Shares of Steel Dynamics Inc (NASDAQ:STLD) are down 1.6% at $40.02 in afternoon trading, extending yesterday's analyst-induced sell-off. Credit Suisse slammed a number of steel stocks on Monday, and downgraded STLD to "neutral" from "outperform." The brokerage firm also slashed its price target to $51 from $55, saying rising interest rates could slow down U.S. demand, and the equity closed the session off 4.1%.

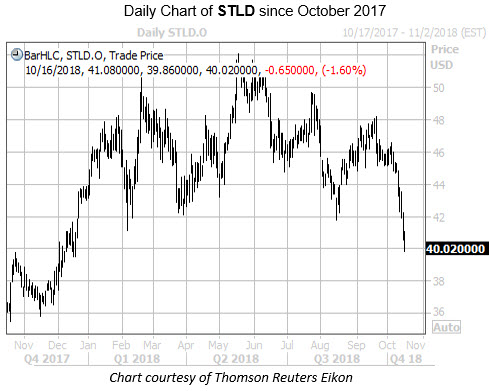

STLD traders could also be reducing exposure ahead of the company's third-quarter earnings report, which is scheduled for after the market closes, tomorrow, Oct. 17. On the charts, STLD has pulled back this month, echoing the stock's technical struggles since reaching a mid-May peak of $52.10. The shares have also plunged below $42, a level that had served as support since early February. The equity is now down 7% year-to-date.

Digging into its earnings history, STLD closed higher the day after reporting in five of the last eight quarters, including a 2.8% gain after its late-July report. Looking broader, the shares have averaged a 3.3% move the day after earnings over the last two years, regardless of direction. This time around, STLD options are pricing in a larger-than-usual 5% swing for Thursday's trading.

Meanwhile, Steel Dynamic puts have been bought to open over calls at a notably high pace. This is per data from the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), which shows STLD's 10-day put/call volume ratio of 14.56 ranks in the 100th percentile of its annual range.

Analysts, on the other hand, are mostly bullish toward the steel stock. Of the nine in coverage, seven maintain "buy" or better recommendations. Plus, the stock's average 12-month price target of $53.57 represents expected upside of nearly 34% upside to current levels.