Sigma Designs Inc. (NASDAQ:SIGM) was downgraded by research analysts at Stephens from a "buy" rating to a "hold" rating in a research report issued to clients and investors on Thursday, MarketBeat.com reports.

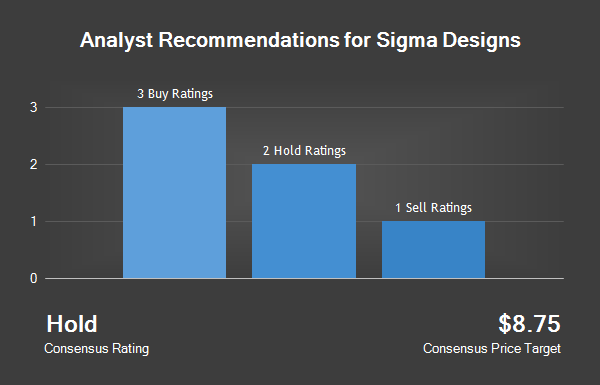

A number of other equities research analysts also recently commented on SIGM. Zacks Investment Research upgraded Sigma Designs from a "strong sell" rating to a "hold" rating in a research report on Wednesday, August 10th. Needham & Company LLC reissued a "buy" rating and set a $13.00 target price on shares of Sigma Designs in a research note on Wednesday, September 7th. Robert W. Baird reissued an "outperform" rating and set a $9.00 target price (down from $10.00) on shares of Sigma Designs in a research note on Wednesday, September 7th. BWS Financial downgraded shares of Sigma Designs from a "hold" rating to a "sell" rating and set a $6.00 target price on the stock. in a research note on Thursday, September 8th. Finally, Lake Street Capital downgraded shares of Sigma Designs from a "buy" rating to a "hold" rating and cut their target price for the company from $8.50 to $7.00 in a research note on Wednesday, MarketBeat.com reports. One analyst has rated the stock with a sell rating, four have given a hold rating and three have given a buy rating to the company's stock. The stock has an average rating of "Hold" and a consensus price target of $8.71.

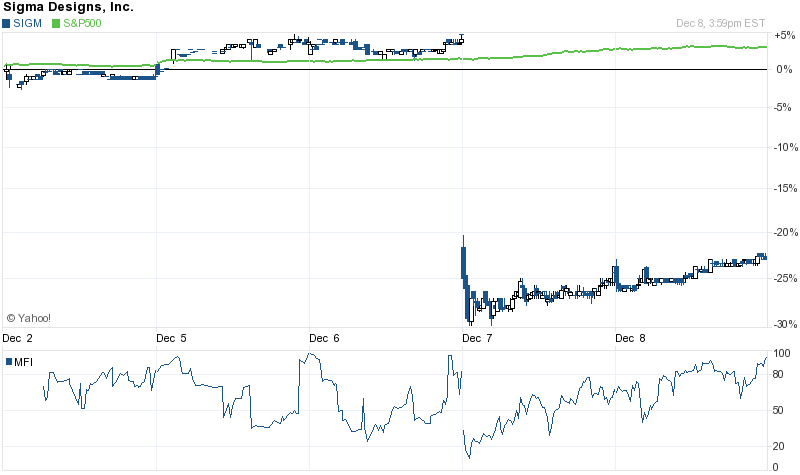

Shares of Sigma Designs traded up 3.57% on Thursday, hitting $5.80. The company's stock had a trading volume of 1,797,085 shares. Sigma Designs has a 52 week low of $5.20 and a 52 week high of $9.08. The stock's 50 day moving average price is $7.59 and its 200 day moving average price is $7.30. The stock's market capitalization is $217.24 million.

Sigma Designs last announced its quarterly earnings data on Tuesday, December 6. The company reported $0.09 EPS for the quarter, beating analysts' consensus estimates of $0.08 by $0.01. Sigma Designs had a negative return on equity of 2.42% and a negative net margin of 6.89%. The company earned $62.70 million during the quarter. During the same quarter last year, the company posted $0.13 EPS. Sigma Designs's revenue was up 1.8% on a year-over-year basis. On average, analysts forecast that Sigma Designs will post ($0.12) earnings per share for the current fiscal year.

A number of hedge funds have recently made changes to their positions in the stock. Dimensional Fund Advisors LP increased its position in Sigma Designs by 3.7% in the second quarter. Dimensional Fund Advisors LP now owns 2,934,474 shares of the company's stock worth $18,868,000 after buying an additional 104,505 shares during the period. Vanguard Group Inc. increased its position in Sigma Designs by 0.3% in the second quarter. Vanguard Group Inc. now owns 2,575,743 shares of the company's stock worth $16,562,000 after buying an additional 8,694 shares during the period. Royce & Associates LP increased its position in Sigma Designs by 8.0% in the second quarter. Royce & Associates LP now owns 1,955,238 shares of the company's stock worth $12,572,000 after buying an additional 145,256 shares during the period. Top Ace Asset Management Ltd increased its position in Sigma Designs by 33.9% in the third quarter. Top Ace Asset Management Ltd now owns 1,601,265 shares of the company's stock worth $12,474,000 after buying an additional 405,209 shares during the period. Finally, BlackRock Fund Advisors increased its position in Sigma Designs by 8.6% in the third quarter. BlackRock Fund Advisors now owns 1,001,710 shares of the company's stock worth $7,803,000 after buying an additional 79,309 shares during the period. 64.86% of the stock is currently owned by institutional investors.

About Sigma Designs

Sigma Designs, Inc is a provider of global integrated semiconductor solutions. The Company offers media platforms for use in the home entertainment and home control markets. The Company sells its products into markets, including smart television, media connectivity, set-top box and Internet of Things (IoT) devices.