The Pound Declined After The Bank Of England Has Left Interest Rates Unchanged.

GBP/USD edged higher during the course of Thursday’s session, with the pair changing hands at 1.24 line in North American trade. Meanwhile, the Bank of England’s (BoE) benchmark rate remained steady at 0.25%.

British Retail Sales slightly gained by about 0.2%, matching the forecasts. Elsewhere in the US, both CPI and Core CPI stood at 0.2%, also matching the forecasts.

On the other hand, specific key events are likely sharp, as unemployment data declined to 254 thousand, while the Philly Fed Manufacturing Index rallied to 21.5 points, topping the estimates.

During Thursday’s session, it seemed that there were no any significant surprises from the BoE, after the interest rates was left unchanged at 0.25% since August, while the asset purchase program stood at 435 billion pounds.

Subsequently, the Bristish economy turned into positive, compared to the BoE’s greater expectation since the Brexit vote in June, which sent the bank dropping plans to reduce rates in October. Instead, the bank neutralized for monetary policy, with surging inflation levels and adding an optimism that the BoE is expecting a rate hike in early 2017.

However, the bank stated on Thursday that the unrelenting strong pound since November, especially against the euro, could weaken the inflation.

GBP/USD Bulls Offsets Bearish Harami

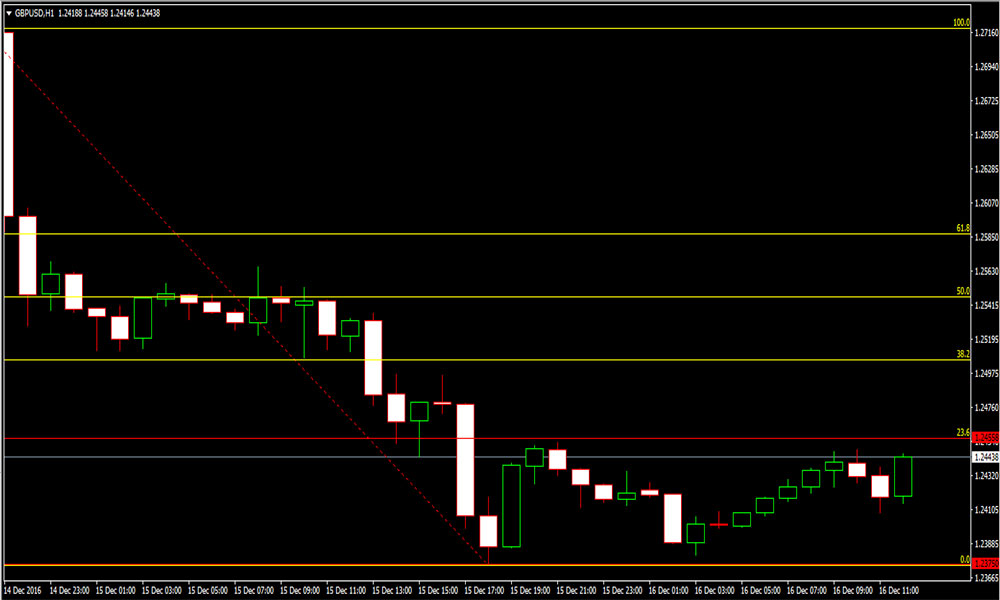

Given an upward course of the GBP/USD pair on the daily chart, an offsetting bearish harami pattern is seen, a pattern comparable to a Western inside bar.

The price movement attempted a 21-period 2-standard deviation upper band after resting outside its boundaries in the last two days. The bearish pattern continued in the context of a 14,3,3-sensitive stochastic pace above 80 level.

Although the oscillator is likely suggesting prices to close near their high in a bullish market trend, it should instantly respond with any eventual daily close near the lows. Thus, market participants might closely watch for price confirmations and search for invalidation of the pattern in the form of a new daily high.

Current Stance of GBP/USD Pair

The chart below illustrates GBP/USD price movement in the wake of the Bank of England after leaving the interest rates unchanged, along with the unemployment claim, which sharply dropped.

Given a bearish tone of the pair, market players have begun selling riskier currencies as it is widely expected that the bearish market trend would respond with any daily close near the lows.

Further, the pair is showing a slight rally for five consecutive sessions, but later declined in two earlier trades. However, it’s still not clear if the price movement is an upside bias though stock prices in on the green in yesterday’s close.

Conclusion

As the illustrative chart above shows a bearish tone of the pair, investors are recommended to still wait on the sidelines as there aren’t any supporting candle present as of writing.