Steel Dynamics, Inc. (NASDAQ:STLD) has signed a deal to fully acquire Vulcan Threaded Products, Inc. for $126 million, inclusive of $42 million in working capital, which is subject to typical post-closing adjustments. The purchase price will be paid in cash from available funds.

The transaction is subject to customary conditions and receipt of regulatory approvals. Steel Dynamics expects to secure all necessary regulatory approvals and complete the deal by Aug 2016.

During 2015, as part of its target growth objectives, Steel Dynamics identified the need of higher-margin downstream business opportunities that utilize its steel products in their manufacturing processes. The company’s strategy was aimed at reducing volatility during both strong and weak market cycles, given steel raw material supply optionality.

When steel demand was weak, these businesses could purchase steel internally from Steel Dynamics’ own mills, thus increasing the company’s steel-mill utilization. Vulcan fits Steel Dynamics’ model as a consumer of special-bar-quality products, currently produced at the latter’s Engineered Bar Products Division.

Vulcan is the nation's biggest manufacturer and supplier of threaded rod products, and also makes cold drawn and heat treated bar. It shipped about 89,000 tons of these products during the trailing 12-month period ended Mar 31, 2016. Vulcan has purchased about 20,000 tons of steel from Steel Dynamics’ Engineered Bar Products Division. Steel Dynamics expects this internal volume to grow in the near term to between 30,000 and 50,000 tons, or just under 10% of the division‘s total shipments for 2015.

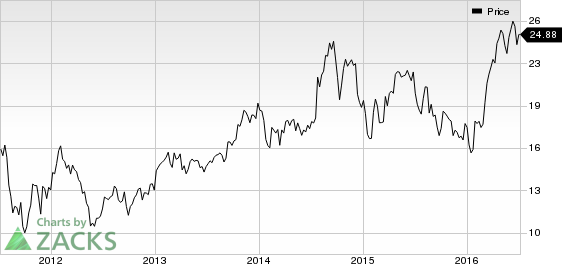

Shares of Steel Dynamics increased 3.7% to close at $24.50 on Jun 30.

Steel Dynamics, a prominent steel producing company along with Nucor (NYSE:NUE) , AK Steel (NYSE:AKS) and U.S. Steel (NYSE:X) , topped earnings expectations in the first quarter of 2016. Its earnings of 26 cents per share beat the Zacks Consensus Estimate of 24 cents. Sales of $1.74 billion also surpassed the Zacks Consensus Estimate of $1.70 billion. The company reported a record liquidity of $2.2 billion at the end of the first quarter, providing a strong foundation for growth.

Steel Dynamics, last month, provided its second-quarter 2016 guidance. The company expects earnings for the second quarter to be in the range of 53−57 cents per share.

The projected second-quarter earnings represent a significant improvement from adjusted earnings of 22 cents per share recorded in the second quarter of 2015. Sequentially, earnings are projected to more than double from 26 cents per share recorded in the first quarter of 2016.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report >>

AK STEEL HLDG (AKS): Free Stock Analysis Report

STEEL DYNAMICS (STLD): Free Stock Analysis Report

UTD STATES STL (X): Free Stock Analysis Report

NUCOR CORP (NUE): Free Stock Analysis Report

Original post

Zacks Investment Research