Sterling Inches Higher Ahead of Multi Inflation Figures

GBP/USD extended the bullish momentum today after a remarkable home-run on Friday with 1.3113 2017 news-highs. Yesterday, the pair made a correction plunging to 1.3046, resting daily RSI to 60 level, then rewarded losses clocking 1.3099 high ahead of major inflation data to be released today which could fuel GBP/USD for a newer high record in case of a positive UK CPI associated with previous hawkish speech by Carney, head of BOE.

Add to that, US dollar continues digging lower with 94.49 2017 fresh-low. Expectations of further tumbling for the U.S. Index in the coming days as Reuters reported a setback yesterday for health care program and a major conflict among Republicans regarding the system.

UK Data, after a release, will be followed by Gov. Carney in the afternoon with expectation for a hawkish tone supporting Sterling sharp tone facing pace buck, but still UK CPI will set the tone for Carney.

Analysts at Nomura Securities, the global financial services giant, say the Bank of England will raise interest rates by 0.25% at their August meeting, increasing the official bank rate to 0.50%.

The first three months of 2017 confirms wages growth is accelerating, a rise of 1.0% over the first-quarter when extrapolated to the end of the year would add up to a robust 4.0% annual rise in wages.

Fundamentals:

1- Consumer Price Index + Producer Price Index + Retail Price Index today at 8:30 AM GMT.

Technical Overview:

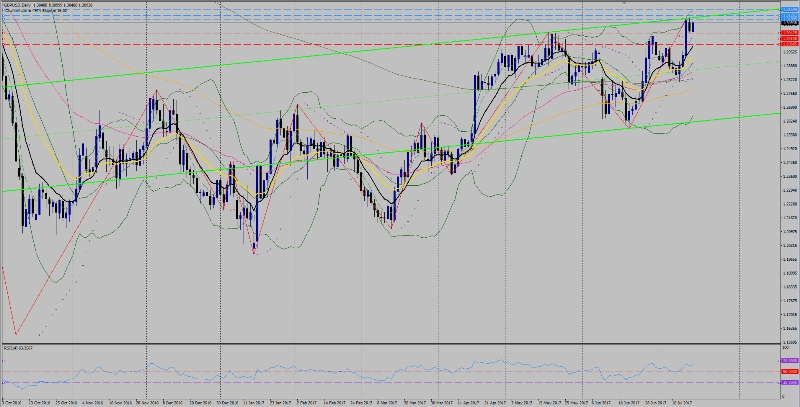

Target: 1.3180

Trend: Upward

Resistance levels: R1 1.3109, R2 1.3126, R3 1.3155 (D1)

Support levels: S1 1.3042, S2 1.3015, S3 1.2988 (D1)

Trend reversal point: 1.2925

Comment: The market powered into a bull breakout over old highs, giving short term bull signals for moves to 1.3180 and chances for a larger bull drive to 1.3470. The strong close favors continuation rallies today. Any corrective dips should fight to hold around highs near 1.3020+/-. Tight congestion in the half of Friday's rally should bull flag. A close under 1.2995* is needed to hurt the upturn/breakout.