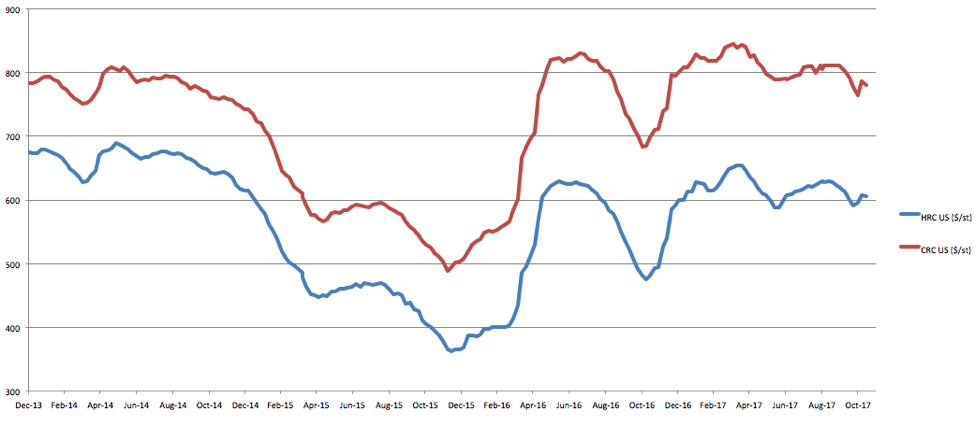

The contract season has already started and steel prices have yet to react. Although domestic Steel prices increased during the last week of October and the first of November, prices fell again last week.

Source: MetalMiner data from MetalMiner IndX(™)

Steel prices have traded flat for most of 2017. Prices, however, started to weaken during Q3. We still want to see more upward price movements before changing the steel outlook.

Chinese Steel Industry

Of course, Chinese steel prices and production serve as the primary drivers of the world steel industry.

According to data released by the National Bureau of Statistics, Chinese daily steel output decreased by 2.5% in October. Capacity curtailment in the steel industry has finally resulted in less steel output from that market.

Some regions, such as Hebei province, plan to continue the steel capacity cuts until 2020, further reducing production by up to 20 million tons.

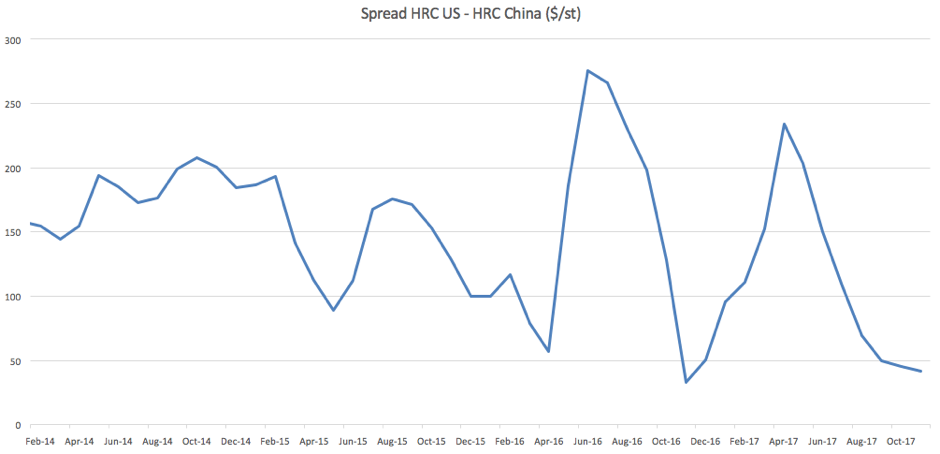

Source: MetalMiner data from MetalMiner IndX(™)

The spread between U.S. HRC prices and Chinese HRC prices has fallen again this month.

In addition, all forms of steel in China except CRC saw price declines. Even if the decrease in Chinese prices appears less steep than the U.S. decline, we want to see more price movements to the upside before drawing any conclusions.

What This Means for Industrial Buyers

Steel price dynamics may recover at some point this month. Therefore, buying organizations will want to pay close attention to Chinese price trends and domestic lead times.