Statpro Group (LON:SOG) has released an in-line trading update for FY17. Annualised recurring revenue (ARR) for StatPro Revolution grew by 13% organically. Statutory revenues, EBITDA and cash were broadly in line with our forecasts and we are maintaining our FY18 forecasts. Given the busy M&A backdrop, which saw competitor BISAM sold for 7.3x sales earlier in the year, and the significant valuation disparity between StatPro and its US-listed financial software peers, we continue to see strong upside potential in the shares.

Year-end trading update: Sales, EBITDA are in line

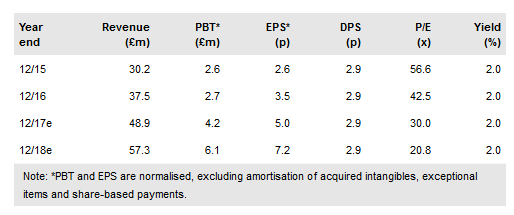

FY17 revenue grew by 30% to c £49.0m (we forecast £48.9m) while EBITDA rose by 35% to £6.9m (we forecast £7.0m). Net debt finished the year at £20.2m, slightly above our £19.7m forecast. The annualised recurring revenue (ARR) for StatPro Revolution, the group’s cloud services analytics product, grew by 13% organically. The total cloud services ARR, which also includes Delta (acquired in May), jumped by 106%. The ARR for the group’s traditional Seven platform grew by 2%, after including the impact of conversions to the cloud platform. This reflects continued demand for the group’s composites product (for the aggregation of individual portfolios) and InfoVest (includes StatPro’s compliance solution).

To read the entire report Please click on the pdf File Below: