Just when Elon Musk’s Tesla (NASDAQ:TSLA) is about to start delivering its first mass-production electric vehicle – the Model 3 – to clients, the stock suddenly dropped from an all-time high of $387 to $303 in just two trading weeks. The price managed to rebound and is currently hovering around $323 a share. However, the company still lack virtually all the traits of a strong business, so Tesla remains the poster child of an emotion-driven market. People do not invest in Tesla because it is a good business, they do it because it is a good story filled with optimism about the future. Therefore, the Elliott Wave Principle, the best method for analyzing market psychology we know of, is even more applicable here. According to it, Tesla’s decline is not over yet.

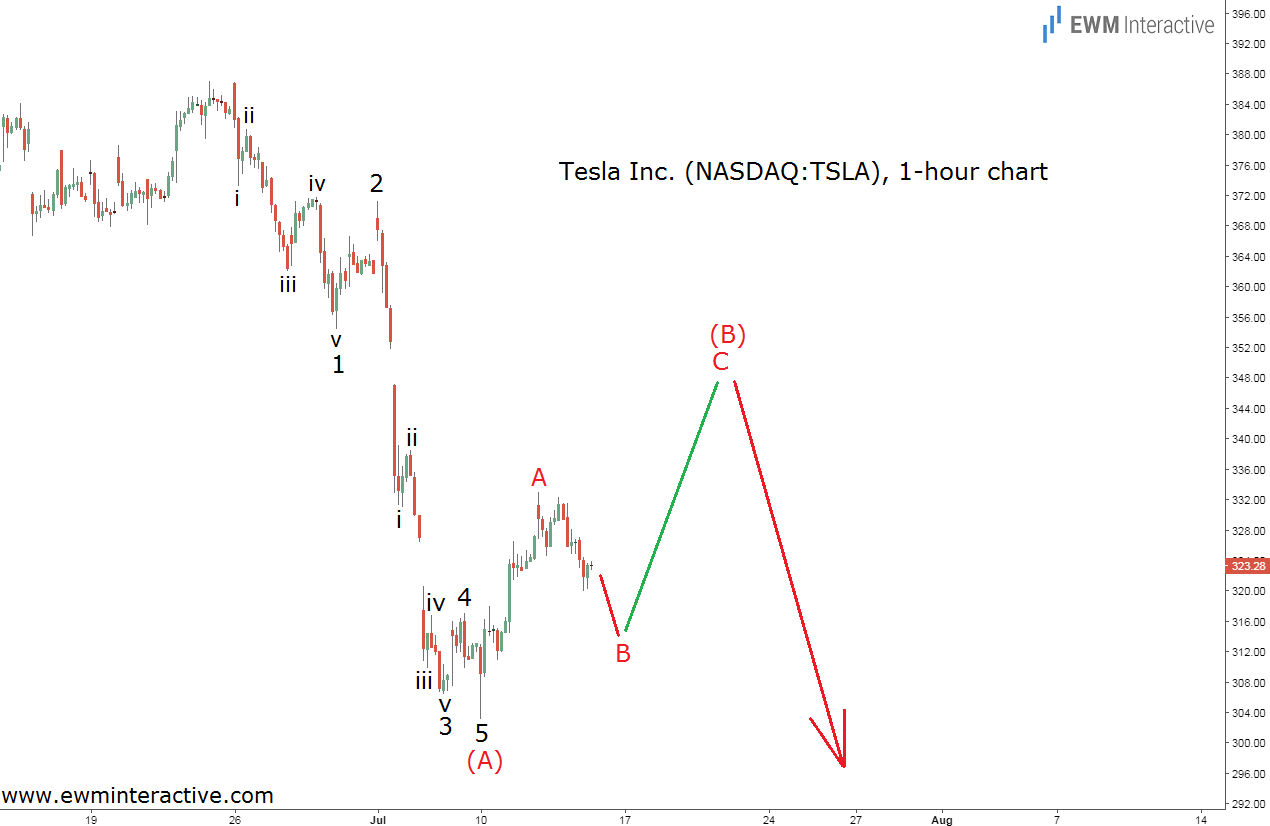

The hourly chart of Tesla stock allows us to see that the structure of the recent crash forms what Elliott Wave analysts call an “impulse“. This is a five-wave pattern, which indicates the direction of a larger move in progress. Every impulse is followed by a correction of three waves in the other direction. Once the correction is over, the trend resumes. It is also interesting to see that the sub-waves of waves 1 and 3 of (A) are clearly visible, as well.

This means two things: first, Tesla stock has reversed to the downside, which is more or less obvious, and second, the bears are not done yet. It is true that wave (B) is likely going to lift the price higher, but as long as the top at $387 is intact, wave (C) down should be expected to drag TSLA below the bottom of wave (A). In other words, chances are the $300 mark is going to be breached.