Our expectations of a quiet session were met yesterday, although we have seen some movements in the past 24hrs which require explaining. Sterling started the day in strong form, punching up towards the 1.59 level against the USD while making a 4 week high versus the euro. There was no real reason for the move so we will have to ascribe it to traders and investors believing that the raft of data due from the UK economy (today’s CPI, tomorrow’s BOE minutes and Budget, Thursday’s retail sales numbers) will all be positive for the pound.

CPI today is an interesting one to call. Expectations are that it will remain on a downward trend with the consensus view seeing inflation at 3.3% vs 3.6% last month, the lowest in 14 months. The key thing will be to gauge how much of an impact the increases in food and energy prices of late are having on the basket.

We saw the dollar fall on Friday as traders started to price out the belief that the Fed would tighten policy any time soon, following a disappointing CPI number; similar is likely for the pound today. From a wider, economic point of view whatever inflation prints at, it will still be way above the level of pay increases we have seen in recent months so people will still be feeling the pinch.

The single currency also managed to fly on yesterday versus the dollar, moving back into the 1.32s and fighting back in the afternoon session to take GBPEUR back below the 1.20 level on the day. The Greek CDS auction – finding out how much investors in Greek default insurance will receive – went well and was the main driver of this EUR bullishness, although it has faded a tad overnight on news that there will be a general strike in Portugal on Thursday.

Aussie dollar has also been taken lower overnight following the latest minutes from the Reserve Bank of Australia. The board saw “ample scope” for cutting interest rates should the situation worsen. BHP Billiton, the large Aussie miner, also warned yesterday that income from China is likely to fall this year as a mining tax was passed by parliament yesterday is likely to eat into profits.

There is little on the information docket today, UK inflation apart, although we do have the latest round of housing starts from the US at 12.30. Expectations are of 700k more houses through the month of February.

The euro crisis – are you protected? World First has teamed up with Charles Russell and haysmacintyre to host a unique event for business leaders. The seminar will feature a series of short presentations taking a closer look at the Eurozone crisis and how this will affect your business in 2012, before exploring some of the ways you can protect yourself from any potential fallout. Register for our free seminar on 29 March or ask for a copy of our whitepaper here.

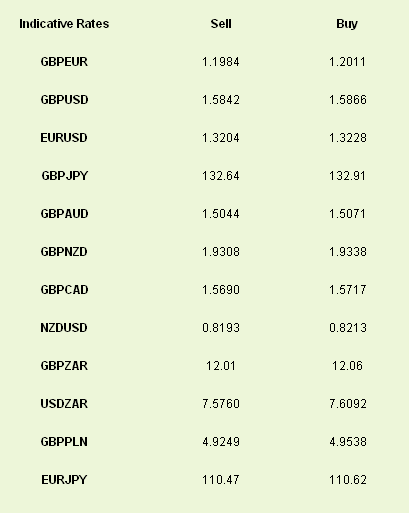

Latest exchange rates at time of writing

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Sterling Higher on Growth Expectations

Published 03/20/2012, 07:30 AM

Updated 07/09/2023, 06:31 AM

Sterling Higher on Growth Expectations

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.