Media outlets continue pressing the notion that new cash is entering the stock market from the sidelines. And for the most part, this may be an accurate depiction.

Anecdotally, many of my risk-averse money management clients have asked me to move them up from “ultra-conservative” to “moderately conservative.” Similarly, a number of traditional “moderates” are asking if now is the right time to become a bit more aggressive. In some cases, these clients are providing me with dollars from savings accounts that have not produced any growth or income.

With respect to actual price trends, stock market resilience has been remarkable. Buyers have been active on nearly every intra-day dip. Even in the face of info that normally frightens risk-takers (e.g., the election fiasco in Italy, China tightening up on property rules, the Fed becoming more leery of endless QE, U.S. government stalemate on the sequester, etc.), quick price recoveries pushed the mute button on one-day sell-offs.

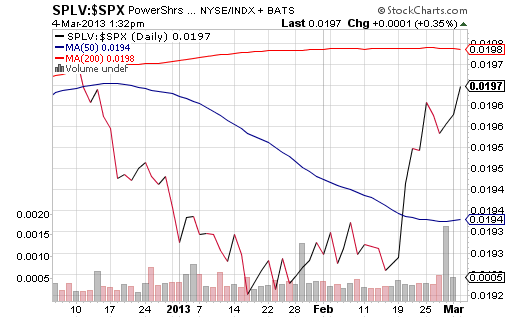

While the activity may be a sign that stocks will not buckle until the Dow and/or the S&P 500 reclaim all-time highs, investors should still reassess the probability of a correction. Long-term Treasuries via iShares 20-Year Treasury (TLT) are back above a 50-day moving average. CBOE S&P 500 VIX Volatility (VIX) is also above a 50-day trendline. And PowerShares S&P 500 Low Volatility (SPLV) continues to demonstrate greater relative strength when compared to the broader U.S. stock market.

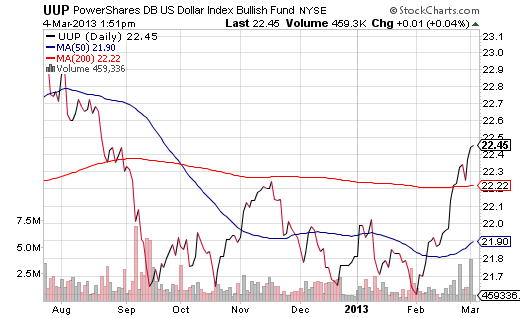

Perhaps the most compelling sign that an increasingly defensive posture may soon change sentiment — and by extension, market direction — is the weakness in foreign currencies. For example, when investors back away from risk, they often run to the perceived safety of the the U.S. dollar. Indeed, over the last few weeks, PowerShares Dollar Bullish (UUP) has jumped dramatically. The exchange-traded fund tracker recently climbed above a long-term 200-day trendline.

Note(s): The price of UUP hasn’t been above a 200-day since August of 2012… shortly after the European Central Bank’s president described that its body would do whatever was necessary to protect the euro. The price of UUP has not crossed significantly above the 200-day from a place of weakness since November of 2011… shortly before European powers determined whether or not to continue providing Greece with bailout money.

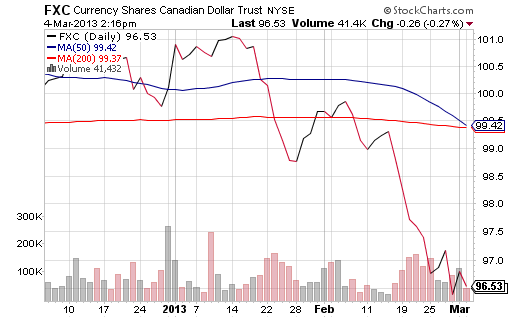

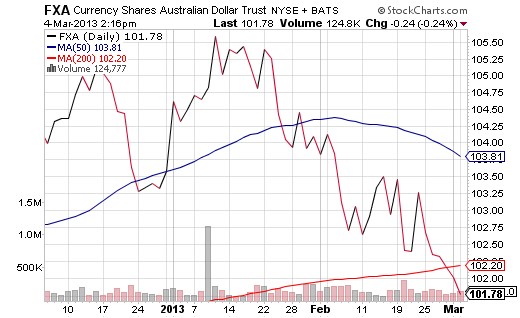

The strength of the dollar is seen in a variety of different ways, like examining “commodity currencies” such as the Canadian Dollar and/or the Australian dollar. The CurrencyShares Canadian Dollar Trust (FXC) has weakened dramatically since February, while the Currency Shares Australian Dollar Trust (FXA) has depreciated rapidly since the beginning of 2013. Perhaps ironically, their weakness is partly attributable to their dependency on exports… and the currency weakness would theoretically benefit the exporting of Canada and Australia.

The euro has been declining steadily, due in large part to Italian government uncertainty as well as the euro-zone’s deepening recession. Aggressive short-sellers who listened to me on “shorting” the euro via ProShares Ultra Short Euro (EUO) about a month ago have unrealized gains.

Even emerging market currencies have been eroding. Until recently, you might have done well to own the Brazilian “real” or even a basket of emergers via WisdomTree Emerging Market Currency (CEW). It hasn’t been in the cards lately.

In sum, the Dow may soon close above an all-time high. The S&P 500 may not be far behind. On the flip side, U.S. dollar strength may be an indication that risk-taking isn’t quite as vibrant as the media want you to believe. Even if you are “long” U.S. and world equities, make certain that you have a plan for reducing risk should the tables turn.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Step Away From The Foreign Currency ETFs

Published 03/05/2013, 01:05 AM

Step Away From The Foreign Currency ETFs

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.