Statpro Group (L:SOG) Revolution ARR rose 46% in FY15

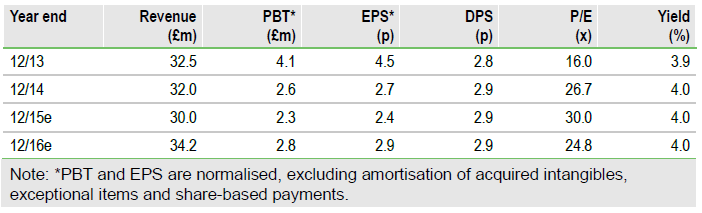

StatPro has reported that FY15 adjusted EBITDA is expected to be in line with our expectations, while revenues were c 4% lower than our forecasts, which we understand was mainly due to the continued weakness in the CAD, ZAR and EUR against sterling. We have tweaked our FY15 forecasts and eased FY16 due to the currency moves. We have also incorporated Investor Analytics (IA), the cloud-based risk analytics solutions provider that StatPro acquired earlier this month, into our forecasts. We continue to believe there is significant upside in the shares, given the lofty multiples of StatPro’s US-based financial software peers and SaaS companies.

Trading update: In-line FY15 EBITDA

StatPro Revolution’s annualised recurring revenue run rate (ARR) grew by 46% at constant currencies to £7.8m (c 27% of the total group ARR) as at 31 December, and by 8% in absolute terms in Q4. StatPro Seven’s recurring revenue was resilient with a net cancellation rate at constant currency, excluding the impact of conversions to Revolution, of c 3% (FY14: zero). Professional Services revenue was significantly lower, due to the absence of larger one-off projects. The launch of StatPro Revolution Performance module remains on track for the summer. FY15 adjusted EBITDA is expected to be c £4.0m, in line with our forecast, while FY15 revenue is expected to be c £30.0m (we forecast £31.3m). Net cash was £1.3m, in line with our forecasts, although we understand the SiSoft acquisition liability, which we had assumed would be settled in FY15, has not yet been paid. StatPro acquired Investor Analytics for up to $16m. This acquisition takes StatPro’s cloud-based ARR to c £11.1m, taking cloud-based ARR to c 35% of total pro forma group ARR total.

To read the entire report Please click on the pdf File Below