Reports by the BBC, shows that Scotland’s official vote has been a resounding ‘No’ as Scotland’s voters decided to stay with the UK. The news comes as 26 out of 32 councils declared their results. The No votes were 1,397,000 while the Yes votes stood at 1,176,000. For the victory to be declared the winner must have 1,852,828 votes, with 4 more council results yet to be declared.

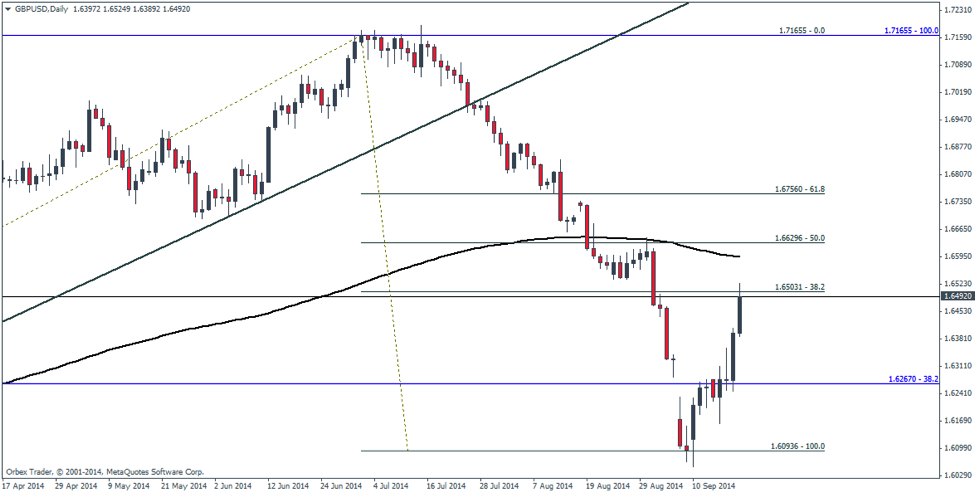

The pound Sterling rallied across the board making intra-day highs at the time of writing. Of particular interest though is the GBP/USD whose price action is showing some bearish signs. Although not complete yet, the H4 candle is currently printing a bearish dark cloud cover candlestick pattern, while on the daily charts, GBP/USD is still below its 200 day EMA. GBP/USD managed to reverse its losses after hitting the 38.2% Fib level of the rally from last year. The pair is currently showing signs of struggling at the 38.2% Fib of the bearish leg as shown in the chart below.

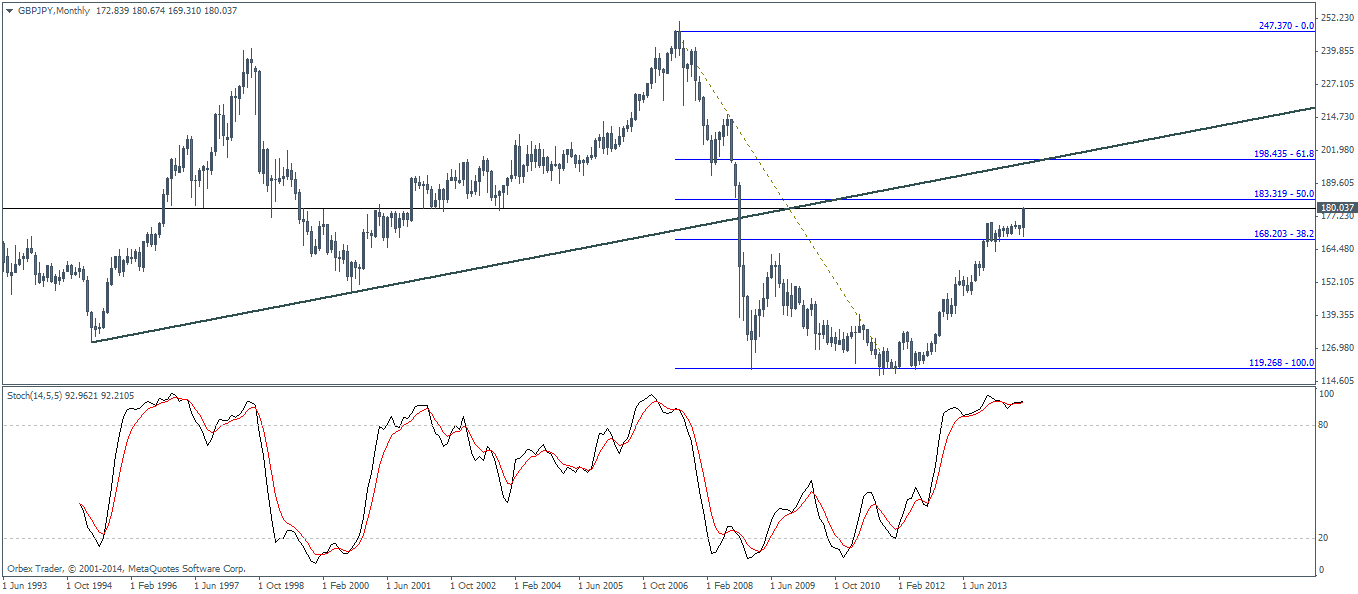

The GBP/JPY managed to make a yearly high at 180.674 with 183.32 coming in at a 50% Fib retracement level from the GBP/JPY monthly charts. Regardless of the market moves, the GBP/JPY looks set to test the monthly 50% fib level. With rumors of Japan’s plans to inject another stimulus into its economy later this year and considering the bullishness of the US Dollar, the GBP/JPY pair might seem like a better bet than trading the GBP/USD which comes with possible headwinds on the Greenback’s strength.

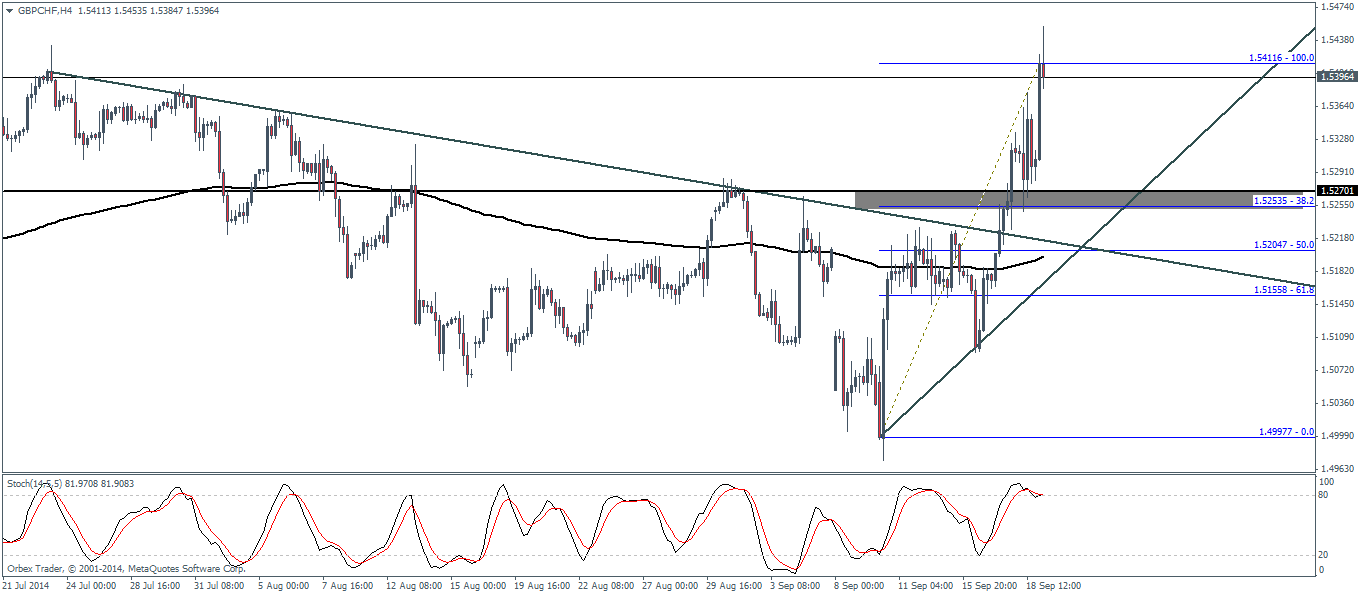

Against the Swiss franc, the pound rallied above its 200 EMA and breaking a trend line, but the H4 charts yet again show some interim weakness hinting to perhaps a correction. Assuming that the price will move lower, we can expect a retest of the 38.2% Fib which shows confluence with the 200 EMA and also the break of the downtrend line.

The EUR/GBP managed to break the support level at 0.789 making way for potential downside moves, trading within the downtrend channel. With price below its 200 day EMA and the Stochastics pointing lower, the EUR/GBP could likely see further pressure to the downside targeting a multi-year support level of 0.77531.

Without much of market moving events in regards to the US and the UK economy most of the GBP crosses are likely to continue their momentum into next week most likely closing the month on an upbeat note. With most of the fundamentals from the UK released this week, which were overshadowed by the Scottish vote, proving to be positive for the Sterling, if the final results to offer a conclusive ‘No’ vote against Scottish Independence, the GBP looks to be well supported to edge higher against most of the currencies.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Sterling Gains as Scotland votes to stay in the UK

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.