StealthGas (NASDAQ:GASS) is scheduled to report second-quarter 2019 results on Aug 22, before market open.

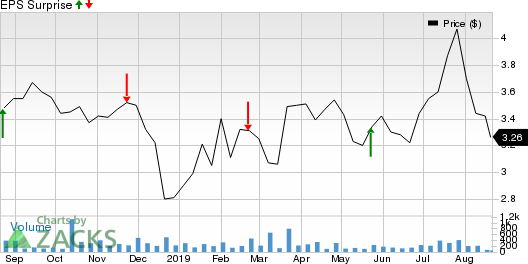

In the last reported quarter, the company delivered a positive earnings surprise in excess of 100%. The bottom line was aided by lower costs. Moreover, it outpaced the Zacks Consensus Estimate with respect to the bottom line in two of the trailing four quarters but missed in the other two.

Given this backdrop, let’s delve deep to find out the factors that will likely impact StealthGas’ second-quarter 2019 results.

Despite the reduction in U.S. exports to China following the imposition of liquefied petroleum gas (LPG) tariffs, U.S. exports to other Asian countries like Japan have kept LPG global trade in good shape. This should aid results of this provider of international seaborne transportation services to LPG producers and users in the to-be-reported quarter. Notably, factors like high utilization and higher Time Charter Equivalent are likely to support the company’s results in the second quarter.

Moreover, lower voyage costs and charter hire expenses are likely to boost the bottom line in the to-be-reported quarter. The company’s operating expense with respect to vessels are expected to decline due to StealthGas’ fleet contraction and reduction in maintenance costs.

The company’s cash balance is likely to show growth in the quarter due to the recent sale of vessels. However, fleet contraction is likely to hurt the company’s revenues in the to-be-reported quarter.

Earnings Whispers

Our proven model does not show that StealthGas is likely to beat estimates this earnings season. This is because a stock needs to have both — a positive Earnings ESP and a favorable Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) — for this to happen. Zacks Rank #4 (Sell) or 5 (Strong Sell) stocks are best avoided, especially if they have a negative Earnings ESP. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: StealthGas carries a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Earnings ESP: StealthGas has an Earnings ESP of 0.00% that acts as a spoiler, leaving surprise prediction inconclusive.

Stocks to Consider

Investors may consider stocks like The Bank of Nova Scotia (TSX:BNS) , Bank of Montreal (TSX:BMO) and Burlington Stores (NYSE:BURL) as these stocks possess the right mix of elements to beat on earnings in their next releases.

The Bank of Nova Scotia has an Earnings ESP of +0.97% and a Zacks Rank of 2. The company is scheduled to report third-quarter fiscal 2019 earnings on Aug 27.

Bank of Montreal has an Earnings ESP of +0.27% and a Zacks Rank of 3. The company is scheduled to report third-quarter fiscal 2019 earnings on Aug 27.

Burlington Stores has an Earnings ESP of +1.13% and a Zacks Rank of 2. The company is scheduled to report second-quarter fiscal 2019 earnings on Aug 29.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft (NASDAQ:MSFT) in the 1990s. Zacks’ just-released special report reveals 7 stocks to watch. The report is only available for a limited time.

See 7 breakthrough stocks now>>

StealthGas, Inc. (GASS): Free Stock Analysis Report

Bank of Nova Scotia (The) (BNS): Free Stock Analysis Report

Bank Of Montreal (BMO): Free Stock Analysis Report

Burlington Stores, Inc. (BURL): Free Stock Analysis Report

Original post

Zacks Investment Research