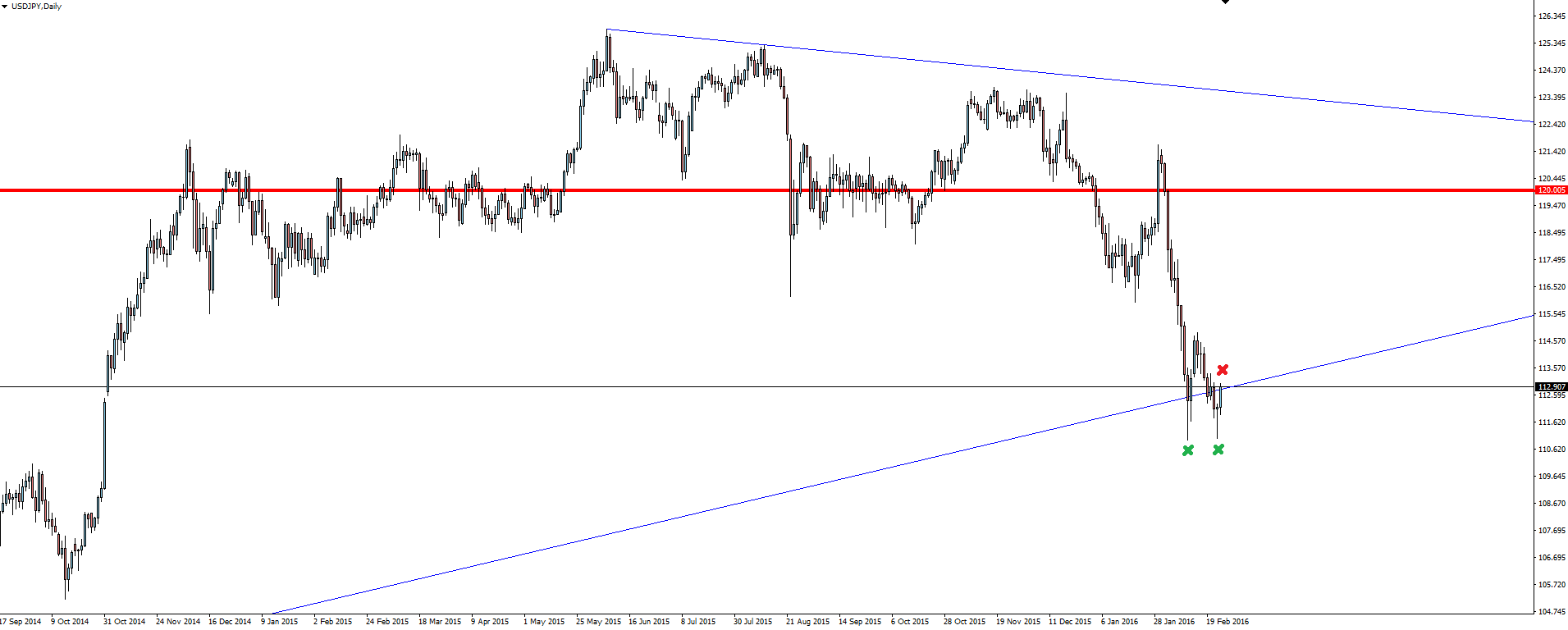

USD/JPY Daily:

Match today’s USD/JPY and S&P500 charts with the two in yesterday’s Headlines and Correlations blog for a highlighted view of what we are watching here.

Price really is at a crossroads here, coming back to possibly retest previous support as resistance. I’m still treating the weekly trend line level as a larger support zone though, and am not interested in trading any sort of clean retest to the short side here.

Chart of the Day:

With the current market themes around oil, stocks and the Japanese yen, we can sometimes get bogged down looking at the same charts. The idea of the chart of the day section was to keep the blog fresh and highlight some new trading opportunities.

The currency cross of EUR/AUD is one pair that we don’t get a chance to feature all that often, with the last time the pair made our chart of the day being way back on Melbourne Cup Day in November 2015!

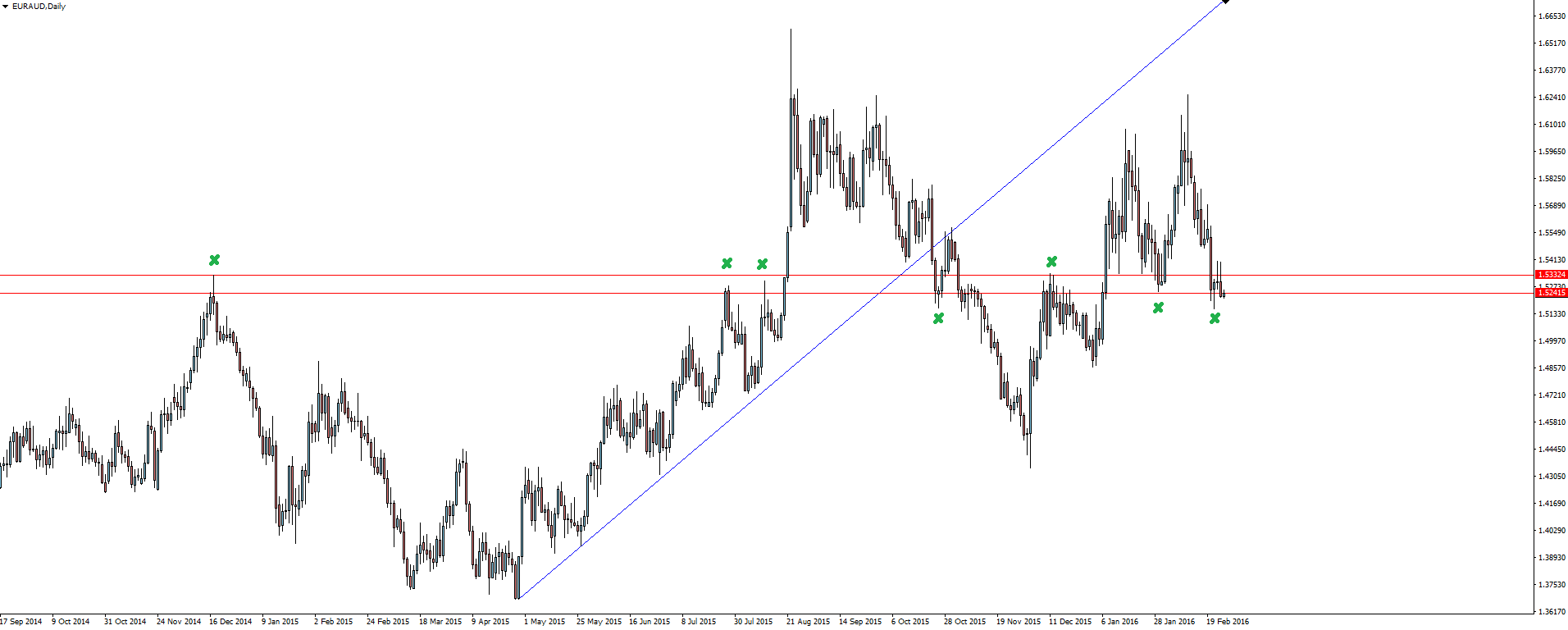

EUR/AUD Daily:

These major levels are a perfect example of why you keep them on your chart even if they have been broken. The type of break-out is very important too and as you can see, each time price has broken the marked level, it has gone through it HARD.

With price back on the level again, whichever way you choose to trade from, you still have a clearly defined level to manage your risk around.

On the Calendar Friday:

NZD Trade Balance

JPY Tokyo Core CPI y/y

GBP BOE Gov Carney Speaks

USD Prelim GDP q/q

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Regulated broker Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, prices or other information is provided as general news and marketing communication – not as investment advice. Consequently any person acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the actions of the reader. We always aim for maximum accuracy and timeliness, and Vantage FX on the MT4 trading platform, shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.